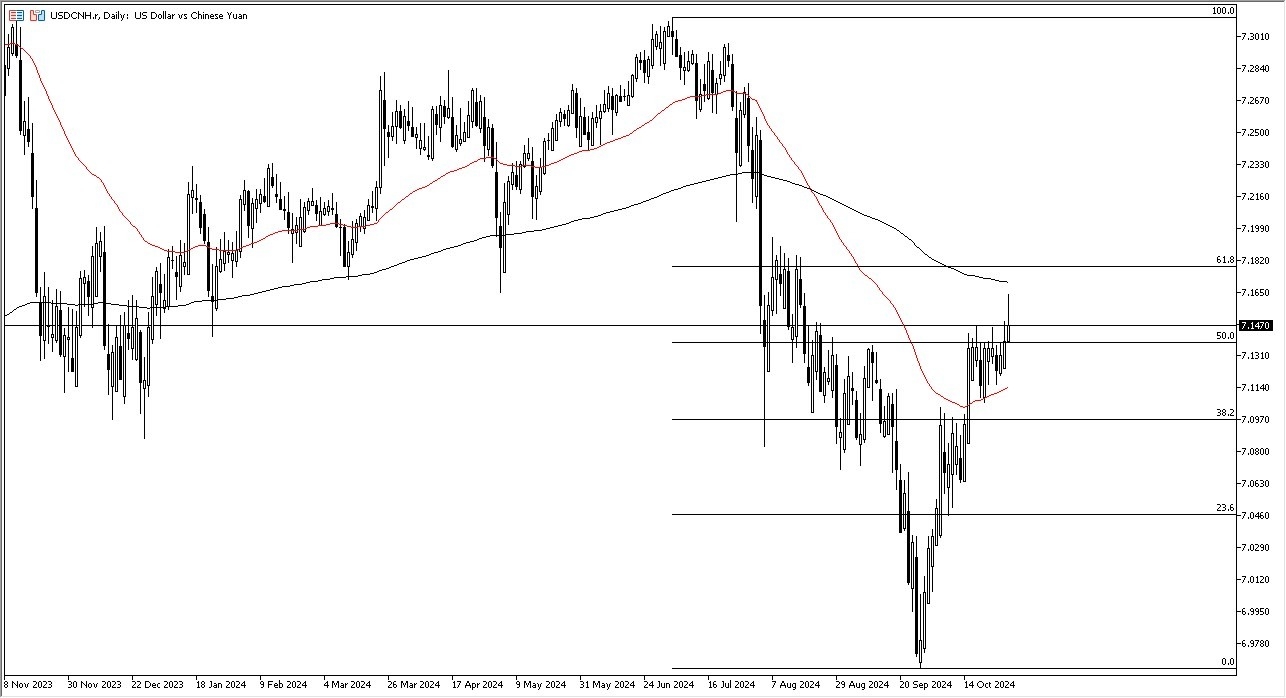

- The US dollar has rallied a bit against the Chinese Yuan during the trading session on Tuesday, getting very close to the 200 day EMA before turning around and falling.

- All things being equal, this is a market that I think continues to look at this through the prism of whether or not we can break above that crucial 200 day EMA.

- While I’m not necessarily a huge proponent of this indicator, it’s obvious to me that the market did in fact react to it during the early Tuesday trading.

After that, we have the possibility of the 61.8% Fibonacci retracement level being tested and then broken above. If that happens, as a general rule, I find this a sign that we're going to have a complete reversal. The size of the candlestick is somewhat negative due to the fact that we gave back more than we have held on to, but it is going to be a situation where we continue to see a lot of noise. If we do fall from here, the 50 day EMA near the 7.1 150 level could offer a little bit of support. As long as we stay above there, I do think that we are trying to build up the necessary momentum to drive the US dollar higher. The US dollar, of course, is considered to be a safety currency.

Top Forex Brokers

Risk On? Risk Off? It’s What Matters

So, look at it through that prism. On the other hand, a move to the downside, then that could show that people believe that the overall global trade situation is getting better. China is struggling a bit and recently we've seen the Chinese Yuan punished for a lack of stimulus in that economy, so we'll just have to wait and see whether or not that continues to be the case here. All things being equal, this is a pair that is heavily influenced by the PBO see, as it is not allowed to freely move sometimes as well.

Ready to trade our Forex daily forecast? Here are the best forex brokers in Asia-pacific to choose from.