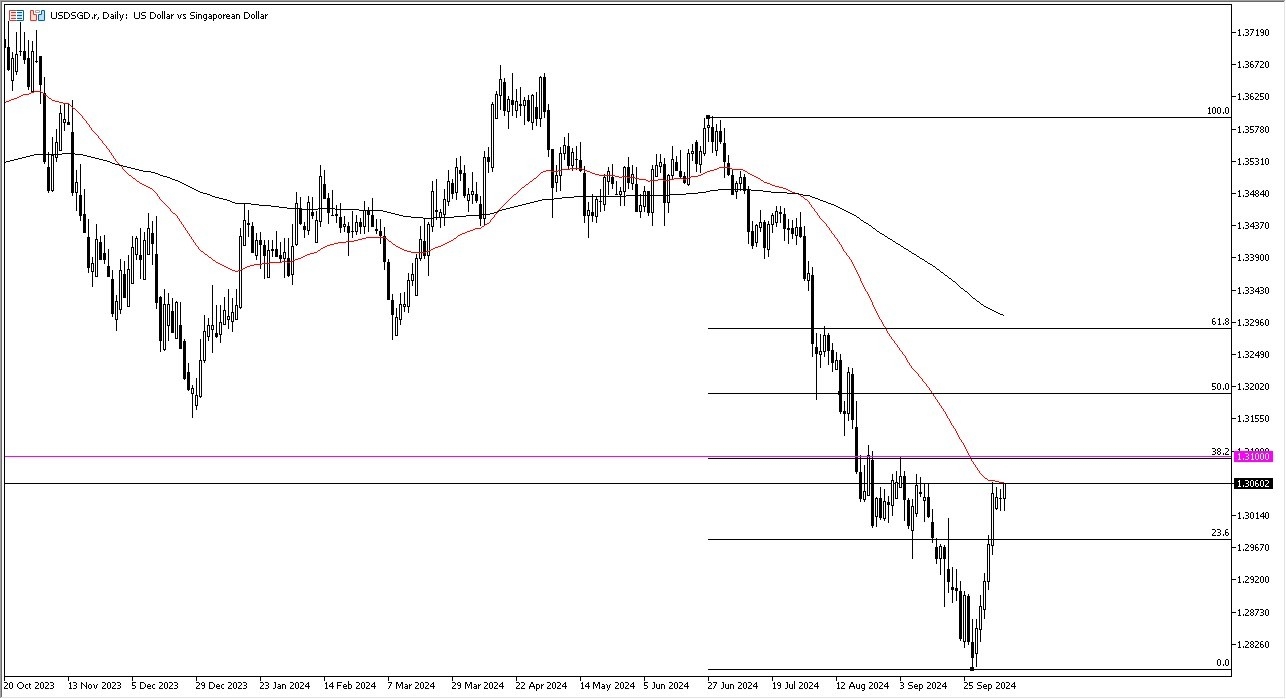

- The US dollar had been sold off quite drastically against the Singapore dollar for some time, but the last couple of weeks have been very bullish for the greenback.

- At this point in time, it’s also particularly interesting to watch this pair because it is at a major inflection point when it comes to technical analysis.

- With that being the case, I think you have to pay close attention to whether or not the market continues to show momentum, or if it starts to give up.

Technical Analysis

Looking at the USD/SGD exchange rate, the interest rate differential actually favors the United States, so you do get paid to hang on to this pair. However, the Singapore economy is much stronger than many others, so therefore the Singapore dollar has seen a bit of inflows as a result. Regardless, we have several things going on at the same time on the charts that are worth paying attention to that has me very interested.

Top Forex Brokers

It’s not only the 50 Day EMA that we are currently testing the captures my attention, but it’s also the fact that the 1.31 SGD level above has been previous resistance, and it also sits on the 38.2% Fibonacci retracement level, an area of a lot of traders will be paying attention to if they still remain bearish longer term. If we break above there, then the 50 percent Fibonacci retracement level is closer to the 1.32 level, also a large, round, psychologically significant figure. In other words, there are several places that the US dollar could run into a bit of trouble, but it should be noted that we are seeing the US dollar bottom against a lot of currencies at the same time, and it’s also worth noting that the other currency pair that behaves very similar to this one, the USD/CHF currency pair, has recently seen the US dollar skyrocket against the Swiss franc. Are we doing the same here?

Want to trade our daily forex analysis and predictions? Here's the best forex brokers in Singapore to check out.