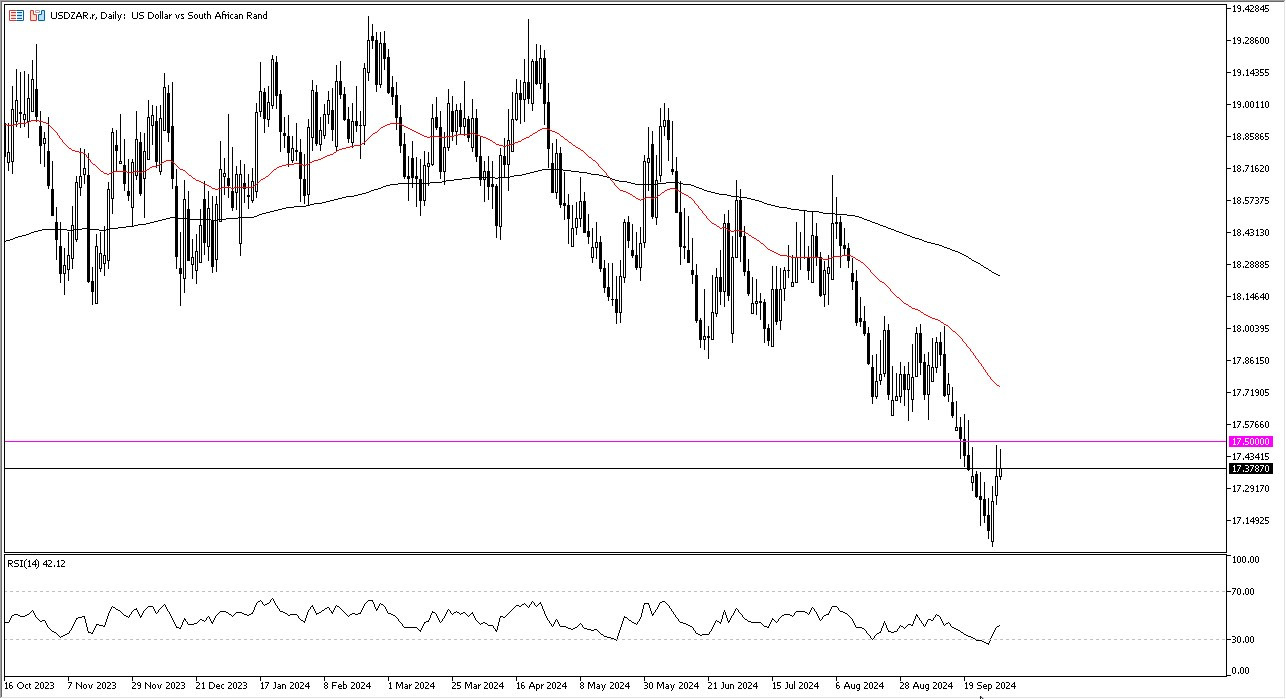

- The US dollar initially rallied during the trading session on Wednesday to try to reach the 17.50 Rand level, an area that was tested during the previous session.

- That being said, this is a market that is struggling to break above that level and it's probably worth noting that this is a major downtrend that we have been in for a while.

The question now is whether or not risk appetite will allow the chasing of higher yields. So far that's been the case, but I would also point out that South Africa isn't necessarily the first place people look to for safety as the world continues to see a lot of uncertainty and even though the South African Rand offers an 8%, and therefore stronger return than the US dollar, the reality is that if we get a geopolitical event that finally scares people, then you've got a real shot at this pair just ripping to the upside.

Top Forex Brokers

In that environment, I think you've got the possibility of getting to 18 rather quickly and then perhaps higher than that. If we continue to see more of the same, then I do think that the dollar will revisit the 17.06 Rand level as well. In general, this is a very volatile market, so keep your position signs reasonable and understand that you are investing in commodities and the emerging market if you are shorting this pair.

The US dollar of course is considered to be a safety currency, so we start to see a lot of fear in the markets, the South African Rand will almost certainly suffer at the hands of the greenback. We have seen this over the last couple of days to a lesser extent, but ultimately, I think you’ve got a situation where the downtrend is so brutal that it’s difficult to fight against them. Because of this, you need to be cautious about putting a lot of money into the market chasing the latest bounce.

Ready to trade our daily Forex analysis? Here's a list of the best forex trading platforms South Africa to choose from.