Potential signal:

- The ASX 200 is positive.

- I am only buying this index and am not even looking to get short.

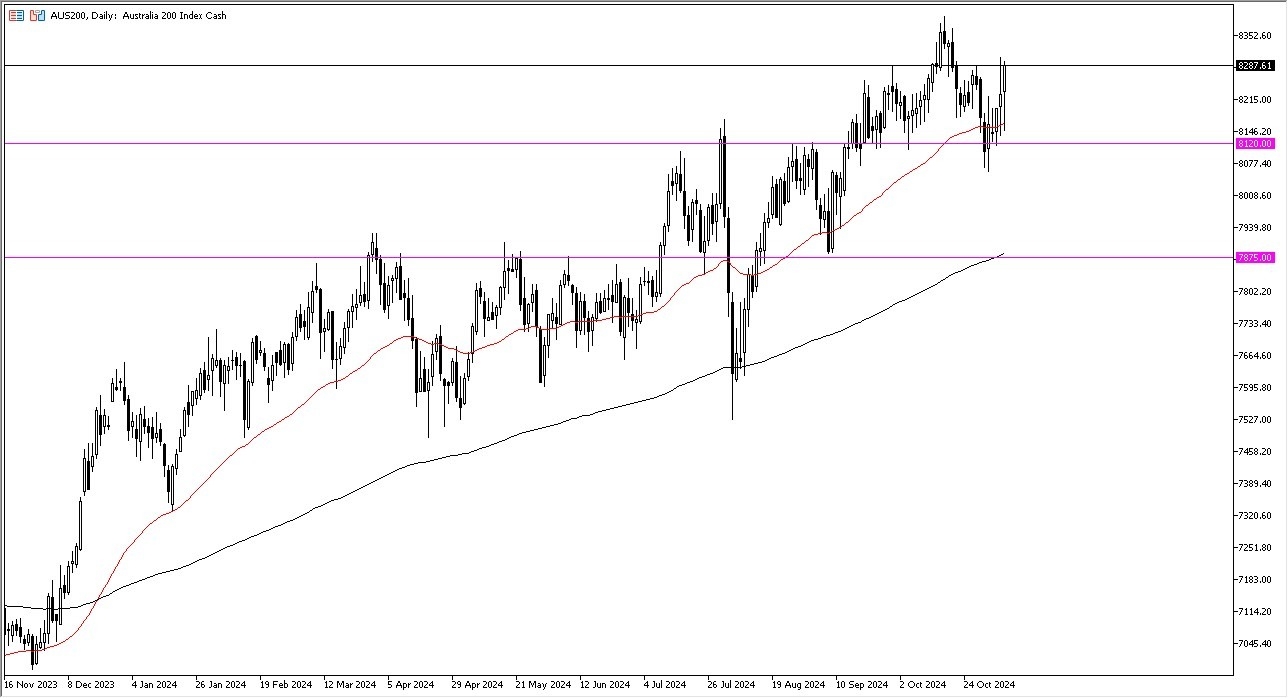

- I would be a buyer at 8310.

- I would have a stop loss at the 8240 level. I would aim for a run to the 8500 area.

The market initially pulled back just a bit during the early hours on Thursday only to test the 50-day EMA to turn around and show signs of life. The 8,120 level underneath is going to continue to be important as it has been both the market has repudiated selling off and now it looks like we are trying to rally to break to the upside.

Top Forex Brokers

In fact, at this point in time, it looks like we are going to try to reach the recent swing high. And if we can reach that area, it's very likely that we will continue to go higher. This is my overall prediction, but I know that there are a lot of issues just waiting to cause issues.

The Makeup of the ASX 200

Keep in mind that the ASX 200 is primarily driven by commodities and financials as there are a lot of commodities coming out of Australia for global growth situations, especially China. But we also have a lot of finance coming out of Australia due to the fact that the Aussies finance a lot of the construction in Asia as well. This is a very risk sensitive index. So, I watched this one quite closely, even though I don't necessarily trade it every day. However, it is likely that we will continue to see this trend continue in the longer term.

I think at this point in time, it is telling us that we will eventually continue to the upside. And if and when we do, we should break out to a fresh new high. Short-term pullbacks should continue to be buying opportunities in this environment. I have no interest in shorting the ASX 200 anytime soon. But if we did break down from here, then I think it's really not until we break down below the $7,875 level that you would have to be concerned.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.