- Bitcoin has initially dipped a bid during the early hours on Tuesday but has seen buyers jump in to pick it back up.

- I think at this point in time, it does make a certain amount of sense that we would see some noise after the massive run.

- So, I wouldn't be surprised at all to see this market grind sideways.

Big Psychological Barrier Above

Top Forex Brokers

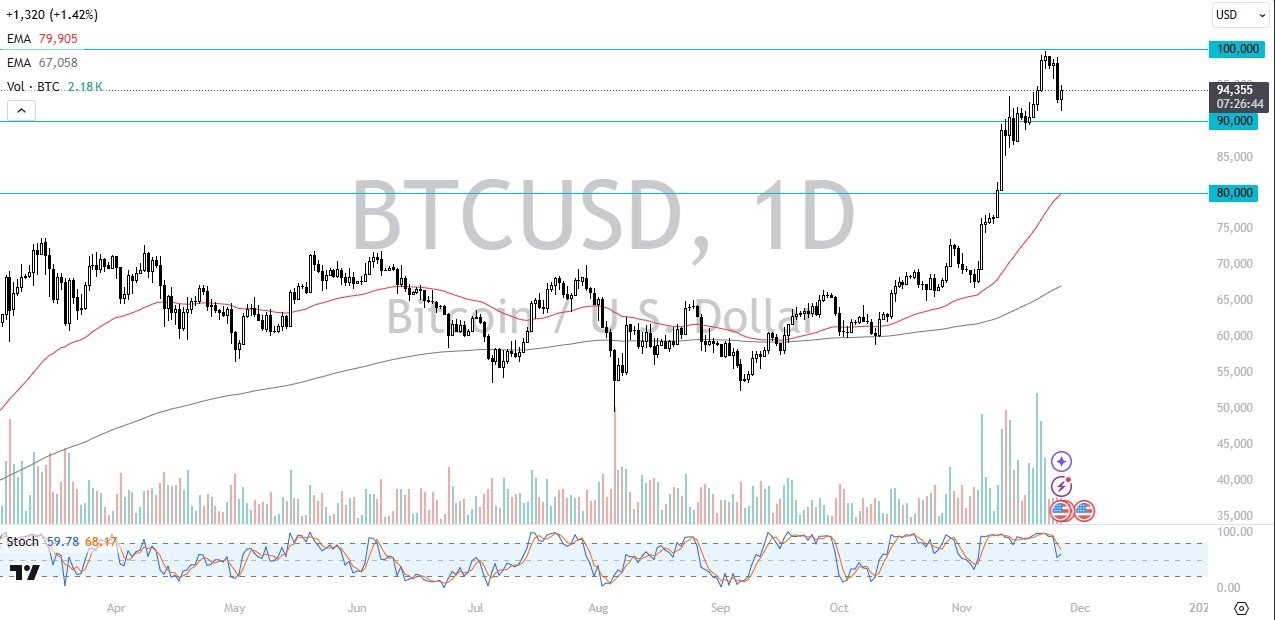

For a while, we have the massive psychological barrier in the form of $100,000 above, and I think that will continue to be a bit of an issue. If we can break above the $100,000 level, then it opens up the possibility of a much bigger move. The market consolidating for a while in a $10,000 level means that if we break above the $100,000 level, it's possible that we could go looking to the $110,000 level.

At this point in time, it's quite clear that this is a buy-on-the-dip market, and as a result, it's difficult to get overly aggressive on the short side. Frankly, I don't think anybody's looking to short Bitcoin at the moment, given the momentum that we've seen over the last several months.

We still have all of the same issues with Bitcoin that we've always had, other than the fact that price goes up. We don't have any real use for it in the real world yet, and we are starting to see a lot of social media noise, which is generally a sign that bad things are coming. That doesn't necessarily equate to a tradable signal. It's just something I've noticed in the last couple of cycle highs.

Even if this is a cycle high, the question then becomes where is the support? The support is at $90,000, and then again at $80,000, followed by $74,000. Remember, we broke out of massive consolidation at $74,000, so I think market memory comes into the picture there. I don't have any interest whatsoever in trying to short this market, and I do recognize if we get that breakout above $100,000, it'll kick off the next leg higher.

Ready to trade daily Bitcoin forex forecast? Here’s a list of some of the best crypto brokers to check out.