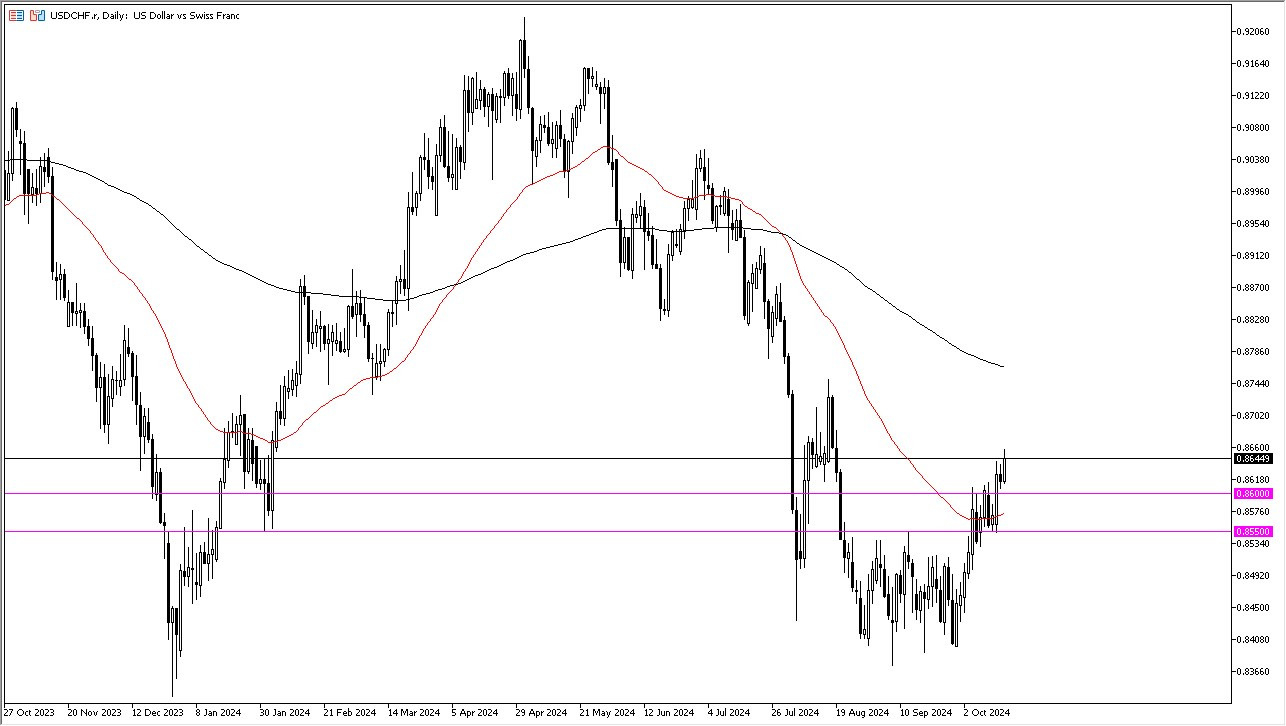

- The dollar has rallied a bit against the Swiss franc in the early hours of Wednesday, as we continue to see a fairly decent and sizable recovery.

- At this point in time, I think you've got a situation where traders are going to continue to look at dips as potential buying opportunities, as the interest rate differential between the two currencies does offer a bit of a carry trade situation.

- Furthermore, you also have to keep in mind that breaking above the 50-day EMA was, from a technical analysis standpoint, rather robust.

- The size of the candlestick from the Monday session really kicked things into high gear, and it looks like the US dollar is rapidly becoming the favored currency in the forex world.

Support Below

Top Forex Brokers

The market also has plenty of support not only at the previously mentioned 50-day EMA, but it has it at the 0.8550 level, an area that acted as a significant barrier, not only during most of August and September, but back in December of 2023 as well. While I do think that a pullback makes more sense than not, the reality is it will only, more likely than not, attract more value hunting.

The 0.8750 level is set up to be a significant target, as well as a potentially significant resistance barrier. This is because not only was there a swing high at this level, but there's also the likelihood of the 200 day EMA racing toward it to offer a little bit of technical resistance. Obviously, if we can break above the 200 day EMA, the US dollar will be entering a new phase where it's another leg higher.

I have no interest in shorting this market. I do think that it is probably only a matter of time before buyers turn things around as the 0.84 level, the area that offered so much support over the previous weeks is in fact a major swing low in this market and it does make a lot of sense that traders would get involved.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.