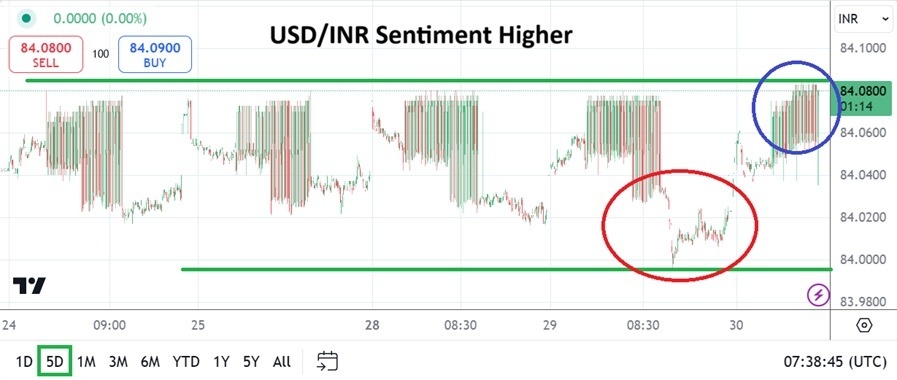

The USD/INR has touched another higher apex in early trading today, the currency pair continues to display an incremental bullish trend, but traders need to be wary of the occasional burst lower too.

The USD/INR touched the 84.0850 vicinity in trading earlier today and it continues to linger near the 84.0800 mark depending on the bids and asks being displayed. The currency pair is controlled tightly by the Reserve Bank of India, but it also consistently continues to show an ability to trend higher. Yes, yesterday saw a violent spike lower to the 84.9960 mark briefly, but then a return to higher values flourished.

Top Forex Brokers

Finding a trading platform which allows USD/INR trading for small speculators is difficult. If a broker is found, then risk management needs to be considered regarding the large spread that often is seen in the USD/INR. The ability to get stuck in a poor position increases if market orders are used, because price fills frequently will not be in the day trader’s favor. However the incremental ability of the USD/INR to move higher remains intriguing speculatively.

The 84.0000 Essentially has Held

Since Friday the 11th of October the 84.0000 has become a rather firm trading ground. And now that the citizens of India are becoming accustomed to the weakened value of the Indian Rupee, and will likely tolerate some more incremental inflation coming their way, the question must be asked where the USD/INR is heading next.

Round numbers in trading are not an illusion. Price levels often reflect ratios that look clean numerically. This is likely because folks programing their trading systems also find entering a round number easier than fooling around with extra digits to look for on a keyboard. The point is the USD/INR is hovering below the 84.1000 mark rather consistently the past handful of days. The 84.0800 had acted like durable resistance until today. But is it the 84.1000 mark that the Reserve Bank of India is leaning towards as the next allowable move higher?

Speculative Considerations and Non-Correlation in the USD/INR

While most of the world’s Forex market is acting with extreme caution because of the U.S economic data coming today and the remainder of the week, and the U.S election next Tuesday, which will then be followed by the U.S Fed’s Rate decision, the USD/INR seemingly trades within a world of its own. Traders looking for correlations to outside influences may be looking in the wrong place.

The Reserve Bank of India controls the USD/INR exchange pair with a heavy hand and this doesn’t appear ready to change in the near or mid-term.

Therefore technical trading needs to pay attention to behavioral sentiment coming from interpretation of technical charts in the USD/INR and attention must be given to the government of India.

The incremental bullish climb in the USD/INR is likely to see new highs develop in the coming days.

USD/INR Short Term Outlook:

Current Resistance: 84.0850

Current Support: 84.0600

High Target: 84.0910

Low Target: 84.0400

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.