Potential Signal:

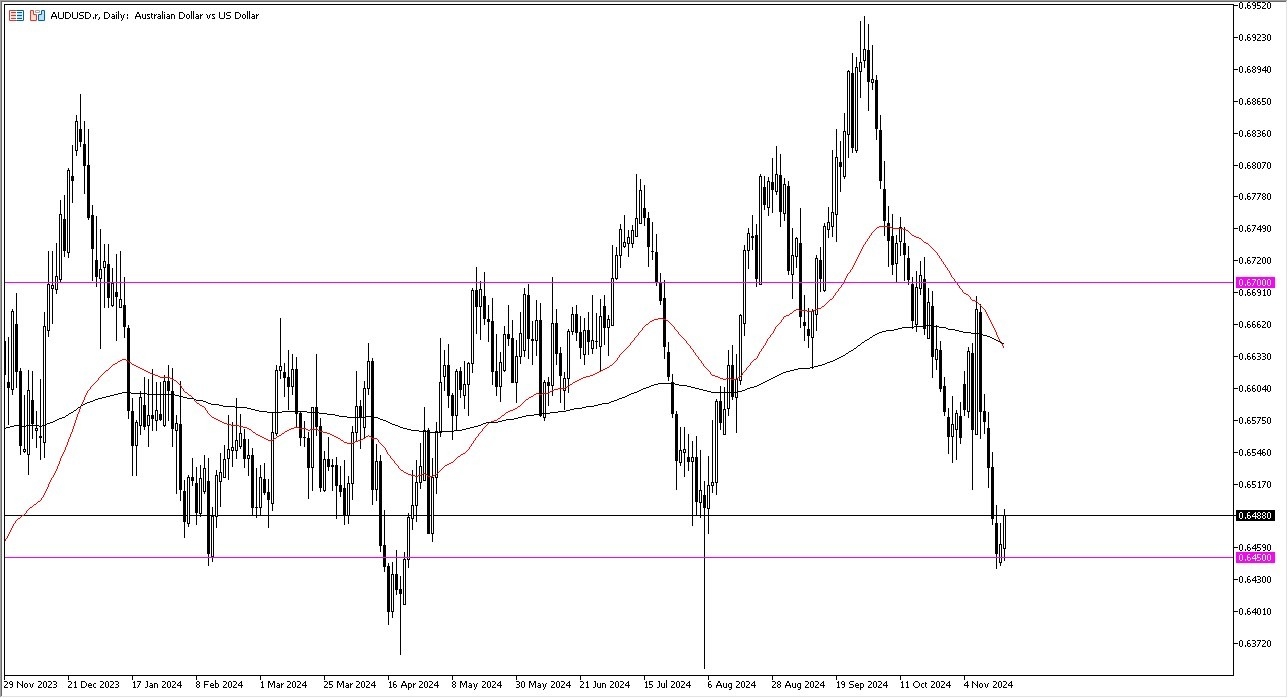

I think a short-term buying opportunity could present itself, but if we were to break down below the 0.6440 level, then you would have to bail out on it, using that level as a stop loss. The target could be 0.6600, with an entry where we are now.

- During my daily analysis of major currency pairs, the AUD/USD pair has come into focus. This of course is a market that I pay close attention to, because it has a major amount of influence coming from Asia, risk appetite, and of course the gold market.

- All things being equal, I do look at this is a market that is oversold, so therefore it’s very possible that we have a short-term trade setting up.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is of course that is oversold, despite the fact that we just saw the “death cross” form, which is when the 50 Day EMA breaks down below the 200 Day EMA indicator, which a lot of people look at as a signal to start selling. All things being equal, this is a market that will obviously see a lot of of volatility, but as we are so oversold at the moment, I think that a bounce is more likely than not.

The market has found the 0.6450 level as major support, as we have seen multiple times. The fact that we bounce during the day on Monday as drastically as we do is a sign that we will more likely than not have a short-term shot higher, and perhaps even as high as 0.6700 above, which is a major resistance barrier. On the other hand, if we were to break down below the 0.64 level, then it’s possible that the market could drop down to the 0.6250 level.

Keep in mind that the Australian dollar is highly sensitive to the Asian markets and Asian demand overall, so it is worth paying close attention to China as well. After all, lot of forex traders use this as a proxy for China, and therefore I think you also have to pay close attention to the Shanghai stock exchange and the idea of what is going on as far as monetary policy out of the Peoples Bank of China. The short term though, I think it oversold bounce is more likely than not.

Ready to trade our free trading signals? We’ve made a list of the top forex brokers in Australia for you to check out.