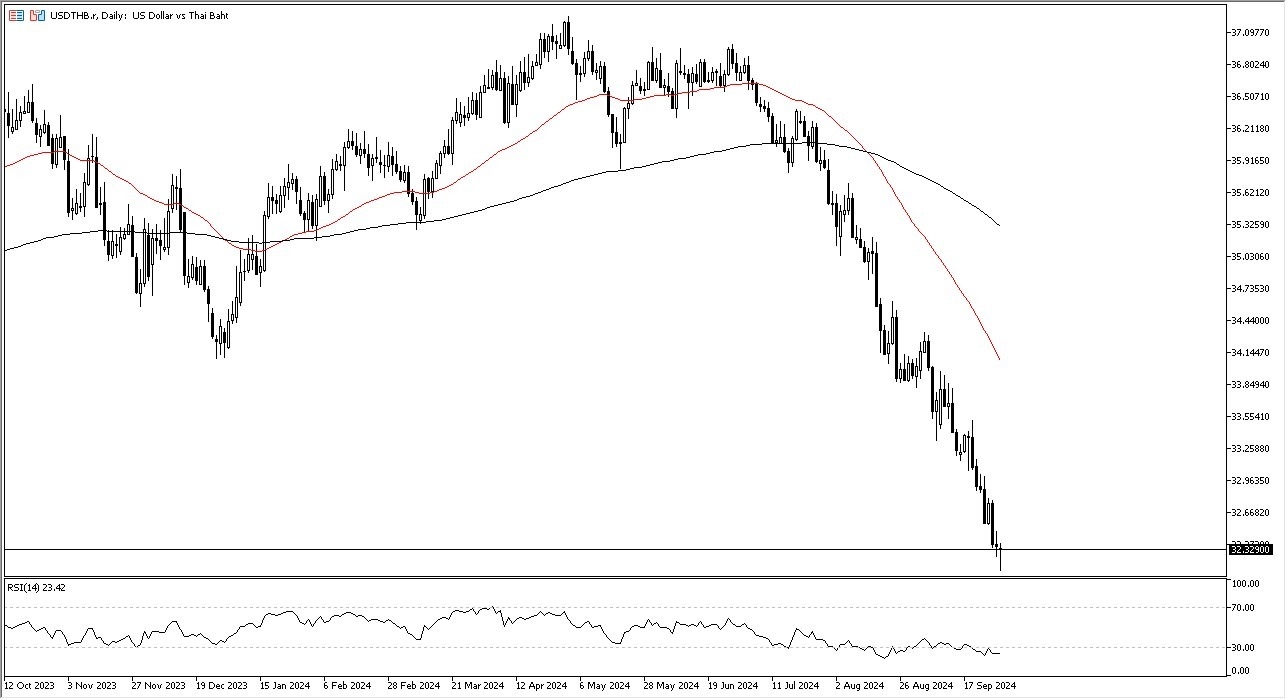

- The USD/THB pair is so oversold that it is likely that we will sooner or later see some type of bounce.

- For what it is worth, it looks like the Monday candlestick is forming a hammer, and it is also worth noting that we are near a major support level that a lot of people’s attention to.

While the Thailand GDP grew 2.59% during the previous year, the rest of the world seems to be slowing down. At this point, it looks like Thailand continues to grow, and this is probably more or less the fact that Thailand is starting from a fairly low level in comparison to places like the United Kingdom or the United States, but also Thailand has better demographics than many other of its neighbors. In other words, Thailand may very well be a much stronger country economically speaking in the future.

Top Forex Brokers

Technical Analysis

It’s worth noting that the 32 THB level is a massive support level going back multiple years. We have shot straight down from the highs to fall off of a cliff, and therefore it makes a certain amount of sense that we would see a lot of value hunters out there willing to get involved and perhaps pick up “cheap US dollars.” Whether or not we actually have that coming down the road is a completely different question, but it certainly looks like we very well could see a rather significant bounce.

Furthermore, I think we also need to keep in mind that if the global appetite for risk it starts to fall off of a cliff, Thailand is not exactly the first place that you put money to work. At this point, I think if the US dollar can break above the 32.50 THB level, it’s likely that we may see a deeper correction, perhaps bouncing all the way to the 33.55 level. If we break down below the 32 THB level on the daily chart, the bottom has just fallen out for a multiyear move.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.