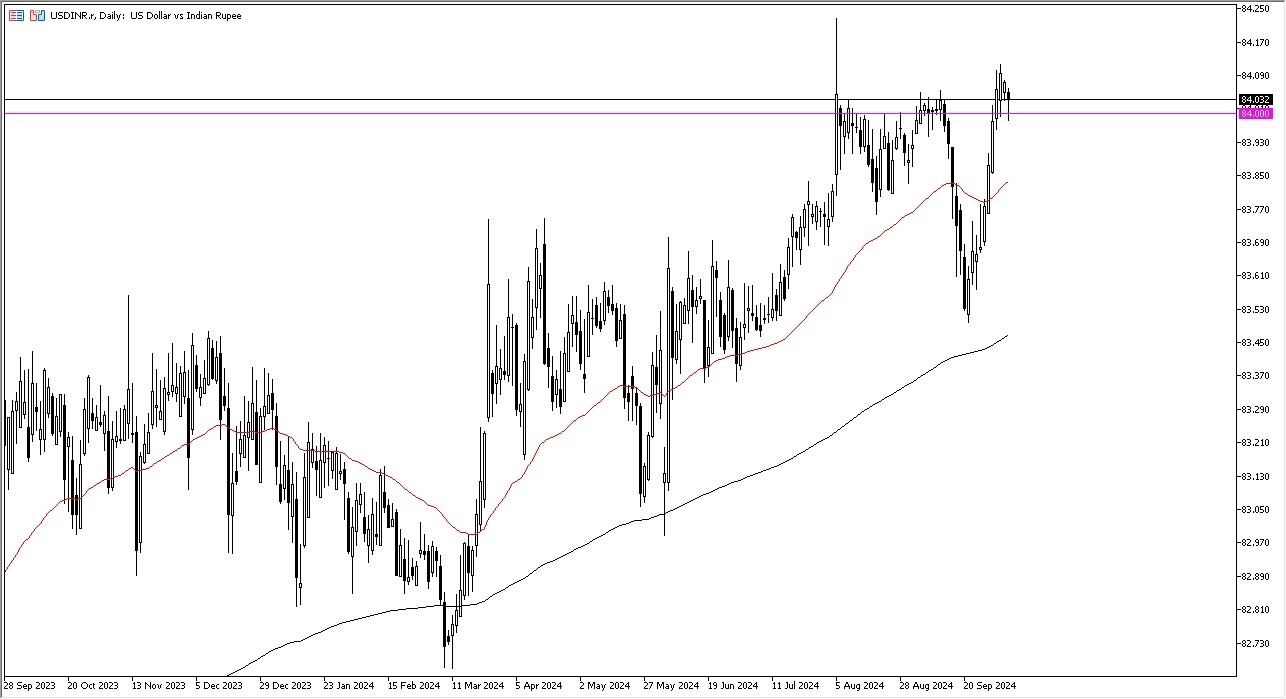

- The US dollar initially fell a bit during the trading session on Tuesday against the Indian rupee, testing the 84 level.

- The 84 level has been very important multiple times, and therefore I think you've got to pay close attention to the possibility of market memory coming into the picture.

- So far, that seems to be exactly what's going on in this market, as per usual. It’s worth noting that this market is very technically driven.

On the Pullback…

I think short-term pullbacks will continue to be buying opportunities as traders look at them as value in the greenback. Keep in mind that there are a lot of open questions about the global economy right now and this of course has a major influence on whether or not people are willing to invest in emerging markets such as India and the currency itself.

Top Forex Brokers

As things stand right now, the market will be able to invest in the greenback and continue to look at the US dollar as the ultimate safety currency. But it is worth noting that the interest rate differential actually favors India ever so slightly, but they are getting closer to an interest rate cut, according to the latest communiques.

So, with that, you could see the US dollar accelerate a bit. That will be especially true if the global economy really starts to slow down, because a lot of times that will have people putting money into US treasuries, which of course take US dollars. If we do fall from here, the 50 day EMA near the 83.83 level, I think is your next support level that buyers will come in and really start to pick up the greenback. To the upside, we could go looking to the 84.17 level. But remember, this is a pair that grinds, and of course the Bank of India certainly has its own influence as it's not exactly a free-floating currency all the time

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms in India to choose from.