Potential signal

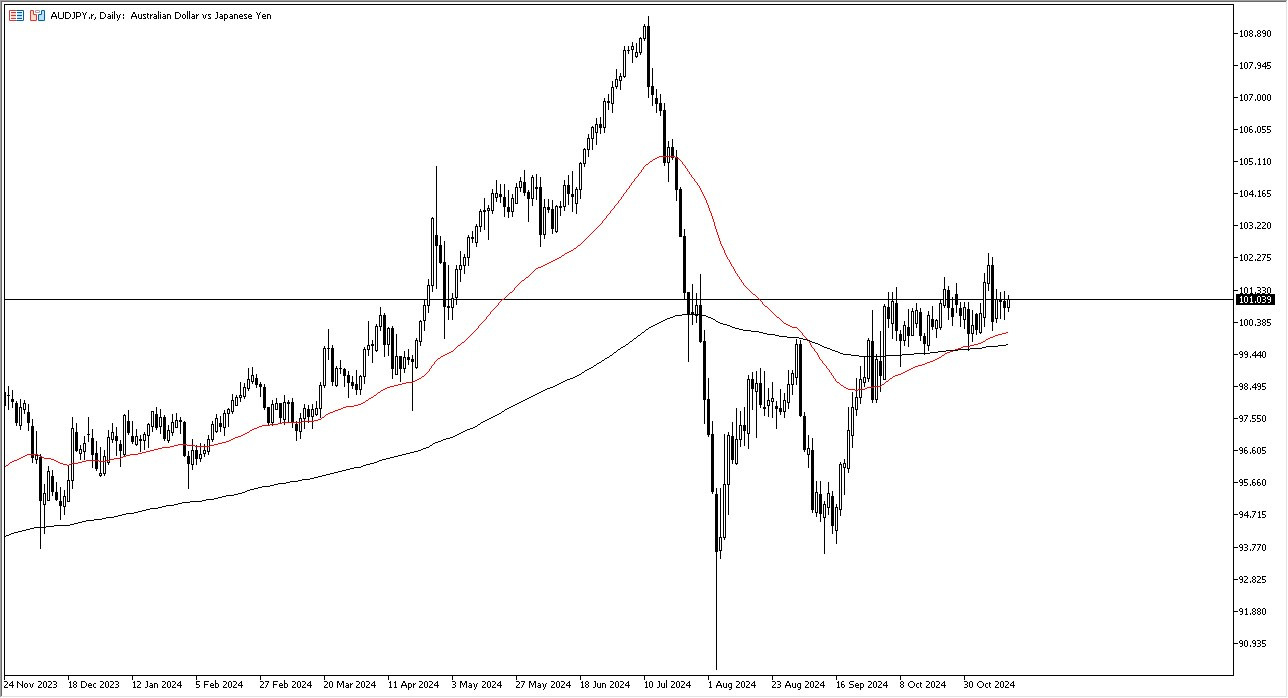

- I am a buyer of this pair above the 102.5 level, with a stop loss at the 101.50 level.

- I am looking forward to taking profit at the 105 level, all things being equal.

The Aussie dollar rallied a bit during the course of the trading session on Thursday as we continue to see a lot of back and forth. All things being equal, this is a market that is paying close attention to the 50-day EMA underneath as potential support, as well as the significant figure of 100 yen. I think that continues to be a little bit of a barrier for short sellers and of course, we have to pay close attention to the idea that the interest rate differential continues to favor almost anything against the Japanese yen.

This is part of why the Japanese yen has been eviscerated over the last couple of months. So, it'll be interesting to see how this plays out, especially as the yen pairs all tend to move in the same direction overall. With this, I think we could see the JPY struggle against most things – especially the Aussie dollar and its “risk on behavior” at times.

Top Forex Brokers

Is There a Ceiling Above?

The 102.50 yen level is an area that I think is maybe a little bit of a ceiling, but I don't think it's a huge deal. If and when we do break above there, though, it's likely that the Aussie will continue to climb. Keep in mind that the US dollar has broken above significant resistance against the Japanese yen. So more likely than not, it's only a matter of time before we see these other pairs follow right along. And therefore, I am watching this one as well as quite honestly, the New Zealand dollar against the Japanese yen, because they do tend to move in the same general direction. Short-term pullbacks I think continue to offer value. The people will take advantage of with not only that 50 day EMA offer in support, but also the 200 day EMA just below they're doing the same.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.