- The US dollar has been fairly quiet against the Indian rupee during the trading session on Thursday, mimicking the action of the last several days.

- This is a little bit impressive by the Indian rupee due to the fact that the US dollar has been beating the pants off of just about anything it comes near.

- That being said, the Bank of India does have a long history of intervening in the market. It's not really a completely, truly free flowing currency.

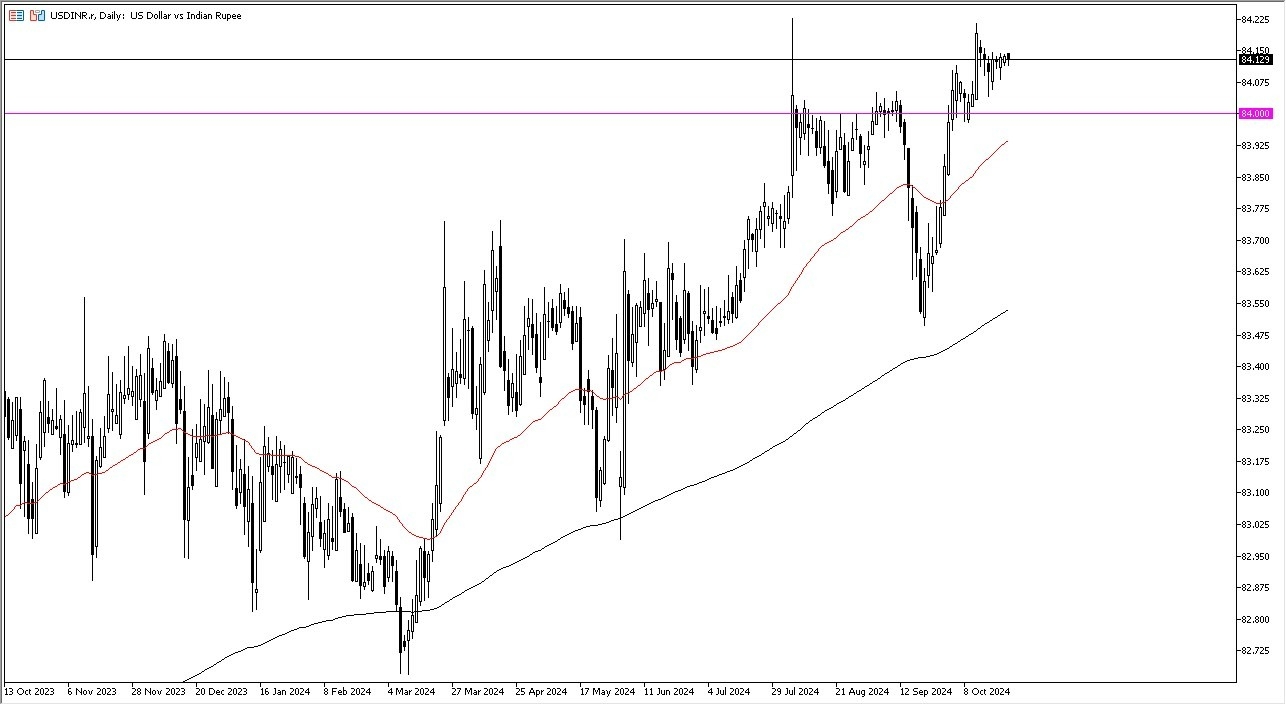

So that has something to do with what we are seeing. The USD/INR technical analysis of course remains the same. It remains very bullish despite the fact that we've run out of momentum, but when you look at the chart over the last couple of years, you can see that this pair does tend to move very rapidly for a short burst and then consolidates for a while.

Top Forex Brokers

Consolidation Seems to Be What We are Seeing

We are now in one of those consolidation times, I think that short term pullbacks will be buying opportunities, and I am especially interested in the 84 rupee level as it is a large round psychologically significant figure. And now we start to have the 50 day EMA racing toward it, somewhere near the 83.94 rupee level. I have no interest in shorting this pair because quite frankly, interest rates rising in the United States has been like a wrecking ball for the currency markets, as the US dollar continues to strengthen against almost everything. Simply put, as I trade the currency markets right now, I am buying the US dollar. If I see a setup where buying a currency over the dollar looks good, I just ignore it. Truthfully speaking, if you know where the US dollar is going, for the most part, you do fairly well in currency pairs. And that's especially true here in the emerging markets.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out