- During the Monday session, we have seen the US dollar pull back a bit against the Swiss franc, as the markets are looking a little overstretched at this point in time.

- The markets continue to focus on a lot of attention to the bond market in the US, which has seen rates shoot higher as of late.

- At this point, the market continues to see a lot of questions asked about the interest rate differential between the two currencies.

This is a market that tends to be a bit of a grind most of the time, but occasionally we will see a bigger move. At this point, I just don’t see it happening, as we got a little overstretched. I also recognize that the technical analysis, although getting better for the US dollar, still suggest that we have a bit of trouble ahead.

Top Forex Brokers

Technical Analysis

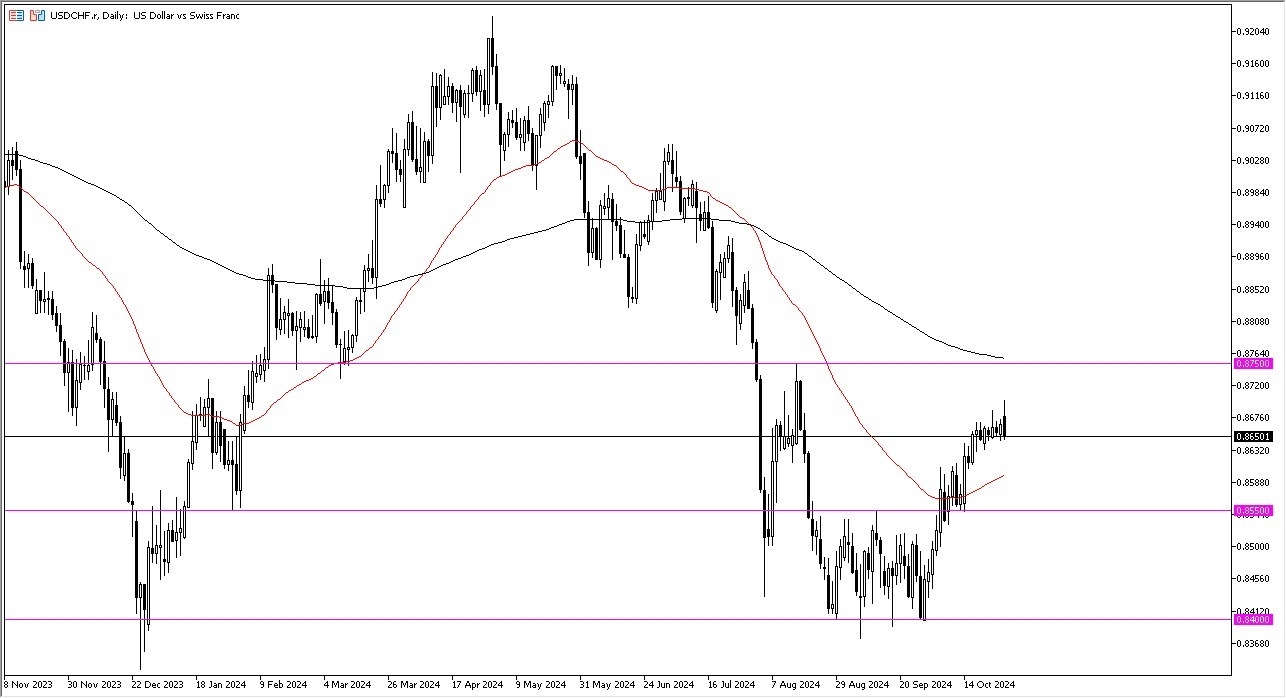

The technical analysis for the USD/CHF exchange pair is a bit mixed at the moment, and although not necessarily overly positive, it’s probably worth noting that the analysis is better that once was. After all, we are roughly halfway between the 50 Day EMA on the downside, and the 200 Day EMA on the upside.

Because of this, you would see a lot of traders going back and forth as to what they want to do, so I think you cannot just trade this pair from the chart, you would have to pay close attention to how the US dollar is behaving against most things. After all, as a general rule, if you get the direction of the US dollar correct, you can generally figure out most of the Forex market.

If we were to break down below the 50 Day EMA, then it’s possible that the market could test the 0.8550 level, an area that has been both support and resistance as of late. If we were to rally from here, then you would have to believe that the 200 Day EMA, near the crucial 0.8750 level, could be the target and could also end up being the ceiling. While I am positive over the longer term, right now I think we’ve got a situation where you have to look at this through the prism of neutrality.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.