USD/MXN

The US dollar continues to punish the Mexican peso, and quite frankly I think this is a market that is trying to build up enough momentum to finally break out above the crucial 20 MXN level. If and when it does, we could see a big move just waiting to happen, but it must be said that we are certainly in an area that is going to be crucial and difficult to break out of. As things stand right now, we have simply been bouncing around between the 19 MXN level and the 20 MXN level, building up some type of inertia.

The US dollar continues to punish the Mexican peso, and quite frankly I think this is a market that is trying to build up enough momentum to finally break out above the crucial 20 MXN level. If and when it does, we could see a big move just waiting to happen, but it must be said that we are certainly in an area that is going to be crucial and difficult to break out of. As things stand right now, we have simply been bouncing around between the 19 MXN level and the 20 MXN level, building up some type of inertia.

Dow Jones 30

The Dow Jones 30 continues to outperform most other indices, and at this point time it looks like it’s going to make a serious move to break well above the 43,200 level. The market is a little overbought at this point, but short-term pullbacks should end up being buying opportunities. The 42,000 level should be support, and then again, we should see massive support at the 40,000 level, assuming that we even fall that far. Liquidity measures coming out of the Federal Reserve will continue to be a major reason why the Dow Jones 30 performs fairly well.

GBP/USD

The British Pound continues to dance around the 1.30 level, and I think it is at a major area of inflection. Quite frankly, this is a market that will continue to look at that area as a potential market moving level, but more importantly, the question will be whether or not it holds as support. If it does in fact do so, then it’s likely that the British pound will go looking to the 1.33 level given enough time. If we break down below the 1.2950 level, then it’s possible that we could go down to the 1.28 level.

The British Pound continues to dance around the 1.30 level, and I think it is at a major area of inflection. Quite frankly, this is a market that will continue to look at that area as a potential market moving level, but more importantly, the question will be whether or not it holds as support. If it does in fact do so, then it’s likely that the British pound will go looking to the 1.33 level given enough time. If we break down below the 1.2950 level, then it’s possible that we could go down to the 1.28 level.

