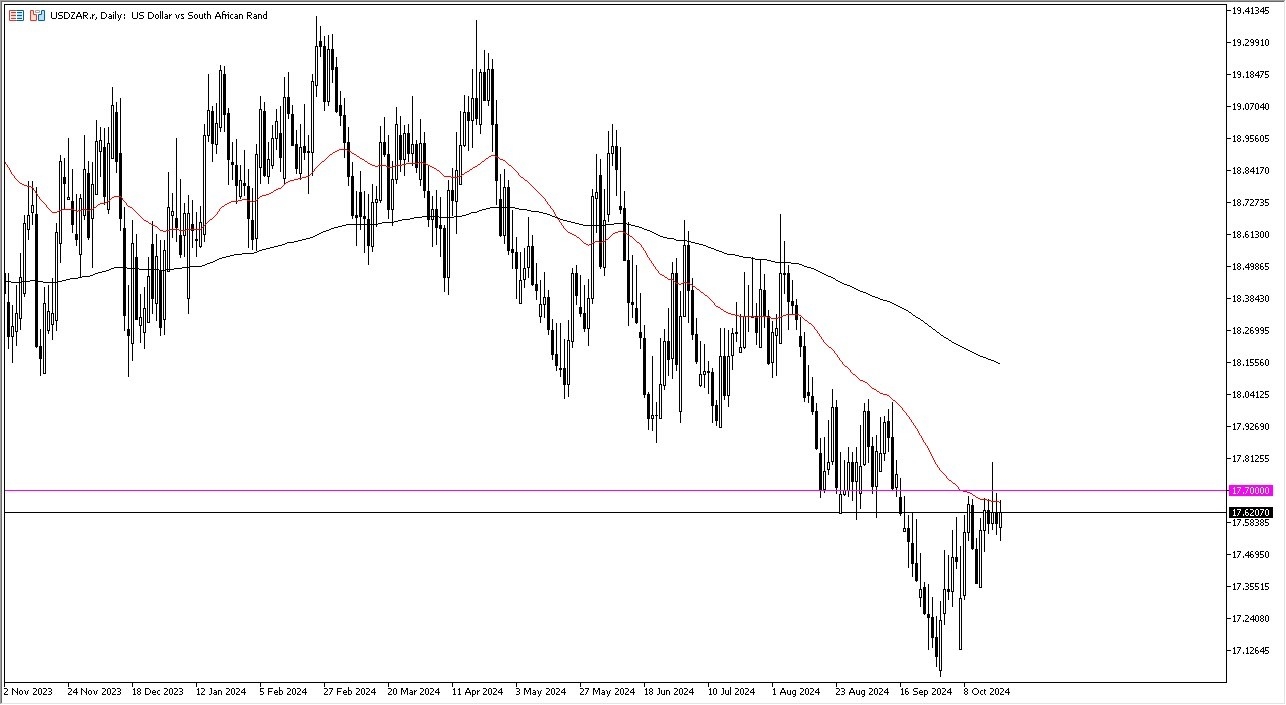

- In my daily analysis of exotic currency pairs, the USD/ZAR pair captures my attention as we continue to test the crucial 17.70 ZAR level.

- This of course is an area that’s been important multiple times, and I think ultimately, we need to pay attention to how the market has been reacting to it.

- After all, we are continuing to pressure that region but have not been able to break above that level quite yet. We did make a significant attempt on Thursday, only to turn around and form a shooting star.

It’s also worth noting that the 50 Day EMA sits just below the 17.70 level, which is an area that has been important multiple times, and I think we have to look at this through the possibility of whether or not we can break out.

I think if we break above the Thursday candlestick of last week, then the US dollar will probably continue to see a lot of momentum enter this market as people chase the next “FOMO trading.”

Top Forex Brokers

Emerging Markets

Keep in mind that South Africa is an emerging market, so a lot of this comes down to risk appetite. If we continue to see a lot of concerns about the global economy, that will almost certainly send more money running to the US dollar, especially as the interest rates in the 10 year note rallied quite significantly during the trading session on Monday.

If we do not have a huge interest rate differential between the USD/ZAR exchange pair, that will pretty much eviscerate the whole idea of owning the South African Rand.

If we break below the 17.50 ZAR level, then I think we continue the overall downtrend. At that point, it’s likely that the market could go looking to the 17.25 ZAR level, and then again to the 17.12 level after that.

In general, this is a market that I think will continue to be noisy, but I also recognize that we have gotten to the point where we have gotten so oversold and there are so many concerns around the world that we could in fact see the greenback start to break out to the upside.

Ready to trade our daily Forex forecast? Here’s some of theTop-Rated Trading Platforms in South Africa to check out.