Signals for the Lira Against the US Dollar Today

- Risk 0.50%.

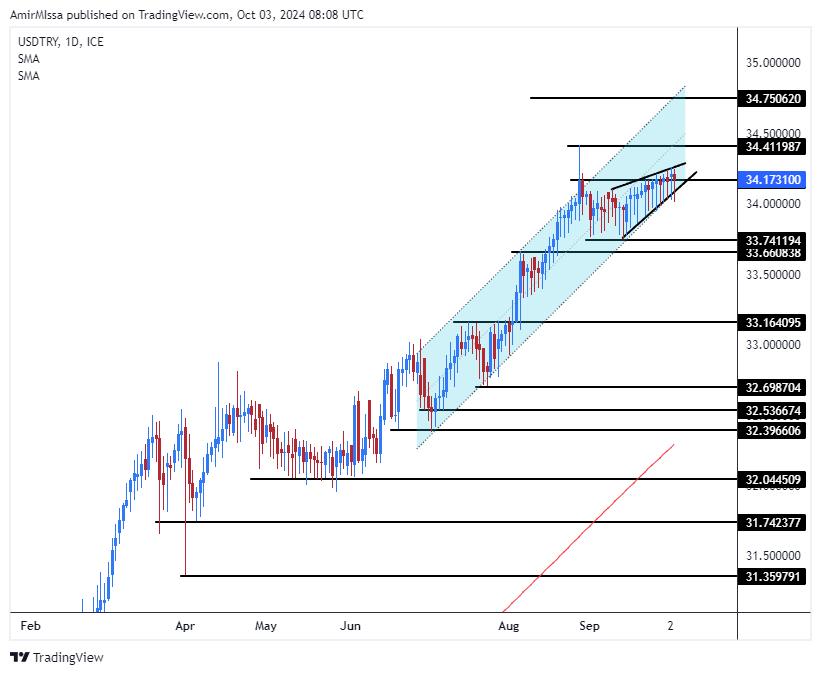

Bullish Entry Points:

- Open a buy order at 33.99.

- Set a stop-loss order below 33.85.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 34.30.

Bearish Entry Points:

- Place a sell order for 34.25.

- Set a stop-loss order at or above 34.35.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 33.80.

Turkish lira Analysis

The Turkish Lira rose slightly during early trading on Thursday. While the pair continued to trade in the same limited range around 34.20 levels throughout the trading week. The lira received limited support from the inflation data in Turkey that was released this morning, as inflation recorded a decline on an annual basis in September of less than 50%, which turned real interest rates. Clearly, it’s calculated by subtracting the inflation rate from the nominal interest rate in banks) into positive for the first time since 2021.

Top Forex Brokers

In the details of the data, the country's statistical institute revealed in its report issued this morning, Thursday, that the inflation rate in September recorded 49.38% on an annual basis. Compared to 51.97% recorded in August. Also, the increase in housing prices (97.87%) and education (93.59%) topped the highest increases on an annual basis. On the other hand, the increases were lower in transportation prices, which recorded an increase of 26.60%, as well as the increase in clothing and footwear prices, which recorded an increase of 30.70% on an annual basis. On a monthly basis, the consumer price index rose by 2.97% in September, led by increases in education prices, which reached 14.21%.

The current decline in inflation rates supports the approval of interest rate cuts in Turkey by the end of the year, as previously indicated by previous reports. The Turkish Central Bank had expected inflation to decline to 39% by the end of the year, while expectations of a Reuters poll had indicated a decline in inflation to 43% by next December. This opens the door for the Central Bank to approve the first interest rate cut, which currently stands at 50%, after it was kept unchanged for the sixth consecutive month last September.

TRYUSD technical Analysis and Expectations Today:

On the technical level, the US dollar declined slightly against the Turkish lira (USD/TRY). The pair recorded levels of 34.16 at the time of writing the report, compared to levels of 34.21 recorded during yesterday’s closing. The price maintained its movement within an ascending price channel on the daily time frame, indicating the general upward trend dominating the pair's trading, which is supported by the pair moving above the 50 and 200 moving averages on the four-hour time frame. Also, the same averages on the daily time frame. Likewise, the pair is trading within a rising wedge frame on a smaller time frame that may open the door to an increase for the pair in the event of a breach of the upper limit of the pattern. Ultimately, The Turkish lira price forecast includes a rise in the pair if it closes above the range of the rectangle shown, as every decline in the dollar price represents an opportunity to buy back.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out