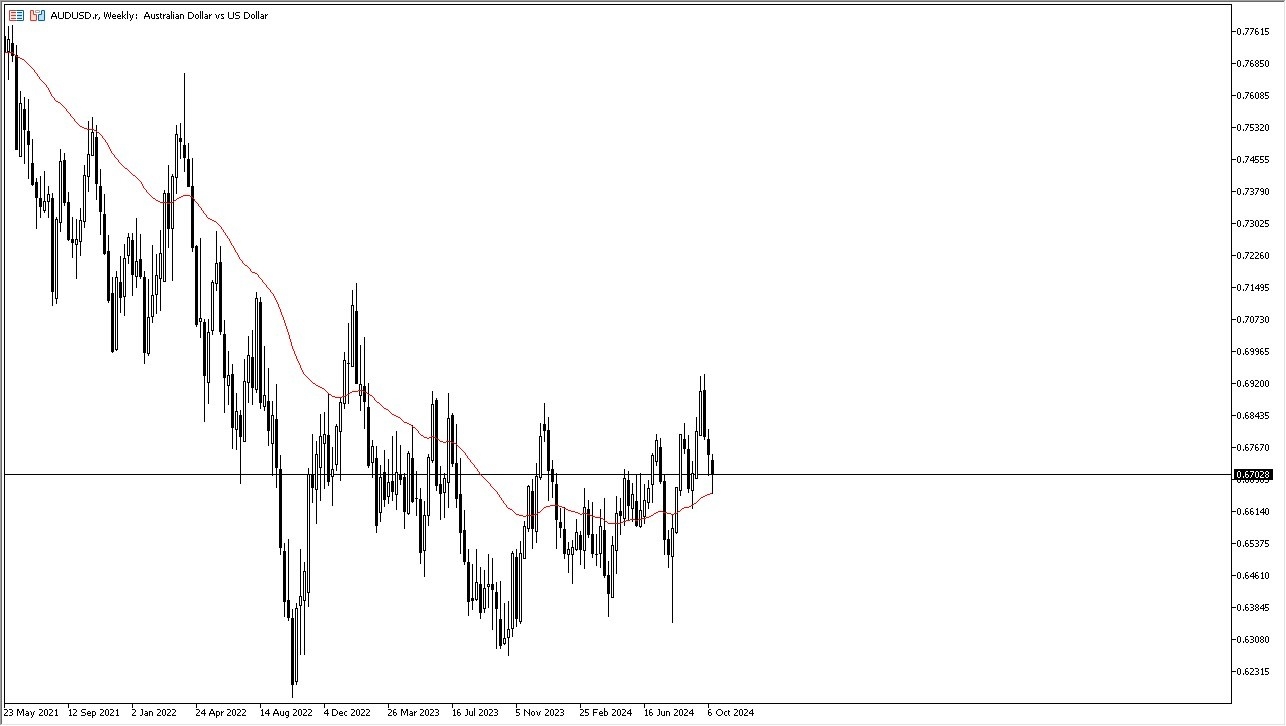

AUD/USD

The Australian dollar fell to reach the 50 Week EMA during the trading week, but then turned around to show signs of life. With that being the case, the market looks as if it is ready to recover a little bit, perhaps trying to reach the 0.68 level. On the other hand, if we were to break down below the bottom of the candlestick for the week and the 50 Week EMA, we could see a drop down to the 0.65 level before it is all said and done. Keep in mind that the Australian dollar is highly sensitive to risk appetite.

USD/CHF

The US dollar has rallied again against the Swiss franc, testing the crucial 0.8675 level. I think it’s probably only a matter of time before we go higher, but you need to keep in mind that this is a pair that had been sold off quite drastically before we got here, so I do think that there is a little bit of “swimming upstream” going on here. If we can break above the 0.8675 level on a daily close, then I anticipate that the US dollar will continue to climb higher against the Swiss franc. If we pull back, I will look for signs of support to start buying again.

