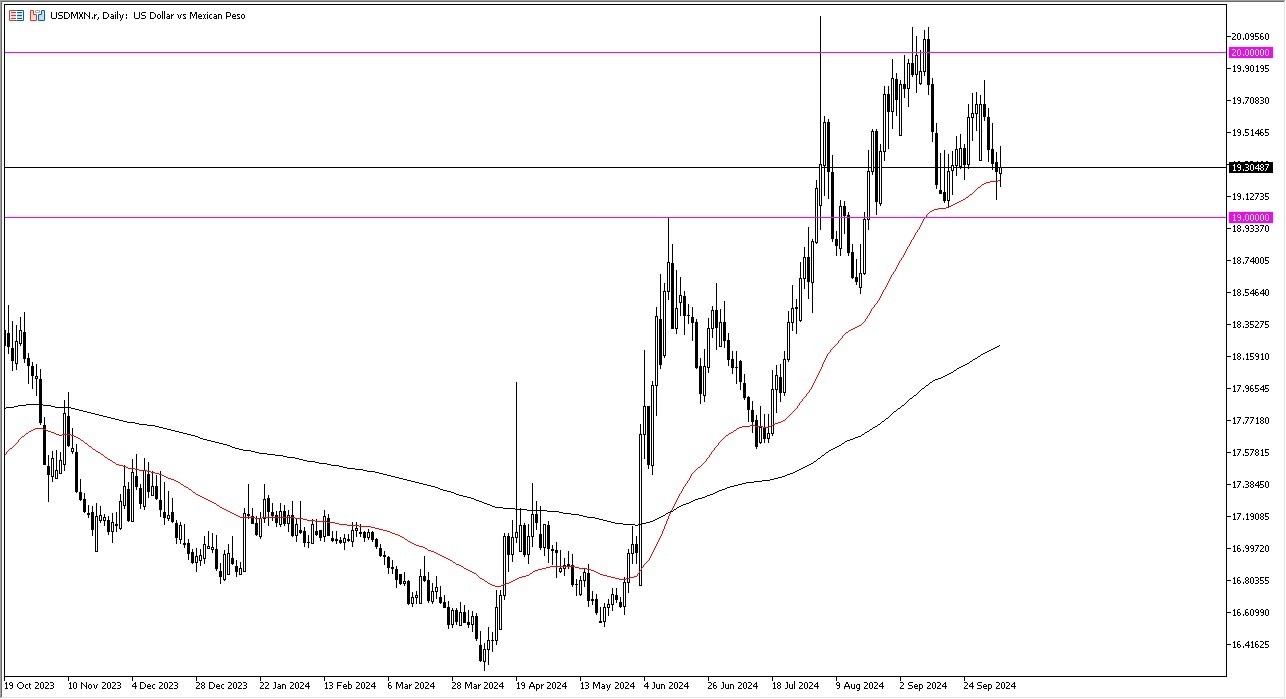

- The USD/MXN pair currently sits on the 50 Day EMA indicator.

- That being said, the market is likely to continue to see a lot of noisy behavior, and I do think that the 19 Mexican pesos level will continue to be a major support level, as it is a large, round, psychologically significant figure, and an area where we’ve seen action previously.

With all things being equal, this is a market that I think continues to see a lot of volatility which is typical for an exotic currency pair, especially considering that these 2 economies have so much intermixing that the pair tends to be noisy anyway. After all, Mexico is the largest exporter to the United States, and of course many of the major business transactions feature American firms building in Mexico, especially in the automotive industry. Furthermore, there are a lot of migrants from Mexico that come into the United States and send home a certain amount of remittances, mainly to support families. In fact, it’s very common for a Mexican citizen to work in the United States for 2 or 3 years, only to turn around and go home, so it is a very fluid situation but there are so many involved in various industries that it certainly has a major influence on this pair.

Top Forex Brokers

Technical Analysis

The technical analysis for the USD/MXN exchange rate of course suggests that there is a lot of support underneath, and with that being said it’s also worth noting that there is a significant amount of resistance above at the 20 MXN level, which is a large, round, psychologically significant figure, and there is a lot of noise just waiting to happen in that region. All things being equal, looks like we are going to continue to go back and forth in this region, therefore I think you got a situation where the trading public will continue to look at short-term dips as potential buying opportunities. However, if we were to break down below the 19 MXN level, then we could see this market drop toward the 18.50 level.

Ready to trade our Forex daily analysis and predictions? Check out the best Forex brokers in Mexico to choose from.