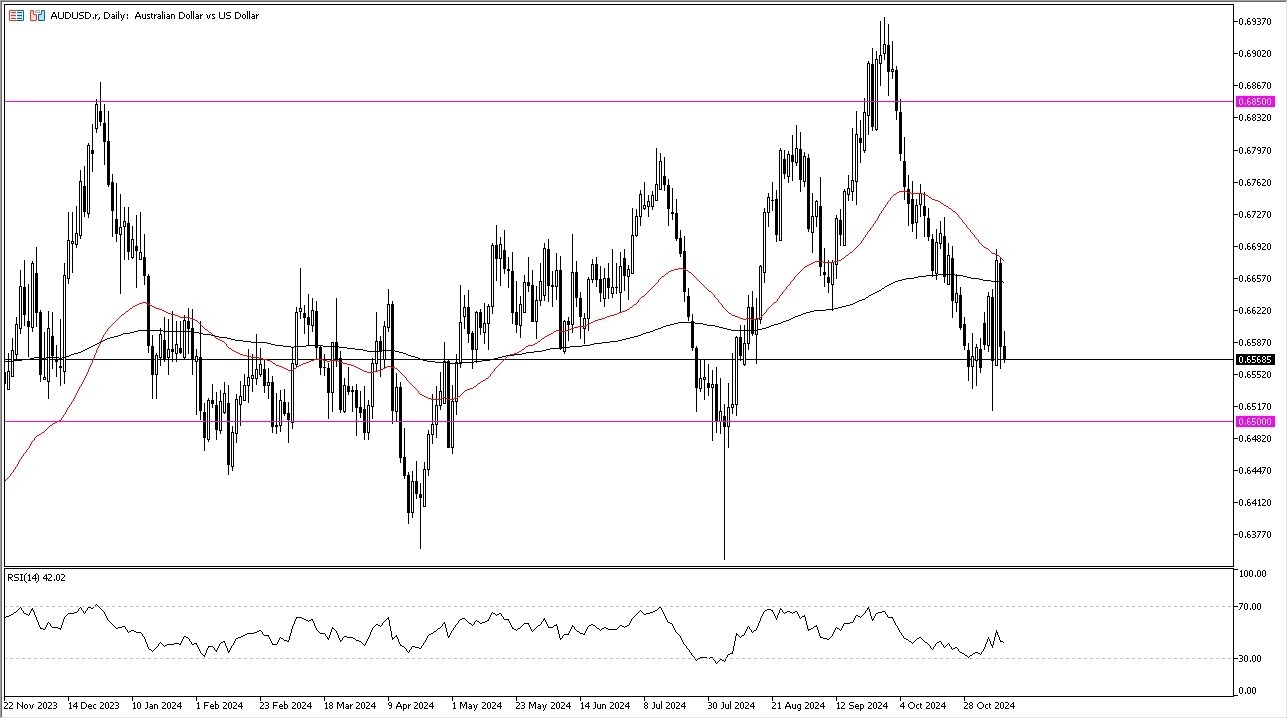

- During my daily analysis of the AUD/USD pair, the market initially tried to rally a bit during the day, but then fell as we continue to see a lot of questions asked about whether or not the support underneath will hold.

- The support underneath of course is the 0.65 level, an area that has been crucial for some time.

- All things being equal, this is a market that is going to be asking a lot of questions of whether or not we will bounce, or if we are going to see some type of reaction, or the question of course being whether or not we can break down significantly?

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is somewhat dire, but the 0.65 level underneath is going to be an area that is important, as we have seen multiple times, as we have bounced from there multiple times. The 0.65 level of course is a large, round, psychologically significant figure, and therefore I think a certain amount of options traders will be looking at this area for some type of bounce.

Above here, we have the 200 Day EMA, which hangs around the 0.6650 level, with the 50 Day EMA sitting above at the 0.6675 level, and is dropping. If they break lower, we could see the 50 Day EMA cross below the 200 Day EMA, kicking off the so-called “death cross” in this market. With this being the case, the market is likely to continue to see further downward pressure if that happens, but if we get a daily close below the 0.65 level, then we may go looking to the 0.64 level.

On the other hand, if we can turn around and break above the 0.6675 level, then we have a shot at a move to the 0.6850 level, perhaps over the longer term.

Ultimately, this is a pair that will move on risk appetite, which of course is going to favor the Australian dollar if it is more of a “risk on” type of market, or the US dollar if it is a more “risk off” type of market. Furthermore, you also have to watch the bond market, as higher interest rates will continue to be a major driver of what happens with the US dollar.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.