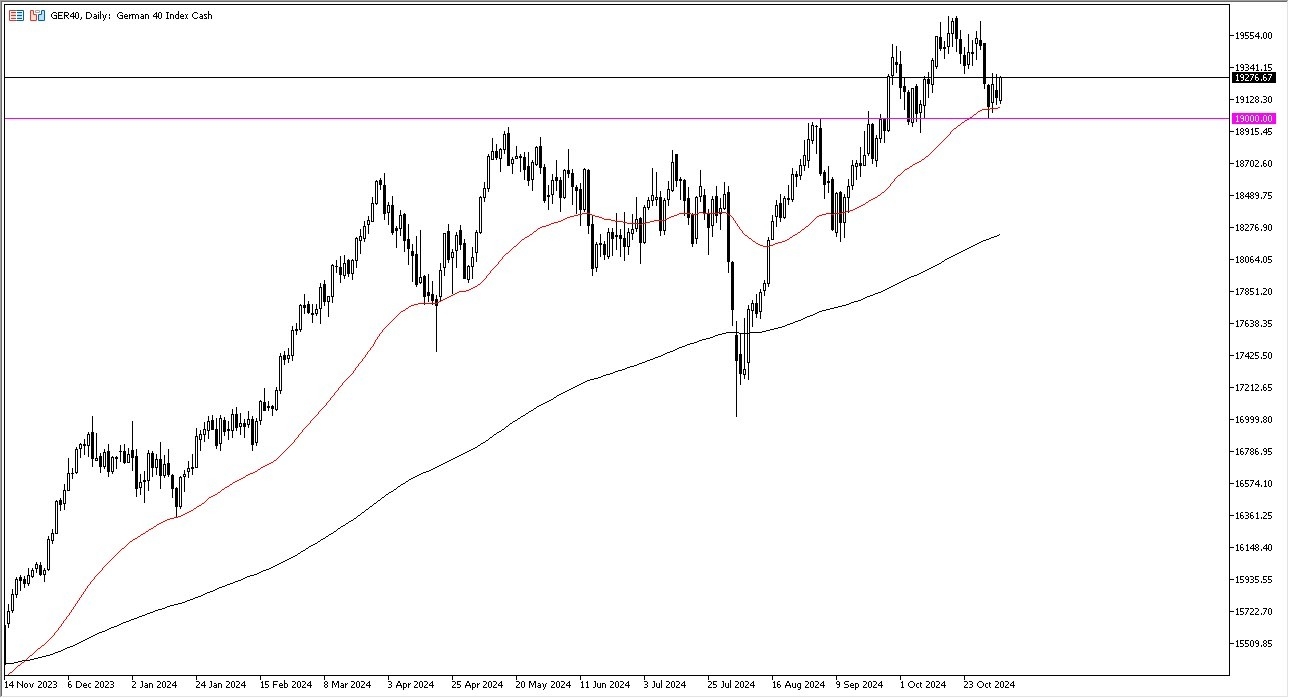

- Dear my daily analysis of the global indices, the DAX 40 has caught my attention, due to the fact that we have seen a lot of bullish pressure, as we have bounced from the crucial 50 Day EMA, and it looks like we are trying to hang on to the overall uptrend.

- For what it is worth, it is probably worth noting that the €19,000 level of course is a situation that buyers have looked at as crucial. With this being said, the market is likely to continue to see this as an area that of course is important.

Top Forex Brokers

Technical Analysis

The technical analysis of course is very bullish for this market, as traders continue to see a lot of upward trajectory, and I do think that it is probably only a matter of time before buyers come in and pick up a little bit of momentum. If we were to break down below the €19,000 level, then the market is likely to see the €18,500 level offer support. In general, this is a market that I think is going to continue to go higher, perhaps reaching the €19,750 level. This is a situation where we had seen a lot of pressure previously, so if we were to break above there, then I think it kicks off the next “buy-and-hold” situation.

On a move below the €19,000 level, then I think you have a situation where traders will start to sell stocks in general, and I do think that the DAX index falling would probably signify that the rest of the European Union will probably fall as well. In general, I think this is a situation where traders are looking for some type of reason to get long sooner or later, but the question is whether or not we can do so anytime soon.

In general, we are in an uptrend, and I think that the DAX will continue to go higher over the longer term but it will be a matter of time before we get any type of clarity when it comes to both the US elections in the Federal Reserve, both of which have a bit of a “knock on effect” in this market.

Ready to trade the daily analysis & predictions? We’ve made a list of the best online CFD trading brokers worth trading with.