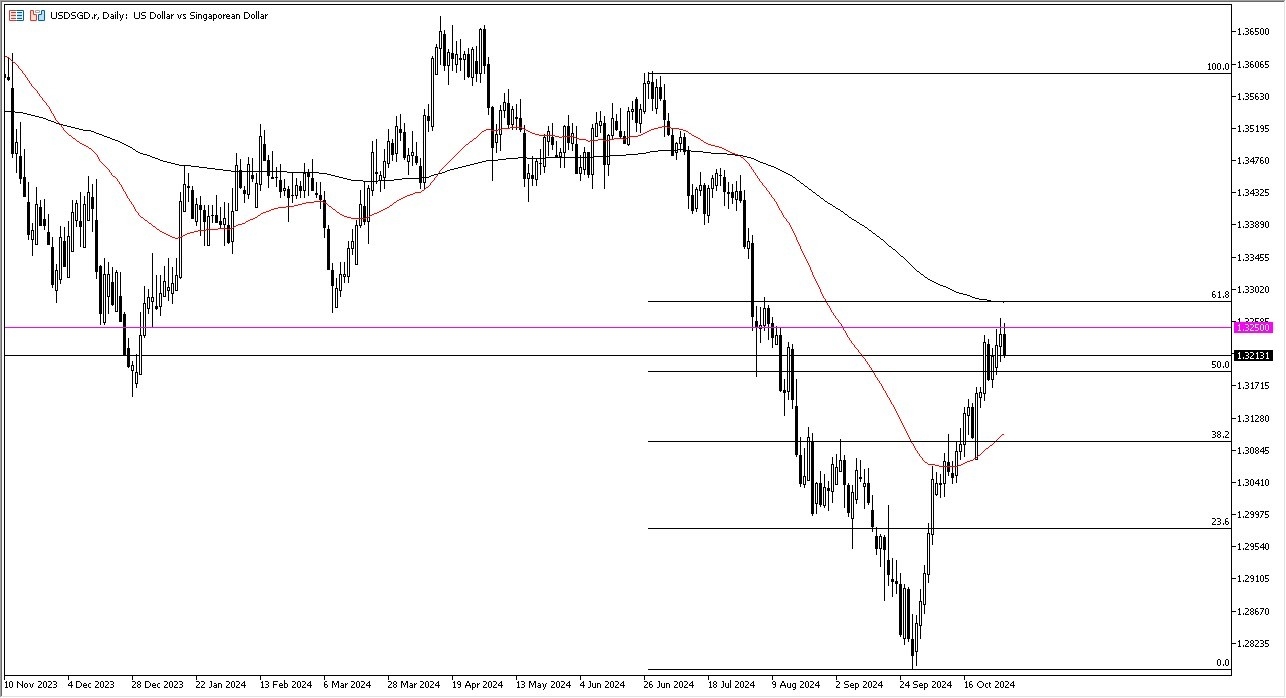

- At this point in time, it is obvious to me that the US dollar is trying to test the 200 day EMA and perhaps even more importantly the 1.3250 level.

- This is an area that's been important multiple times and now that we are between the 50% Fib level of the biggest sell-off.

- The 200-day EMA is backing up the 61.8% Fibonacci retracement level.

So, in general, this is a market that I think is a little overextended. Now the question of course is going to be whether or not the US dollar is going to continue to strengthen or if we continue the downward trajectory toward the 1.31 level. Near the 1.31 level we have the 50 Day EMA it would make sense if we were to see a certain amount of people will be in that area to get involved.

Top Forex Brokers

Watch The US Bond Markets for Guidance

The market will be paying close attention to the interest rates in America, as the bond markets have been crazy. It's worth noting that the rates in the United States could very well get out of hand as people are starting to spike again. And if that's going to be the case, that will help the dollar before it's all said and done. That being said, keep in mind that Friday is the jobs number, and that has a major influence on what happens with the greenback next.

I think in the short term we are a little bit pulled back, but we very well could find a buy on the dip type of setup just waiting to happen, because quite frankly, I think there are enough issues out there and the fact that the US economy remains somewhat strong that people may be running to the greenback in mass. However, the exact opposite could be true as well if things change suddenly.

Want to trade our daily forex analysis and predictions? Here's the best forex brokers in Singapore to check out.