- During my daily analysis of minor currency pairs, the AUD/CHF pair has caught my attention as the Australian dollar has now reached the 200 Day EMA.

- All things being equal, this is a market that will continue to be driven by risk appetite, something that you need to be cognizant of.

- After all, the Australian dollar is considered to be a “risk on currency” because it is so heavily influenced by commodity markets and Asia, while the Swiss franc is considered to be one of the “safest currencies in the world.” In other words, people buy this pair when they feel like taking a little bit of risk.

Top Forex Brokers

Technical Analysis

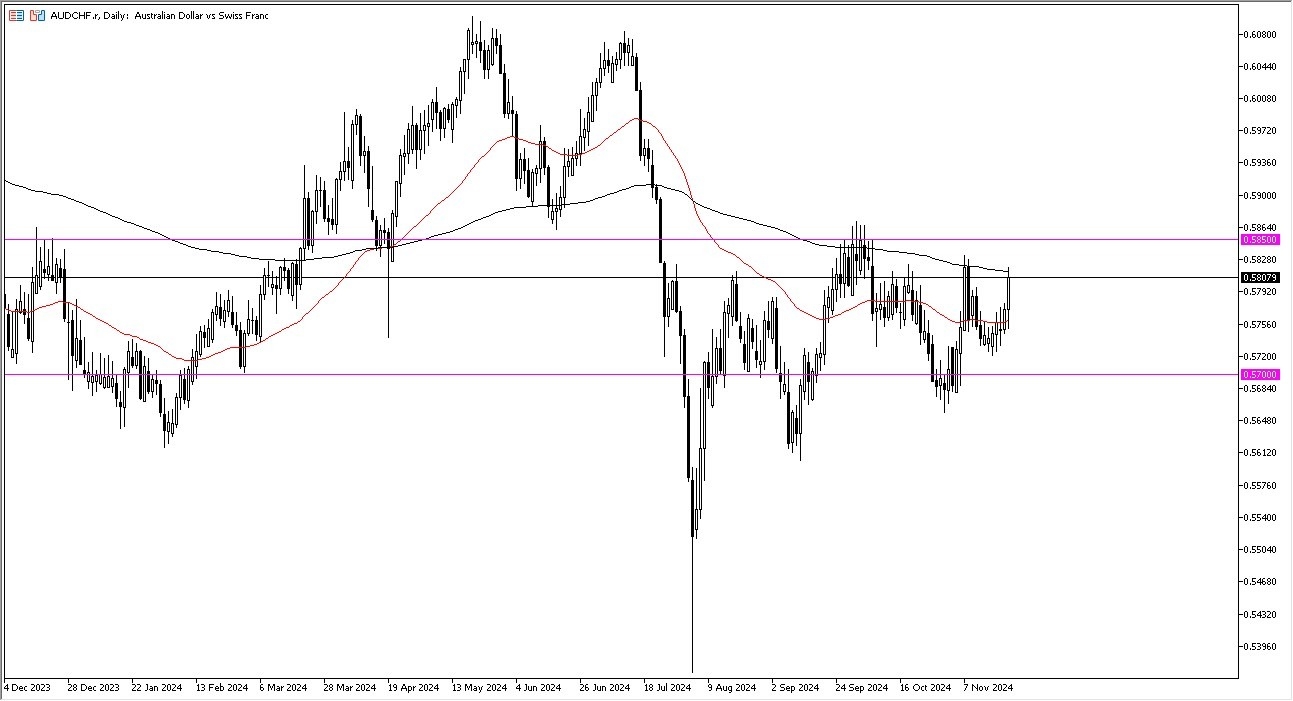

The technical analysis for the AUD/CHF pair is a bit of a mixed bag at the moment, due to the fact that although we have a very strong candlestick for the day on Friday, the reality is that the 200 Day EMA could come into the picture to offer quite a bit of resistance. Furthermore, we also have the 0.5850 level offering massive resistance, as it has been important multiple times in the past. Because of this, I think you have to pay close attention to what happens over the next 50 pips or so, because if we can break out above the 0.5850 level, it opens up another leg higher.

On the downside, we have the 50 Day EMA near the 0.5760 level, an area where a lot of people are going to be paying close attention to to see whether or not there is enough support there. If we break down below there, then it opens up the possibility of a move down to the 0.57 level, an area that is the bottom of the overall consolidation that we have been in for several months now anyway.

Make sure to keep an eye on other markets, such as stock markets in the United States, Europe, and Asia. Those stock markets can give you an idea as to what the risk appetite might be, and therefore I think you’ve got a situation where you can buy the Australian dollar if other “risk on market” start to rally as well. Of course, the exact opposite is also true.