- The Canadian dollar has initially pulled back just a bit against the Japanese yen during early trading on Thursday.

- That being said, this is a market that continues to see the same resistance barrier that people are paying attention to, specifically the area between the 111.50 yen area and the 112 yen area.

- This is a region that’s been consolidating for some time, and I think that will continue to be the story in this market.

If we can break through there, then I think a lot of upward momentum re-enters the market. That being said, you also have to keep in mind that traders will continue to look at the overall risk appetite. And if that picks up, that should help. We do get core retail sales out of Canada on Friday, so that might be a mover as well. This will be especially true if retail sales in Canada, much stronger than anticipated, as it could only exacerbate the move to the upside and the potential breakout.

Top Forex Brokers

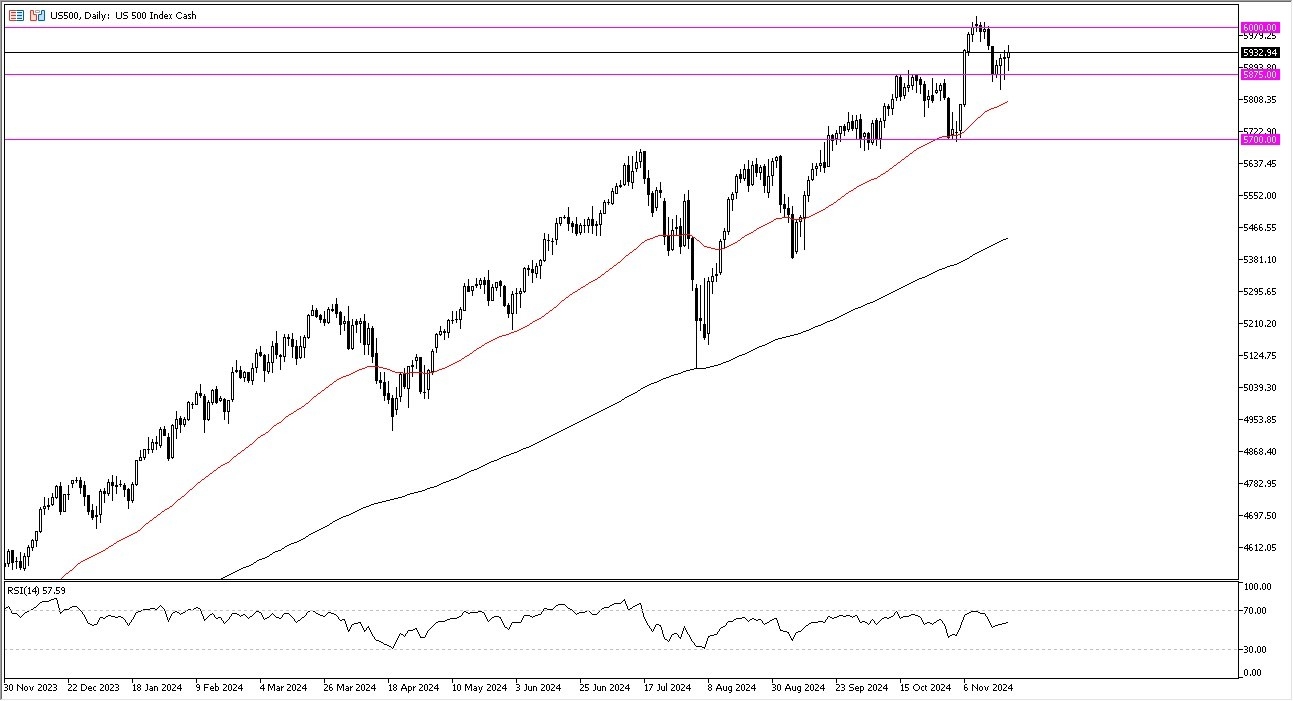

Moving Averages in this Pair

The 50 day EMA is starting to get towards the 200 day EMA. And it looks like we are trying to get a bit of a bullish cross, which of course helps the idea of longer term traders jumping in with the so called golden cross underneath. We have support at 109 yen. As long as we can stay above that level, I really don't see a situation where the market breaks down.

And to the upside, we could go as high as 115 yen. I do expect this to happen sooner or later. But also keep in mind that the Canadian dollar is heavily influenced by crude oil, which hasn't really been that great as of late. So ultimately, this is a market that's building up pressure, but it can't break out quite yet. If and when it does, it could be quite brutal.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.