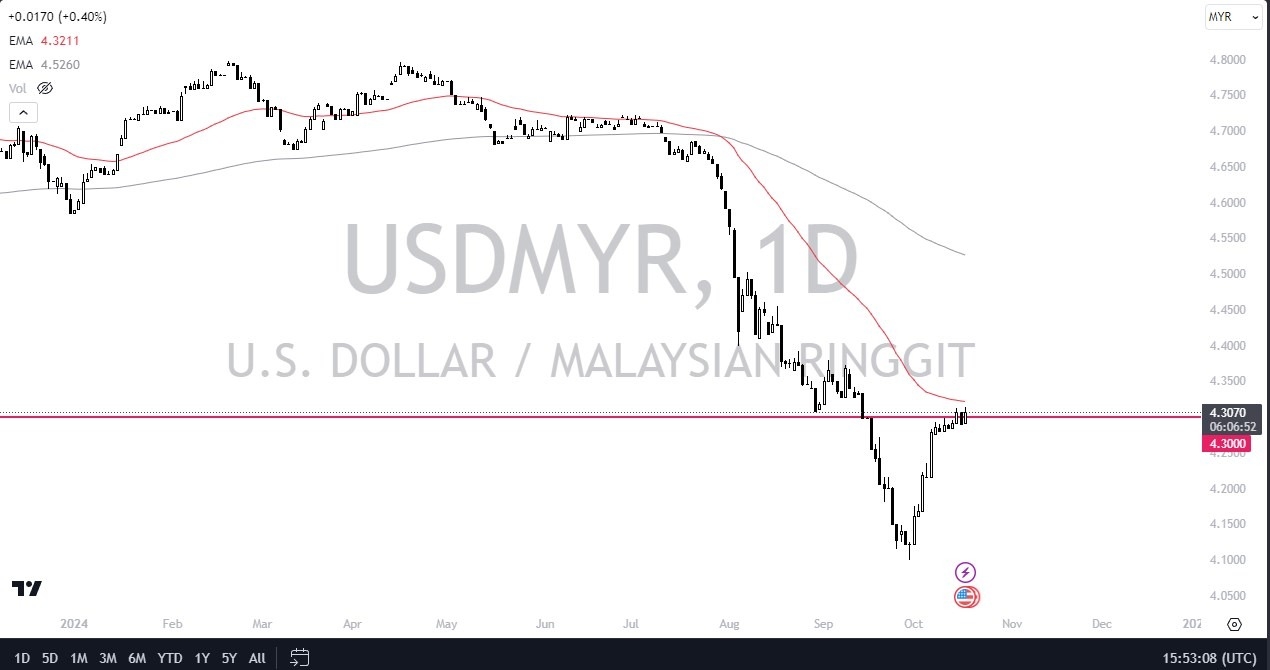

- During my daily analysis of exotic currency pairs, the USD/MYR pair has caught my attention, as we are currently hanging around a large, round, psychologically significant figure in the form of the 4.30 MYR level.

- Furthermore, it’s also worth noting that the US dollar has strengthened quite a bit against a lot of the emerging market currencies, such as the South African Rand.

- In other words, we are starting to see a lot of the same action and a lot of the smaller currencies, and when I see that, I stand up and take notice.

US Dollar Dominance

Despite what some people will tell you, the US dollar is the key to figuring out Forex markets. If you can get the dollar direction correct, in general you tend to do fairly well. This is especially true when you start talking about emerging markets, because most emerging markets move in the same direction, at least those that are not directly influenced by the central banks of those countries. In the case of South Africa and Malaysia, they free float and therefore it makes a certain amount of sense that we start to see the US dollar move in the same direction. As I look around the world and a lot of these pairs, the US dollar is starting to strengthen, and therefore it makes a certain amount of sense that we would see they all move in tandem.

Top Forex Brokers

Keep in mind that the US dollar is considered to be a safety currency, and the 50 Day EMA sitting just above it does offer a little bit of technical resistance. If we can break above there, the market could go looking to the 4.50 level above, which is backed up by the 200 Day EMA. If we fall from here, then we could drop to the 4.20 level, which is an area that is somewhat important, but it could even open up a move down to the 4.10 level. In general, this is a market that has been in a downtrend for some time, but it certainly looks as if it is trying to turn things around. Breaking above the 50 Day EMA would be a crucial move for US dollar strength.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.