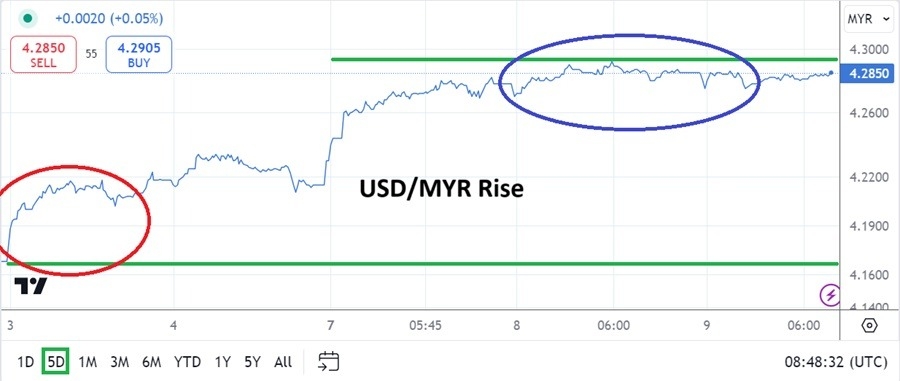

The USD/MYR continues to see some buying activity as behavioral sentiment has turned cautious the past week and a half in the currency pair.

- After touching a low of nearly 4.0950 on the 30th of September the USD/MYR has experienced a bearish trend.

- Price velocity this Monday kicked in strongly when financial institutions returning to their trading desks in Malaysia and elsewhere in Asia reacted to the stronger than anticipated U.S jobs numbers.

- On Friday the USD/MYR was trading near the 4.2125 ratio.

Monday’s surge higher, as the outlook for the U.S Federal Reserve became less clear, hit the 4.2675 mark quickly. Since experiencing the strong buying momentum, the USD/MYR has continued to show incremental bullish momentum and the price of the currency pair as of this writing is around 4.2855.

Top Forex Brokers

USD/MYR Near-Term and What is Next

The USD/MYR reversal higher has correlated to the broad Forex market which began seeing signs of USD centric strength creep into financial institutions the past ten days as risk adverse sentiment has grown. It should not be discounted either that the notion the USD had sold off too much by the end of September was a factor too for the USD/MYR. However, the combination of nervousness via the mixed U.S economic data has added to the buying momentum.

Tomorrow the U.S will issue important inflation data and it will impact the USD/MYR. Yet, day traders on Thursday of the currency pair need to understand the bulk of the reaction in the USD/MYR will be seen when Malaysian financial institutions open again on Friday. This because the trading of the currency pair is almost illiquid when the U.S will be releasing its data which carries a 12 hour time difference between Malaysia and U.S Eastern Standard Time.

Bullish Reversal in a Mid-Term Bearish Trend

Day traders need to be cautious today and tomorrow. The USD/MYR is likely to be choppy leading up to the U.S inflation report outcomes. Betting on the results of the U.S CPI numbers is akin to pure gambling by speculators unless they have genuine inside knowledge of the USD/MYR.

- The USD/MYR has produced a strong bearish trajectory over the mid-term, the Malaysian Ringgit had been one of the better performing currencies globally.

- Traders of the USD/MYR can still correlate trading to the USD/SGD to gauge potential relationships technically.

- If tomorrow’s U.S CPI data meets or is slightly weaker than anticipated this might start to create durable resistance for the USD/MYR and potentially spark renewed selling.

- Day traders need to use solid risk management over the next two trading days to avoid swift changing values.

USD/MYR Short Term Outlook:

Current Resistance: 4.2870

Current Support: 4.2830

High Target: 4.2910

Low Target: 4.2770

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.