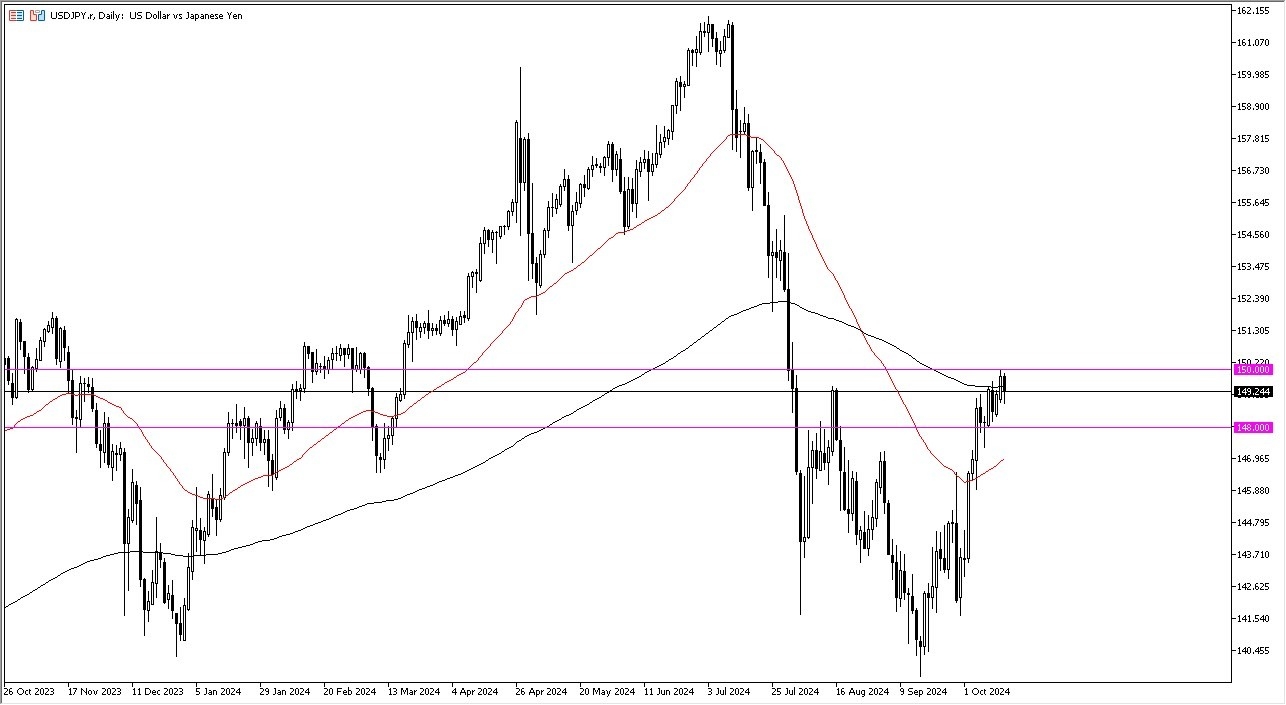

- The day has been fairly noisy on Tuesday in the dollar against the Japanese yen as the 150 yen level continues to be a massive barrier.

- That being said, the sell-off has been met with a little bit of value hunting and we currently find ourselves dancing around the 200 day EMA.

- This indicator is used by longer term traders quite often to determine the overall trend, but quite frankly, you can only read so much into it. For me, the most obvious spot on this chart will be the 150 yen level.

- And if we can get above there on a day like close, I think we're going to go higher. And when I say higher, I mean more likely than not, much higher, so do keep that in the back of your mind.

The Various Levels to Watch

The 148 yen level underneath will continue to offer support, and I think that's worth noting, especially as the 50-day EMA seems to be racing toward it. With all of that being said, I think we've got a situation where traders continue to look at the carry trade and the interest rate differential as something that's just a little too good to ignore. The interest rate differential between the two economies remains fairly robust.

Top Forex Brokers

And of course, the Bank of Japan has recently admitted that it cannot raise interest rates any further. So, there you go.

If we break down below the 148 level, then I suspect that means that the US dollar is in serious trouble and perhaps the Japanese yen is gaining due to some type of major risk off event.

That being said though, I do think that there's a major barrier, 150 yen, that once it breaks, it will bring in more of the FOMO traders. In that situation, you have a serious chance of a bigger move into the carry trade. This would simply be a continuation of the previous move that we had seen in the recent past.

Ready to trade our USD/JPY forex forecast? Here are the top forex brokers in Japan to choose from.