- The US dollar has initially pulled back just a bit against the Swiss franc only to turn around and show signs of life.

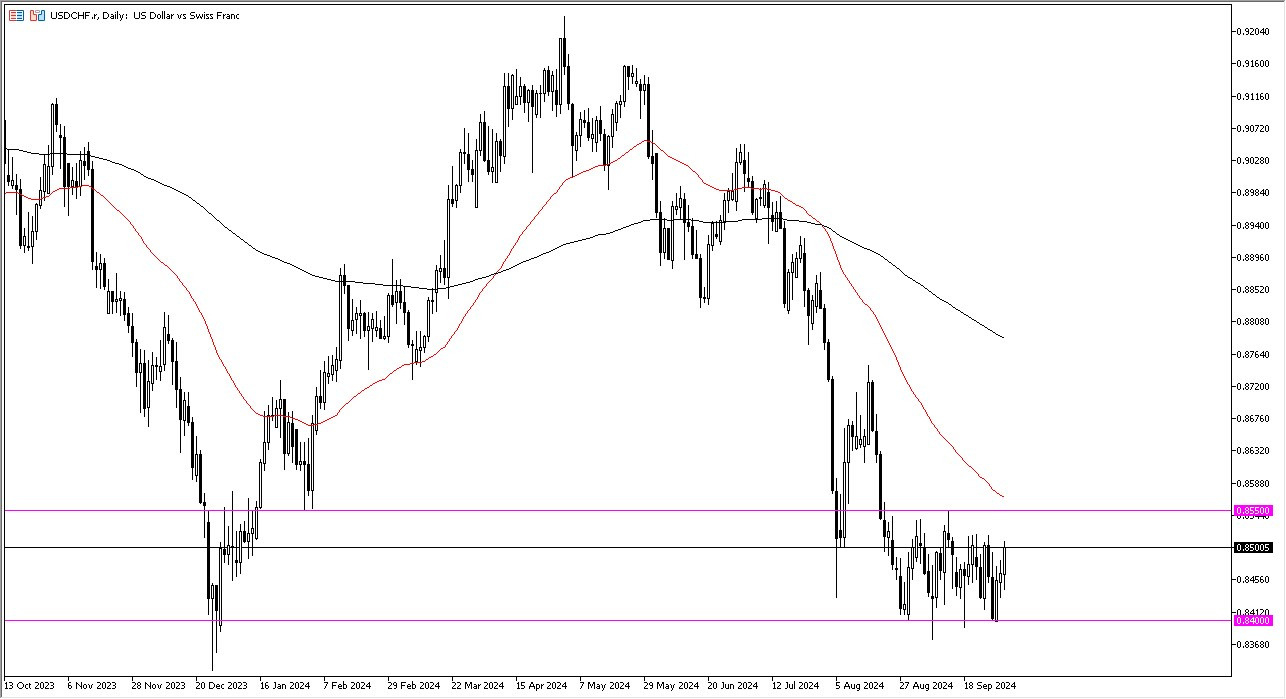

- It looks like we are hanging around in a consolidation area that I think a lot of people will be paying close attention to as the 0.84 level is a major floor and the 0.8550 level above as a major ceiling.

- The 50 day EMA is in that area as well and therefore, I think if we do break above there, then it's possible that the market could go looking to the 0.8725 level.

Choppiness Continues

All things being equal, this is a market that continues to be very choppy and that makes a certain amount of sense due to the fact that the market looks at both of these currencies as potential safety currencies and therefore they do behave somewhat similar.

Top Forex Brokers

This is probably the one currency, the Swiss franc that is, that can out safety the greenback in an environment where the world runs for safety. Half the world will go to Switzerland so, you could see further downward pressure.

However, if we do get more of a risk on move, then you will see the greenback break above the 0.8, five, five, zero level and the 50 day EMA in general. I think you've got a situation here where we continue to go back and forth, but I do think eventually we have to break out of this area. And once we do that probably tells you where the next 200 pips will come from. If we break down though, the next thing that will come to mind is what will the Swiss national bank do? Because they don't hesitate to intervene if the Swiss franc gets too strong. Ultimately, this is one of the things about the CHF that you always have to watch, because it is a small enough currency that the central bank can have a major influence on where it goes next. However, it’s typically the EUR/CHF pair that they pay the most attention to.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.