Fundamental Analysis & Market Sentiment

I wrote on 6th October that the best trade opportunities for the week were likely to be:

- Long of Gold in USD terms following a daily close above $2,685. This did not set up.

- Long of the S&P 500 Index following a daily close above 5,768 on a relatively large bullish candlestick with little upper wick. This set up on 9th October and gave a win by the end of the week of 0.31%.

The weekly profit of 0.31% equals 0.15% per asset.

Last week’s key takeaways were:

- The Bank of Canada cut its Overnight Rate by 0.50% from 4.25% to 3.75%. This cut was widely expected. The Bank’s rhetoric on further rate cuts has taken on a more dovish tone, and this helped weaken the Canadian Dollar over the past week.

- Canadian Retail Sales – this showed a weaker pace than expected, contributing to the more dovish atmosphere around the Loonie. The month-on-month increase was only 0.4% when an increase of 0.5% was expected. What really stood out was the very negative Core Retail Sales data, which showed a month-on-month decline of 0.7% while an increase of 0.3% in that metric was widely anticipated.

- Flash Services and Manufacturing – as expected in the USA, stronger in Germany, weaker in France.

- US Unemployment Claims – very slightly better than expected.

Top Forex Brokers

The Week Ahead: 28th October – 1st November

The coming week’s schedule is much busier than last week and also includes very important data items, such as US Non-Farm Payrolls and PCE Price Index data:

- US Core PCE Price Index

- US Non-Farm Employment Change and Average Hourly Earnings

- US JOLTS Job Openings

- US CB Consumer Confidence

- German Preliminary CPI

- Bank of Japan Policy Rate and Monetary Policy Statement and Outlook Report

- US Advance GDP

- Australian CPI

- Swiss CPI

- Chinese Manufacturing PMI

- Canadian GDP

- US ISM Manufacturing PMI

- US Employment Cost Index

- US Unemployment Claims

- US Unemployment Rate

Monthly Forecast October 2024

I forecasted that the EUR/USD currency pair would rise in value during October. Its performance so far is as follows:

October 2024 Forecast Performance to Date

Weekly Forecast 27th October 2024

I made no weekly forecast this week, as there were no unusually strong directional price movements over the past week, which is the basis of my weekly trading strategy.

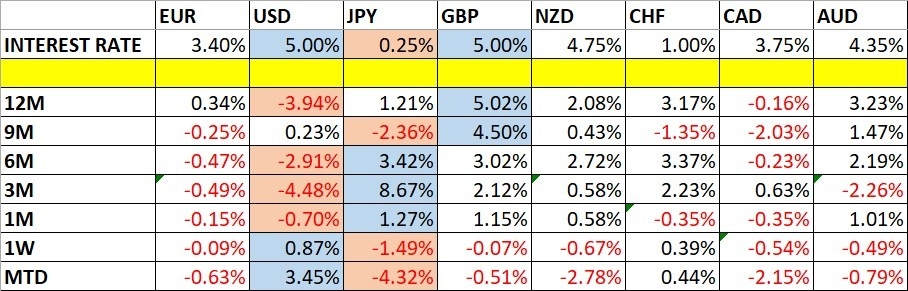

The Japanese Yen is by far the most volatile major currency and looks likely to stay that way.

Last week, the US Dollar was the strongest major currency, while the Japanese Yen was the weakest.

You can trade these forecasts in a real or demo Forex brokerage account.

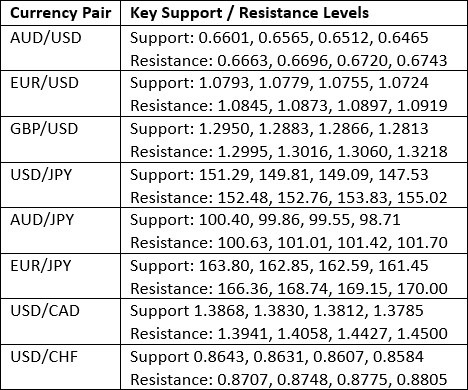

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a bullish candlestick with a bit of an upper wick which rejected the resistance level at 104.15. The Dollar has been rising for a few weeks, and continued to rise last week, breaking through at least one key resistance level.

