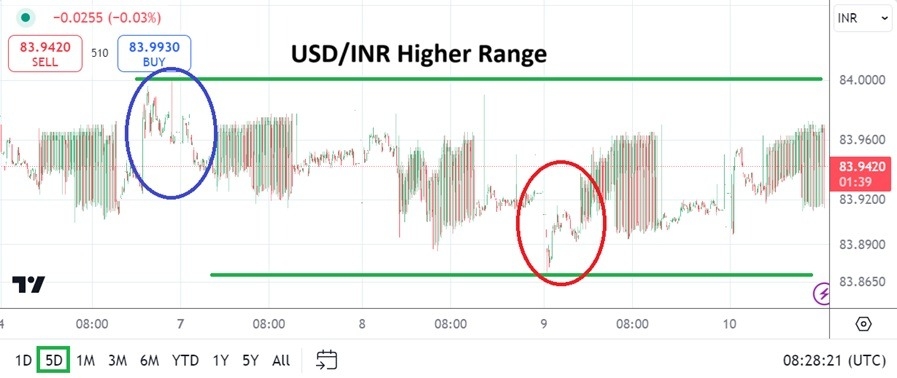

Traders of the USD/INR have been treated to another round of Reserve Bank of India governance regarding the currency pair as the higher price realms have again taken hold.

- Speculators who have the courage to pursue the USD/INR exchange rate should not be surprised by the ability of the USD/INR to climb back within its higher values and suddenly see the 84.0000 level act like a magical resistance level.

- The move higher can be given plenty of explanations, some analysts can say a correlation to U.S Federal Reserve outlook has been demonstrated in the USD/INR, but experienced players in the currency pair also know the Reserve Bank of India is influencing values.

Yes, from the middle of September until the end of the month, the USD/INR did show some trading volatility that was outside of its higher price realm. But the lower depths of 23 September near the 83.4400 vicinity did not last long, and since then the USD/INR has been incrementally creeping back to its known range which has seen a stranglehold since the start of August.

Top Forex Brokers

Speculative Warnings from the Reserve Bank of India

The Reserve Bank of India issued a warning to banks a few days ago that they should be careful about speculative positions with the Indian Rupee. Importantly, this warning was to banks, the Reserve Bank of India and the government have made it nearly impossible for day traders to wager on the USD/INR inside of the nation and expressly frown upon the notion. The return to the highest part of its range – the 84.0000 level – shows the Reserve Bank of India has decided to manage the Indian Rupee with an even more firm stance for the time being. Bids and asks for the USD/INR are also large, and should be treated with care.

The U.S will release important economic data today via the Consumer Price Index. The inflation report will have an impact on the broad Forex market, but it is unlikely to have a profound effect on the USD/INR. The Reserve Bank of India is monitoring the value of the currency pair and is likely considering value propositions via a mid-term outlook gauged to commerce conducted by Indian corporations involved with export and import, U.S interest rates, India interest rates, the potential outcome of the U.S election, and domestic government fiscal needs internally.

Tight Range and Quick Hitting Targets via Focused Orders

Traders who believe they can bet on the USD/INR with a broker cleanly should use strict entry price orders. The high tight range of the USD/INR may be seen for the next few weeks as the U.S Fed is waited upon in November, the U.S elections are held and behavioral sentiment is interpreted by the Reserve Bank of India.

- Speculators who want to sell highs and buy lows technically can do so via entry orders, but they must make sure they are getting proper price fills.

- And then the traders need to make sure they can get out of targeted value with a take profit order that is executed by the broker.

- It may be wise to not aim for the highest of highs or lowest of lows technically with price orders, this so brokers cannot claim there was enough volume to execute an order at the extreme levels.

USD/INR Short Term Outlook:

Current Resistance: 83.9700

Current Support: 83.9300

High Target: 83.98500

Low Target: 83.9150

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.