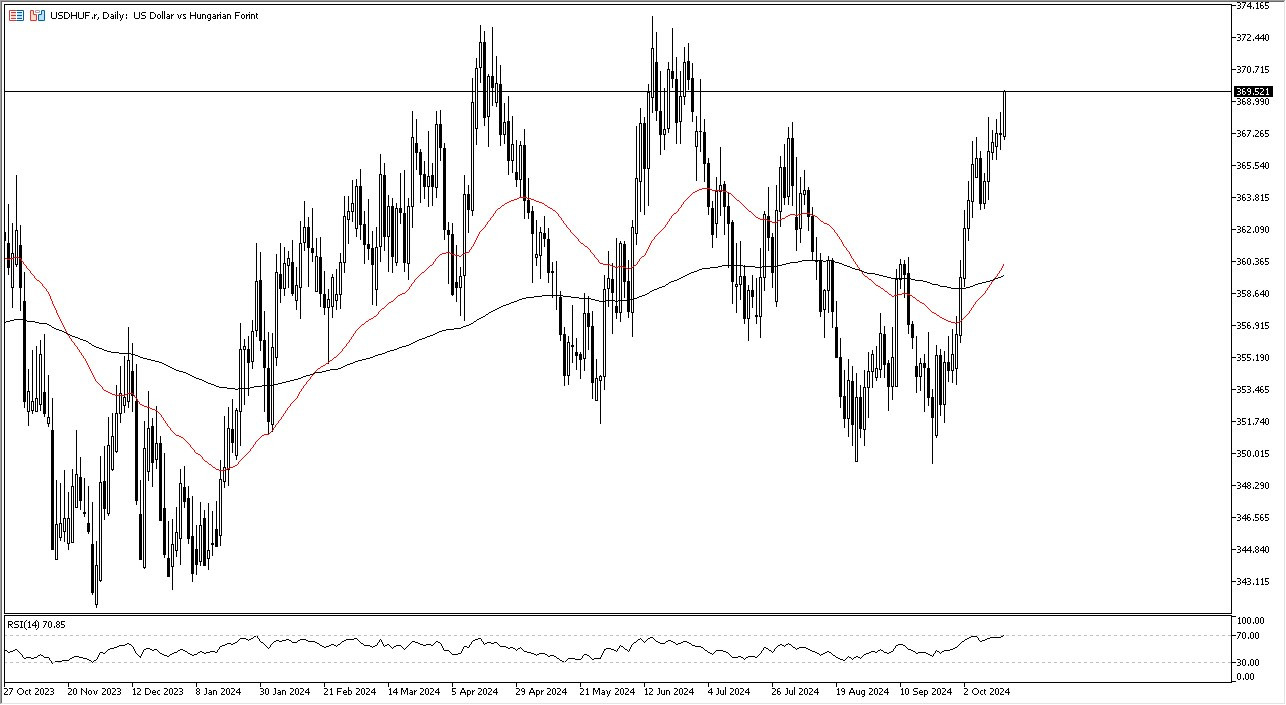

- The Hungarian forint has been struggling for quite some time, and in my daily analysis of exotic currency pairs, the USD/HUF pair stands out.

- This is because we have had a very impulsive candlestick to the upside, after a very impulsive move over the last several weeks.

- With this being the case, we are threatening the 370 HUF level, an area that previously has been of significant resistance.

Technical Analysis

The technical analysis is obviously bullish, but you also have to ask questions as to whether or not the market is overbought at this point. The Relative Strength Index is currently flirting with the 70 level, which is the area where we start to consider markets to be “overbought.” Because of this, I think it’s likely that the market could get a little bit of a pullback, but it’s obvious to me that the 360 HUF level should offer a significant amount of support as it was an area of consolidation previously. In other words, we pull back to this level, then I think you have an opportunity to pick up “cheap US dollars.”

Top Forex Brokers

The 50 Day EMA has broken above the 200 Day EMA to kick off the so-called “golden cross”, so longer-term traders will be looking at this through the prism of perhaps buying and holding this pair, which does make a certain amount of sense if we continue to see a lot of questions as to whether or not money is looking for a safer home in the form of the United States, while if the risk appetite takes off to the upside, that should help the Hungarian forint as a result. As things stand right now, this is a market that I think continues to pay close attention to geopolitical issues.

All things being equal, this is a market that I think will continue to look at the Federal Reserve as well, as the Federal Reserve has recently cut rates, but now it looks like the economic figures out the United States suggest that the Federal Reserve may not be as loose with monetary policy is people had hoped. If we can break above the 375 level, this market could go screaming to the upside. In the meantime, I think short-term pullbacks will offer buying opportunities.

Want to trade our daily forex analysis and predictions? Here are the best trading platform for beginners to choose from.