- The US dollar has rallied significantly during the course of the early hours on Mondays as we continue to see the interest rate differential come into the picture and influence the market.

- After all, the US dollar, of course, offers a positive swap against the Japanese yen and at the end of the day, you do get paid.

- The Bank of Japan has recently admitted that they couldn't do much about interest rates.

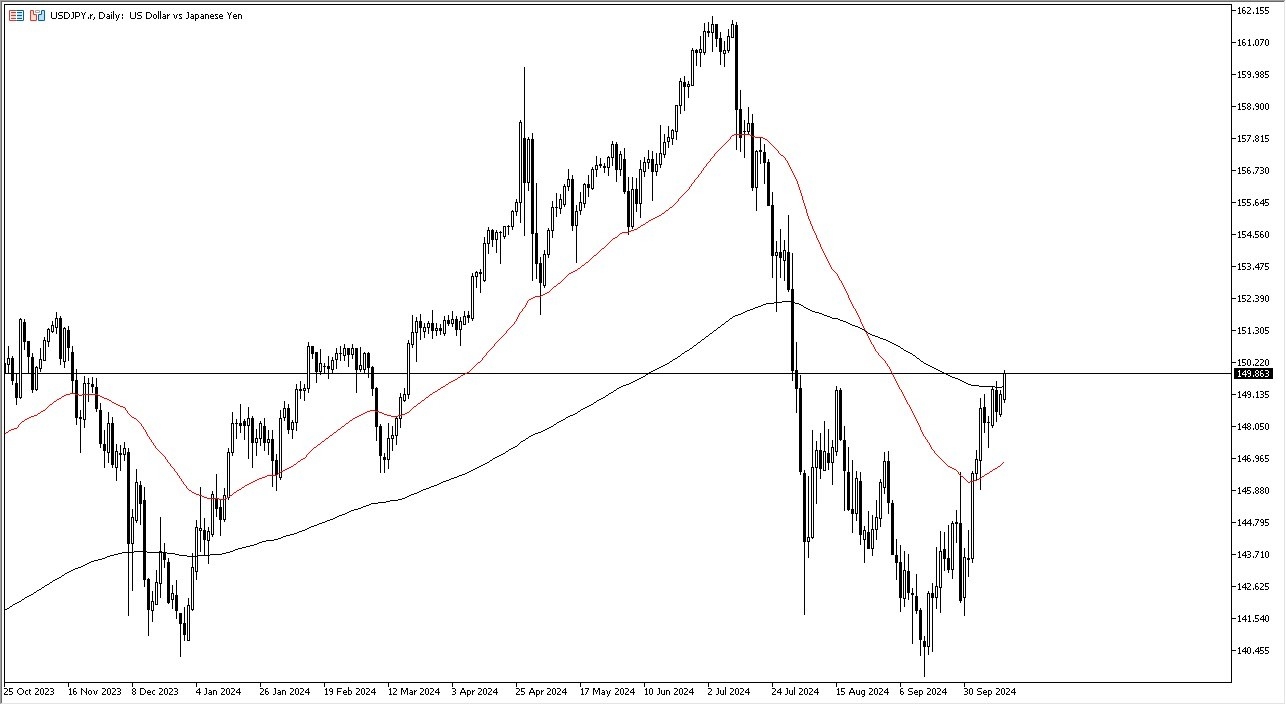

So ultimately, I think you've got a scenario where this pair does eventually rise quite a bit. In fact, I would anticipate that it ends up reaching toward the 153.50 yen level, although that probably takes some time. While this pair can move quickly, there is a real concern in the buyers as we recently have seen such a wipeout.

Top Forex Brokers

Bond Markets are Calling for More Inflation

For what it is worth, it looks like the bond market is now calling for more inflation. And as rates start to rise in the bond market, that makes the US dollar that much more attractive. I have no interest whatsoever in trying to short this pair. And I think you've got a scenario where traders will continue to look at this as a market that is returning to the previous carry trade. This of course will continue to see interest as the payment at the end of every day is something that a lot of people will be paying attention to.

Underneath, we have the 50-day EMA near the 147-yen level, which I think offers a bit of a floor at the moment and will continue to be something worth noting. I have no interest in shorting this pair until we break down below that indicator at the very least. It just doesn't look very feasible. This is a situation where the market is building up a lot of momentum, and this pair often will thrive on that very momentum.

Ready to trade our USD/JPY forex forecast? Here are the best forex brokers in Japan to choose from.