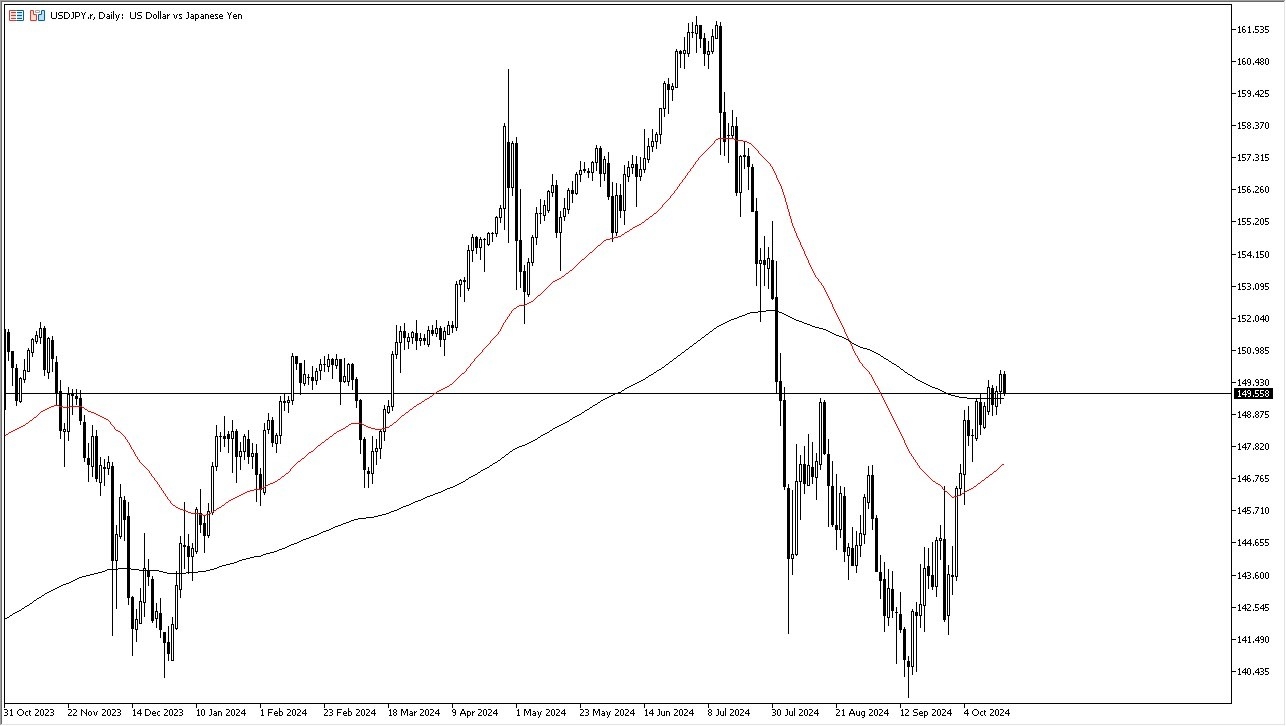

- In my daily analysis of the USD/JPY pair, the first thing I see is that we are hanging around the 200 Day EMA, which of course is an indicator that a lot of people will pay close attention to.

- The ¥150 level of course is a large, round, psychologically significant figure, and if we can break above the ¥150 level, the market is likely to continue to go much higher.

- That being said, we also have a lot of noisy trading just waiting to happen, and I think that you have to look at this through the prism of a market that remains a positive “carry trade” opportunity.

At this point in time, it’s worth noting that the Bank of Japan has readily admitted that they cannot raise interest rates anytime soon, so I think you’ve got a situation where it is probably a situation where we continue to see the Japanese yen punished, although it’s probably worth noting that the action on Friday certainly seem to be a bit of profit-taking and perhaps a little bit of exhaustion from the yen selling off.

Top Forex Brokers

Technical Analysis

At this point in time, we are above the 200 Day EMA, at least at the moment, and that of course would be a very bullish sign.

[graph_5755]

Furthermore, there are a lot of noisy areas underneath that should continue to offer value, and I think you have to look at this through the prism of whether or not we can find some type of momentum inducing fundamental noise to get the market moving.

If we do break to the upside, then I think it’s very likely that this pair could go looking to the ¥143 level.

If we pull back significantly from here, I think there is a lot of support to be found near the ¥147 level, which also features the 50 Day EMA approaching it and therefore I think technical traders would be interested in that region as well. In general, this is a market that I am a buyer of, and have no interest in shorting.

Ready to trade our daily forex forecast? Here are the best forex brokers in Japan to choose from.