Top Forex Brokers

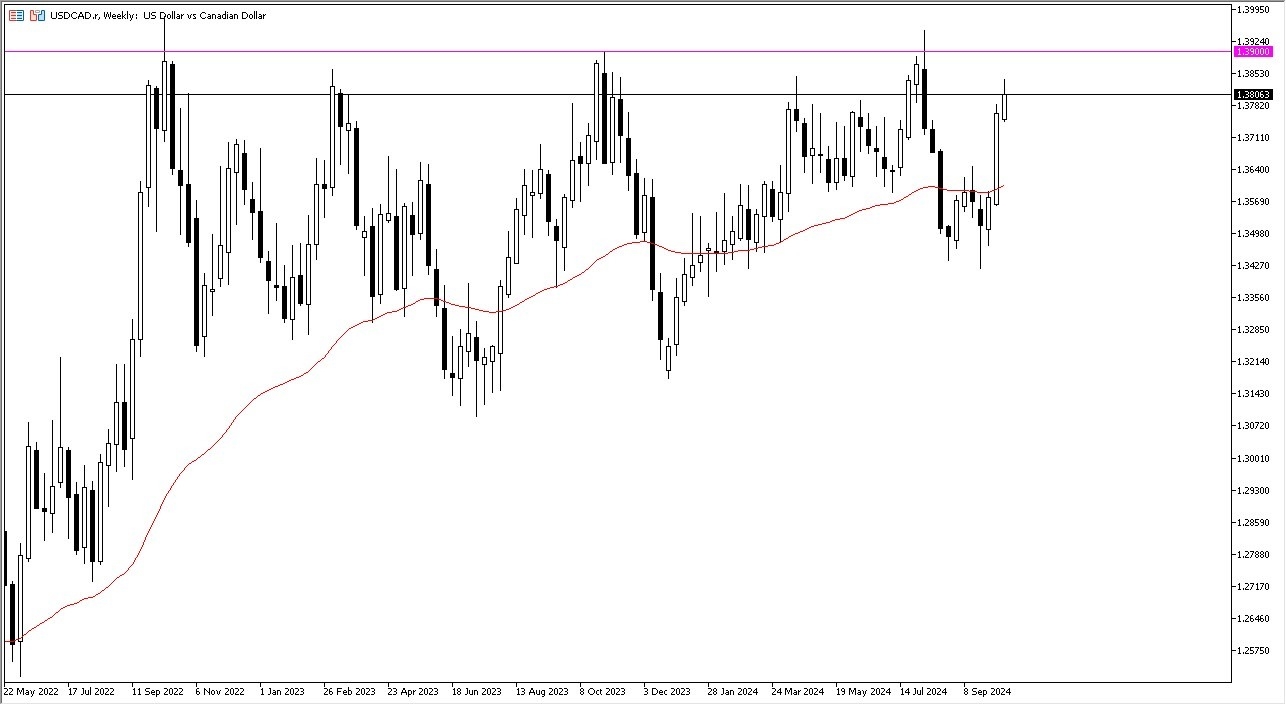

USD/CAD

The US dollar continues to Rally against the Canadian dollar, but it’s probably worth noting that the area that extends to the 1.39 level above is rather significant resistance, so I do think that the upward pressure is probably somewhat limited in the short term. I think short-term pullbacks are more likely than not, but that will end up being a potential buying opportunity in this market. If we can get a daily close above the crucial 1.39 level, then it’s likely that this pair goes looking to the 1.40 level in the next few weeks. I have no interest in shorting this pair, at least not as things stand right now.

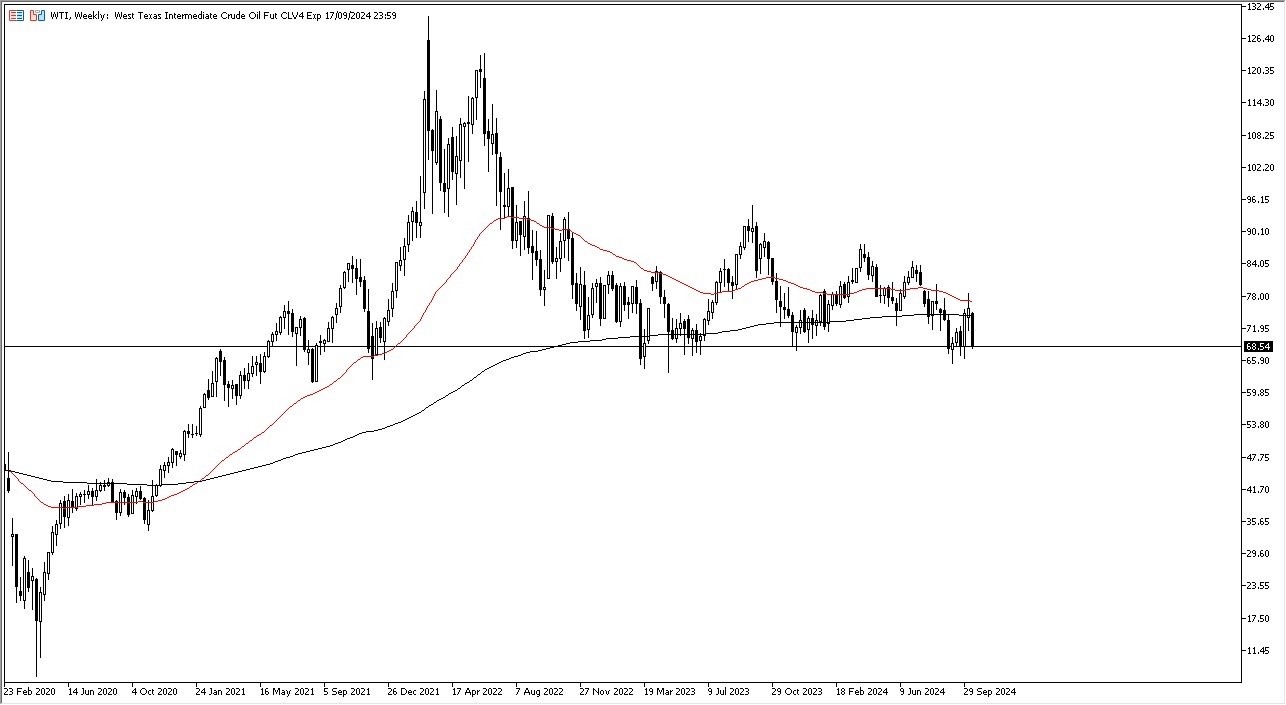

WTI Crude Oil

The West Texas Intermediate Crude Oil market fell rather hard during the course of the trading week, and as we approached the crucial $68 level, we began to threaten significant support from the last 2 years. At this point, it’s very likely that we will probably see some type of support come into the picture and perhaps even a bounce. If we don’t, crude oil is going to be in a lot of trouble, and it will probably free fall from here. Anna rally, I suspect that the upside is somewhat limited, so I would think of that more or less as a short-term opportunity.

