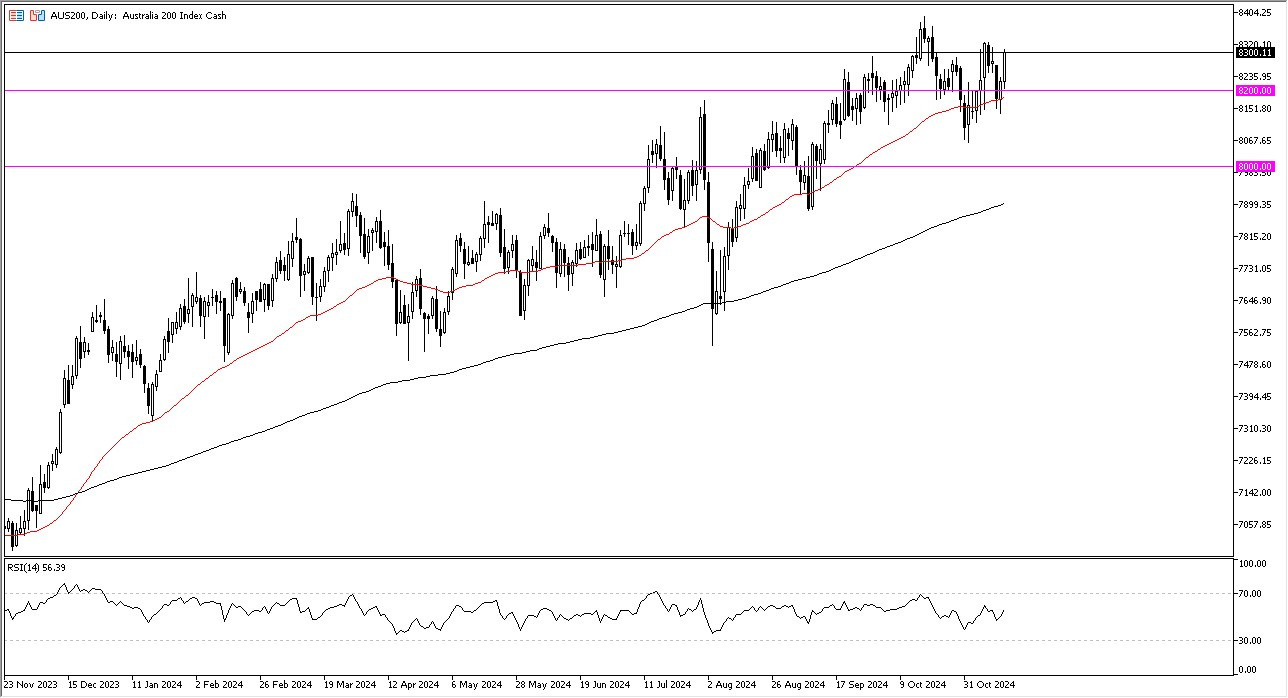

- The ASX200 has rallied pretty significantly during the trading session on Thursday as it looks like the 8200 Australian dollars level will continue to be important and recognized as potential support.

- It's probably worth noting that the 50-day EMA is also hanging around the same area and with that being the case, I think it does offer a significant amount of support and therefore it doesn't surprise me at all that technical traders would be interested in getting long at this point.

The market pulling back should continue to offer a little bit of value, as the uptrend has been so crucial, and deadly obvious at this point in time.

Top Forex Brokers

There are Multiple Levels to Watch

The 8,400 Australian dollars level is an area that a lot of people would be paying close attention to as well. And I think ultimately, we have a situation where traders are looking at each and every pullback as a potential buying opportunity in what has been an extraordinarily strong market. Over the last several weeks, we have gone somewhat sideways, but when you think about it and you look at the chart, it makes a certain amount of sense because we have seen such a huge run up to this region. Once we break above the 8,400 Australian dollars level, I would assume that the next target would be 8,500 Australian dollars rather quickly. If we were to break down below the 50-day EMA, then it could open up a move down to the 8,000 Australian dollars level, which also has the 200-day EMA sitting just below it, so do keep that in mind that area could be the potential floor in the market. The relative strength index is still basically in the middle of the normal range. So, I don't see any technical signals at all that suggests that this market cannot continue to go higher.

Ready to trade our daily AUD/USD Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.