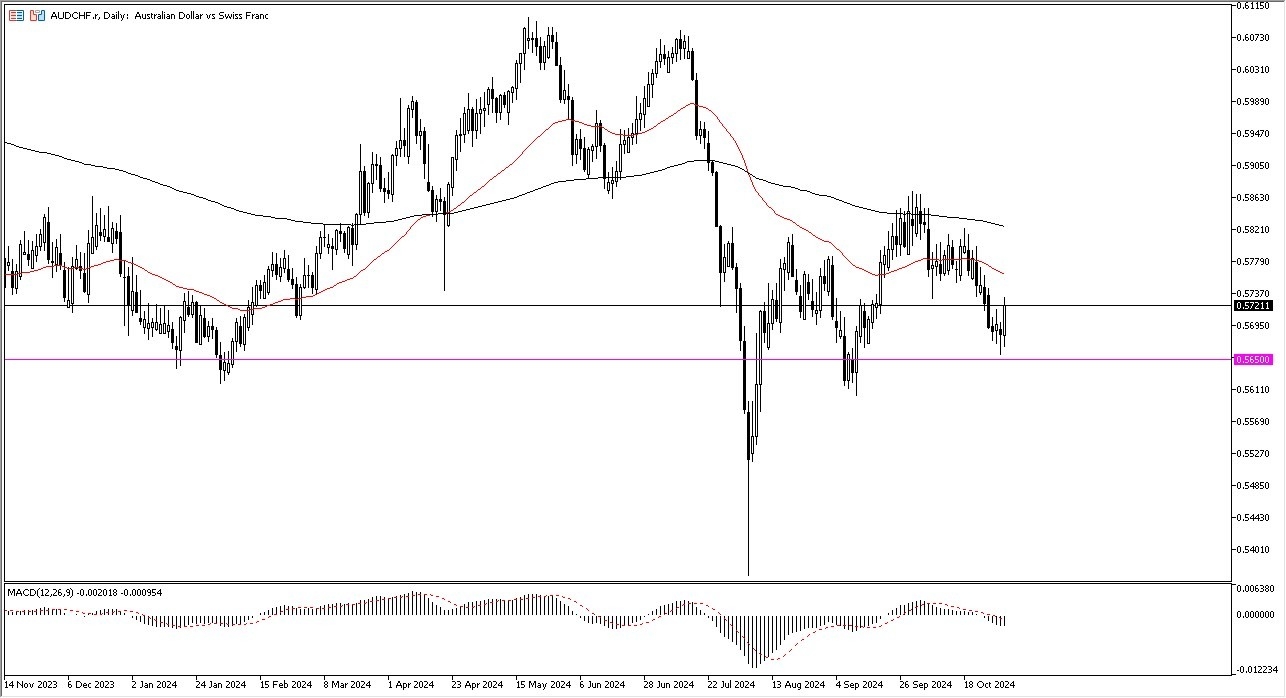

- The Australian dollar initially pulled back just a bit during the trading session on Friday, only to turn around and show signs of strength again against the Swiss franc.

- The 0.5650 level seems to be offering a bit of support and the fact that we broke out of the range for the last three or four days does suggest that perhaps momentum is returning.

- If that’s the case, we could see a bigger move as this pair tends to move rapidly at times.

The Aussie dollar itself is considered to be a currency that is more about risk appetite, while the Swiss franc is considered to be one of the premier safety currencies around the world. So maybe this shows that traders are willing to stick their necks out a little bit and take on a little bit of risk. At this point, if we do rally, then the 0.5750 level could be an area of resistance due to the 50-day EMA being there.

Top Forex Brokers

On a Breakdown

If we break above there, then you could be looking at the 200 day EMA at the 0.5850 level. Any move below the 0.5650 level could send this market down to the 0.56 level, but at this point it doesn't look as likely. If that were to happen, it would almost accompany significant selling pressure in probably most markets, at least those who are sensitive to risk appetite.

Remember, money goes to Switzerland when it's looking to hide and protect itself, and it will go away from Switzerland when it comes time to start trying to make a little bit of alpha. The size of the candlestick is impressive and certainly much bigger than the three before it, so I think you've got a situation where momentum is picking up, and we could very well see this market grind its way higher over the next several weeks.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from.