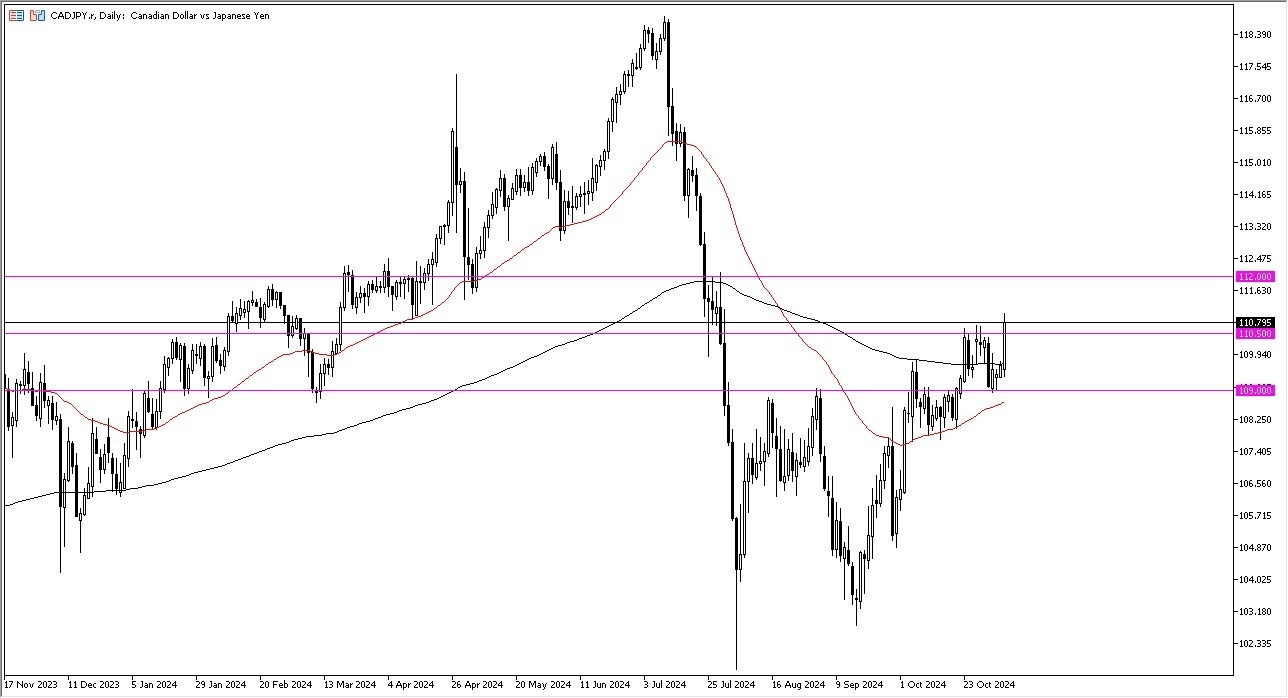

- The Canadian dollar has rallied rather significantly against the Japanese yen during the trading session on Wednesday as we are now above the 110.50 yen level.

- That being said, there is a lot of noise between here and the 112 yen level and therefore I think it will be a bit choppy and noisy on the way to the upside.

- I do not think tis will be an easy move higher, but I am looking for it to happen at this point in time.

Keep in mind that employment numbers out of Canada on Friday will have a major influence on what happens next. So, it could be even noisier than you would expect. Short-term pullbacks I think are buying opportunities with the 109 yen level underneath being massive support based upon previous resistance and of course, previous support. “Market memory” should continue to play a part here, and at this point, I think you have a situation where we are simply going to bounce around, but in a somewhat positive way in the near term.

Top Forex Brokers

Moving Averages

The 200 day EMA is sitting above there, but the 50 day EMA sits right around the 109 yen level. In general, keep in mind that if the Canadian dollar continues to rally against the Japanese yen, it will be more of a risk on type of move as the Japanese yen is considered to be a major safety currency.

The Canadian dollar is highly influenced by crude oil, but in general, the interest rate differential in Canada being so much stronger than Japan is a major reason why this CAD/JPY pair has been going higher for a while. Buying dips will more likely than not be the way that I trade this market at least until we break down below the 50-day EMA when I might consider shorting. Longer term I think we probably go looking toward the 118 yen level but that would take serious time.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.