The price is above its level from three months ago, but below its level from six months ago, suggesting a long-term mixed trend in the greenback, which suggests uncertainty.

It is also worth noting that despite the strong bullish momentum, the price is again trading within a new consolidating triangle chart pattern. This is suggestive of ultimately ranging behaviour.

This week's outlook for the US Dollar is very unclear, as there are fundamental and sentimental reasons for its recent strengthening. The Federal Reserve is taking a more hawkish approach. However, that could change if we see weaker than expected US non-farm payrolls, JOLTS, or GDP data this week.

I recommend trading the US Dollar long this week unless there is susprising US economic data that pushes the Fed into a more dovish approach.

USD/JPY

The USD/JPY currency pair behaved very similarly to the US Dollar Index last week, printing a firm bullish candlestick that closed quite near the high of its range.

The price rose for the fourth consecutive week and is now above its level from three months ago and is also very close to overtaking its level from six months ago, which would put it in a bullish long-term trend. This area of resistance centred on ¥152.75 / ¥153.00 therefore looks likely to be pivotal.

There has been a lot of volatility in the Japanese Yen, which continues, and there is also quite a lot of movement in the US Dollar, so this currency pair remains at the heart of the Forex market and will be attractive to day traders.

I think if we see a solid bullish breakout beyond ¥153.00, this currency pair might start to become interesting on the long side.

XAU/USD

I have been bullish on Gold for weeks as it has continued to make bullish breakouts to new highs. The upwards trend which got strong a few weeks ago has produced a very profitable trade on the long side for trend traders.

Many assets reversed strongly last week against a resurgent US Dollar, but the fact that Gold continues to make new record highs against the US Dollar is telling and shows strength in Gold as a particular asset.

Despite Gold's reputation as a risk hedge, historically, the price of Gold has tended to be positively correlated with major stock market indices. We have seen the broad S&P 500 Index also breakout to new record highs, so the correlation is in action right now.

Gold could be knocked by a decline in risk appetite over the coming week if US jobs or GDP data disappoint. However, sometimes in these cases Gold can hold its value and won’t fall by much, so it really does look like a good trade, or at least, one of the best trades in the market right now.

I still see Gold as a buy, but only following a daily close at a new record high price. In fact, there is a big quarter number at $2,750 just above that, so I would like to see a close above that level first.

S&P 500 Index

Despite making a new record high the week before last, the rise in this major stock index seems to have run out of momentum, at least for the time being. The price action during the second half of last week looks bearish, so a further fall over the short term looks quite likely.

Despite these short-term bearish factors, we have seen major US equity indices gain nicely this year, and recent weeks have seen the wider S&P 500 Index outperform the NASDAQ 100 Index, suggesting a broader-based stock rally.

There is now little over one week to go to the US Presidential election, and opinion polls and betting markets are suggesting that a Trump victory is the most likely outcome. If the polls and markets remain this way over the coming days, we may well see the stock market rise again. New Presidents tend to trigger a rally in the US stock market, and the rally after Trump’s election was notably strong, and this could happen again. Even if Harris wins, that could also boost the market.

Poor jobs or US GDP data this week, on the other hand, might produce a stronger short-term decline.

Due to the long-term bullish picture and the upcoming US election, I will be eager to enter a new long-trade here if we get a daily close at a new all-time high above 5,878.

Bottom Line

I see the best trading opportunities this week as:

- Long of Gold in USD terms following a daily close above $2,750.

- Long of the S&P 500 Index following a daily close above 5,878.

Ready to trade our Forex weekly analysis? Check out our list of the top 10 Forex brokers in the world.