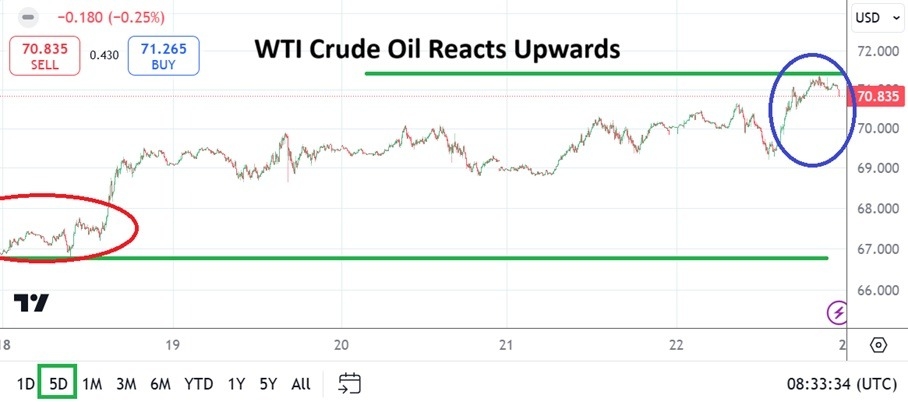

WTI Crude Oil was able to produce a polite bullish climb last week after testing important support levels last Monday, now speculators may question where reliable resistance might prove durable.

WTI Crude Oil went into this weekend having accomplished a solid incremental bullish climb. The commodity finished trading on Friday near the 70.835 ratio. WTI Crude Oil began trading last Monday slightly above 67.000 and then momentarily sank below the value. However, a burst of buying was soon generated and by late Monday the commodity was back above 68.000 USD and challenging the 69.000 mark and above.

Top Forex Brokers

Speculators were treated to some technically choppy trading on Tuesday, but WTI Crude Oil started to bring the 70.000 ratio into sight, by Wednesday the ratio was punctured. After the 70.000 level was shown to be attainable a reversal lower then ensued. Thursday’s trading saw a bit more choppiness but without violent reversals, and Friday’s high before going into the weekend touched the 71.345 vicinity before giving up the higher values.

Saber-Rattling and Calm Trading Conditions in WTI Crude Oil

While trading in some assets may have been briefly effected by saber-rattling between Russia and Ukraine last week, energy players remained calm. WTI Crude Oil didn’t show much of a significant influence via behavioral sentiment. The commodity traded in a rather polite fashion and what should intrigue traders was the ability for 67.000 to produce support and then create upwards momentum throughout the week. Some may claim the upwards momentum was produced because of the saber-rattling but that is unlikely, because by Friday highs most trader had seen the developing news and digested it a couple of days before.

Friday’s high in WTI Crude Oil will now be inspected and tomorrow’s opening will be a test of current speculative tastes. The high above 71.000 was not able to hold, but WTI Crude Oil will begin its trading with the level in sight. If WTI Crude Oil remains under the 71.000 level when trading opens and throughout Monday, this may be a sign some big players suspect the commodity may be in slightly overbought territory.

Speculative Prices and a Relatively Tight Range

The fact that President-elect Trump is going to certainly institute a pro-active U.S energy policy and allow producers in the States greater freedom to conduct business will create headwinds for the price of WTI Crude Oil moving forward. The range of the commodity last week was a healthy sign.

- Incremental bullish positions can still be influenced, but the question about where resistance levels will persist must be asked.

- WTI Crude Oil above 71.000 may be rather speculative and a high above 72.000 seems rather far away taking into consideration current behavioral sentiment in the energy sector, but it isn’t impossible because large players will find advantages every once in a while and drive the price upwards.

- Having said that, using technical resistance levels that are perceived above 71.000 may prove to be a wagering ground for sellers.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 68.300 to 72.200

Having achieved an incremental climb last week is a positive opportunity for day traders as long as they can use their risk taking tactics wisely. The higher levels that WTI Crude will start the week with are open for inspection by technical traders. Fundamentally many producers in the U.S understand they will be able to pump more oil if they want to and global supply remains abundant.

The price of WTI Crude Oil remains a speculative bet for retail traders, but there does seem to be some ability to consider resistance levels above could cause a bit of selling. Traders should not be overly ambitious, but any move above 71.000 should be looked at carefully and any prices over 72.000 via current market conditions would likely be too high and cause a response. Having created buying last week, it will be intriguing to see if selling is produced in greater abundance this week and if the 70.000 to 69.000 levels again are tested.

Ready to trade our Crude Oil weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.