- The USD/NOK currency pair captured my attention as a search for trading opportunities in the exotic currency pairs.

- After all, the market is highly sensitive to the oil market, due to the fact that Norway is a major exporter of crude from the North Sea.

- On the other hand, we also have the US dollar which of course is a safety currency, so if we do get some issues as far as risk appetite is concerned, they can also work against the Norwegian krone.

Technical Analysis

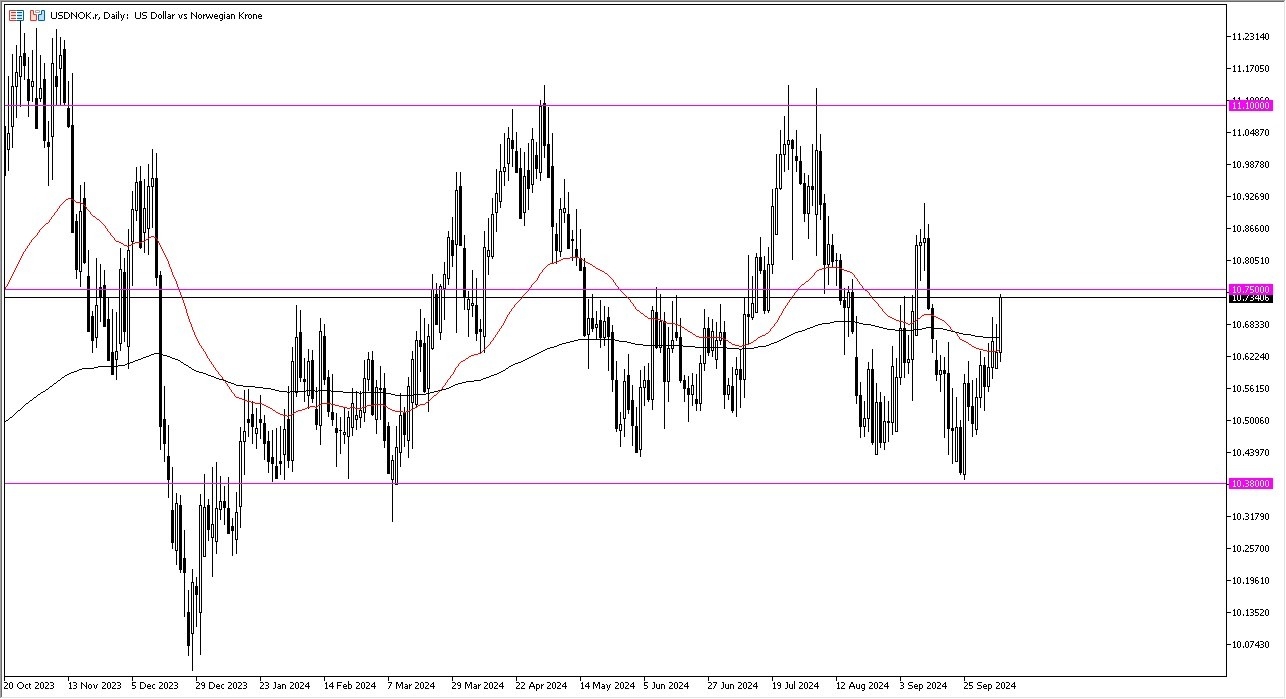

The technical analysis for this market is somewhat mixed, but it is worth noting that we just blew through the top of a couple of long wicks as far as the previous couple of trading sessions, and of course we just broke above the 200 Day EMA, and the 50 Day EMA indicators. That being said, the 10.75 level above is a significant amount of resistance just waiting to happen, as it has been important multiple times. In fact, this is essentially the “midway point” in the longer term consolidation area that we had been in, and therefore we are getting fairly close to “fair value” when it comes to this pair.

Top Forex Brokers

Underneath, we have the 10.38 NOK level offering significant support as it is the bottom of the overall consolidation range, where we had bounced from rather significantly. That being said, above we have the 11.10 NOK level offering massive resistance, and serving as resistance at the top of the overall consolidation range. Because of this, I will be watching the 10.75 level very closely, to give us an idea as to which direction we are going. Will we fail to break out above this level? Or will we break out above there and close above there on a daily close to send more “FOMO buying” into this market?

Make sure you pay close attention to the crude oil markets, because that seems to be the major contributor to the volatility during the last 24 hours, and I think it will continue to be a major mover of what happens next.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.