Signals for the Lira Against the US Dollar Today

Risk 0.50%.

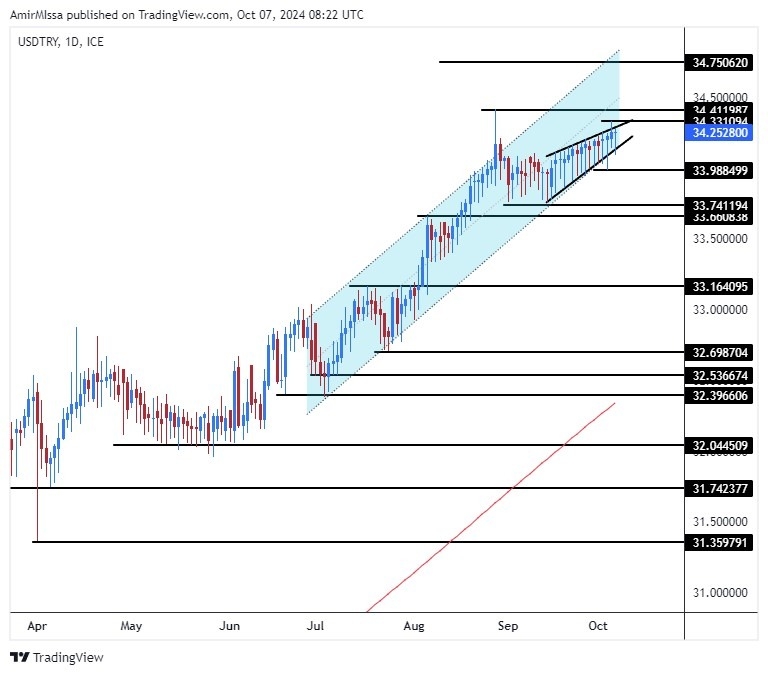

Bullish Entry Points:

- Open a buy order at 33.99.

- Set a stop-loss order below 33.85.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 34.30.

Bearish Entry Points:

- Place a sell order for 34.35.

- Set a stop-loss order at or above 34.51.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 33.99.

Turkish lira Analysis:

The US dollar against the Turkish lira has stabilized within the same trading range it has been moving in for the past few weeks. The pair is fluctuating with the lira's resilience, trading below its all-time high reached last August, supported by the Turkish Central Bank which is working to stabilize the lira.

At the beginning of the week, analysts at Goldman Sachs released a report revising their previous expectations regarding the timing of easing monetary policy in Turkey and the first interest rate cut. The bank's analysts indicated that the Turkish Central Bank will maintain the interest rate at current levels until the beginning of next year instead of cutting it in November as previously expected. This came after the release of inflation data last week. Also, the bank's analysts revised their expectations for inflation at the end of the year to 44% compared to the previous forecast of 40%.

Goldman Sachs analysts attributed the revision of their expectations to the higher-than-expected monthly inflation data, with prices rising by 2.97% across Turkey and 3.9% in Istanbul. The Goldman Sachs report added that the 3% inflation rate last month was "much higher" than the level required for the central bank to start cutting interest rates, which may delay this decision.

Conclusively, the bank warned that the continued weakness of the lira's purchasing power and increased inflationary pressures could push the government to raise the minimum wage in December, which could exacerbate the risk of inflation rising again next year.

Top Forex Brokers

TRYUSD Technical Analysis and Expectations Today:

The US dollar continued to rise slightly against the Turkish lira (USD/TRY) at the beginning of the weekly trading. The pair recorded levels of 34.25, approaching the peak it recorded last week at 34.33 lira. Technically, the pair is trading within an ascending price channel on the four-hour timeframe. While on the larger timeframe, the price is trading within an ascending price channel, within the overall upward trend dominating the pair's trading, as the pair moved above the 50-day and 200-day moving averages, as well as the price moving above the 50-day moving average on the four-hour timeframe, which represents a strong support level for the pair. The Turkish lira price forecast includes a rise in the pair with the price stabilizing within the price channel, as every decline in the dollar price represents an opportunity to buy back.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.