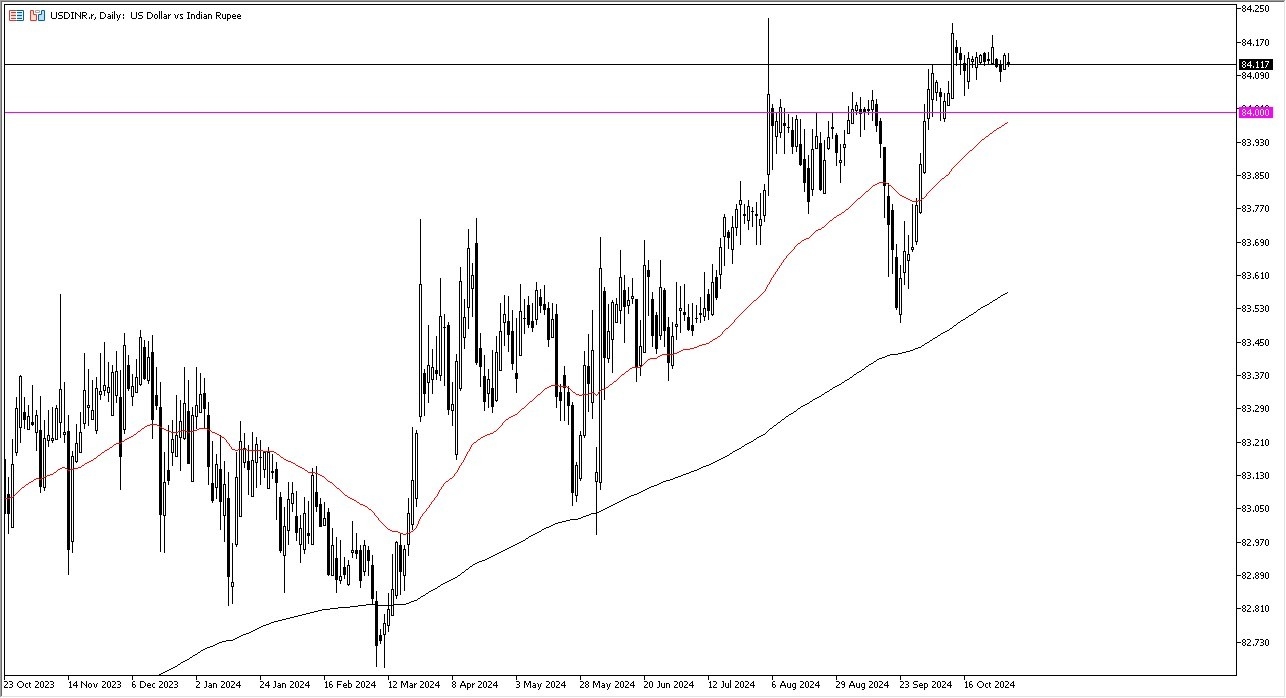

- The US dollar continues to go back and forth during the course of the trading session on Thursday, as we continue to see a lot of noisy behavior in this market.

- That being said, the 84.15 level is an area that seem to be a bit of a magnet for price, as we have essentially gone back and forth in this region for the last 2 weeks or so.

Keep in mind that the Bank of India quite often gets involved in this pair, and therefore it doesn’t freely float back and forth. That being said, the market broke above the ₹84 level, which was a major victory, and it did so in an extraordinarily sharp move. Because of this, it’s not a huge surprise to see this market go sideways for a while, due to the fact that the market needs to work off some of the excess froth, and perhaps even take a bit of a breather after that huge move.

Technical Analysis

Top Forex Brokers

The technical analysis for this pair is bullish, but I also recognize that we are going to have to wait for some type of fundamental reason for this market to get moving. It is worth noting that this is a market that could be reacting to the Non-Farm Payroll announcement on Friday, and therefore it’s worth noting that the volatility could finally pick up. At this point, if we do fall from here, I believe that the ₹84 level will continue to be a bit of a short-term floor. On the other hand, if we break above the ₹84.20 level, then we could see a little bit more “FOMO” running into this market, and therefore allowing the US dollar to continue its strength.

Furthermore, we also need to pay close attention to the idea that bonds in America continue to see rates rise, and that of course is a major influence on where we are going over the longer term. With this being said, the market is likely to continue to see a lot of upward pressure more than anything else, but we are just simply waiting for a reason to get to the upside.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.