The West Texas Intermediate Crude Oil market fell rather hard during the course of the trading week, and as we approached the crucial $68 level, we began to threaten significant support from the last 2 years. At this point, it’s very likely that we will probably see some type of support come into the picture and perhaps even a bounce. If we don’t, crude oil is going to be in a lot of trouble, and it will probably free fall from here. Anna rally, I suspect that the upside is somewhat limited, so I would think of that more or less as a short-term opportunity.

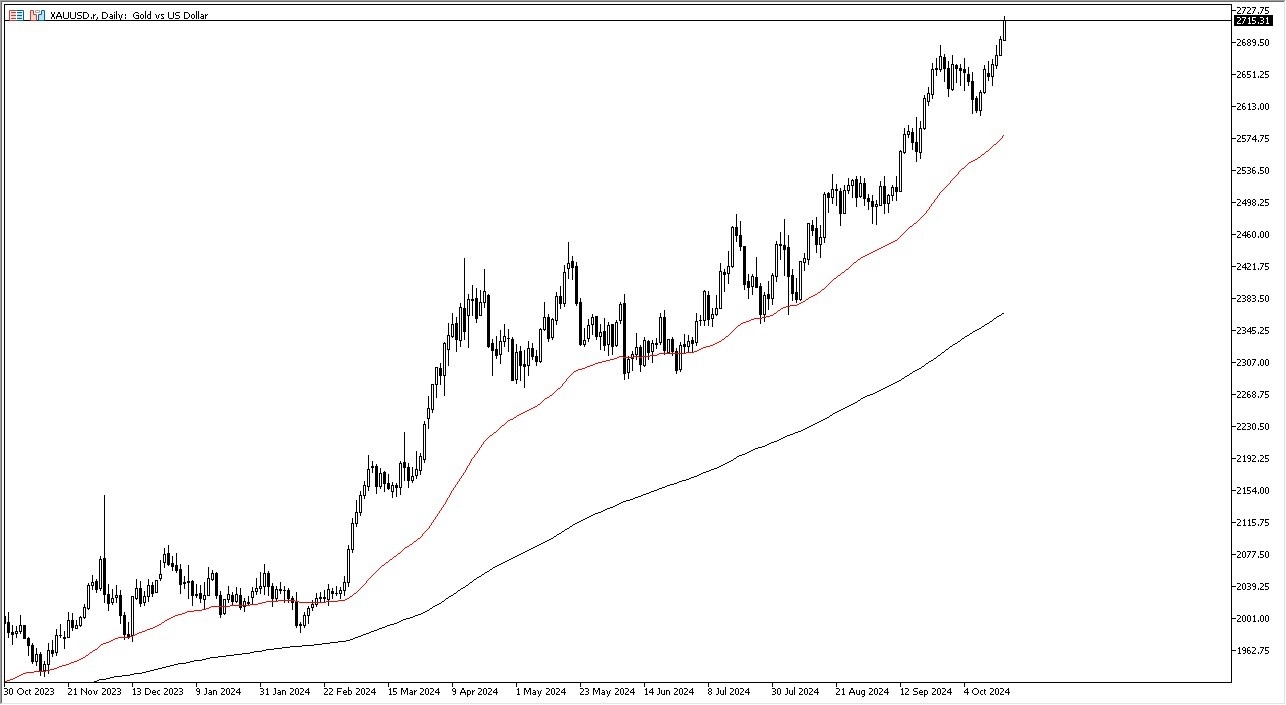

Gold

Gold markets have rallied rather significantly during the trading week to break above the $2700 level. The $2700 level of course is a large, round, psychologically significant figure, but quite frankly I don’t think it has much more importance than that. The way we have broken out to the upside suggest that we have further to go, and we look at the chart, you can see that the bullish flag has been broken to the upside. The “measured move” for that bullish flag? $2800. That will be my target for the time being, and I like the idea of buying dips every time they occur.

Gold markets have rallied rather significantly during the trading week to break above the $2700 level. The $2700 level of course is a large, round, psychologically significant figure, but quite frankly I don’t think it has much more importance than that. The way we have broken out to the upside suggest that we have further to go, and we look at the chart, you can see that the bullish flag has been broken to the upside. The “measured move” for that bullish flag? $2800. That will be my target for the time being, and I like the idea of buying dips every time they occur.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.