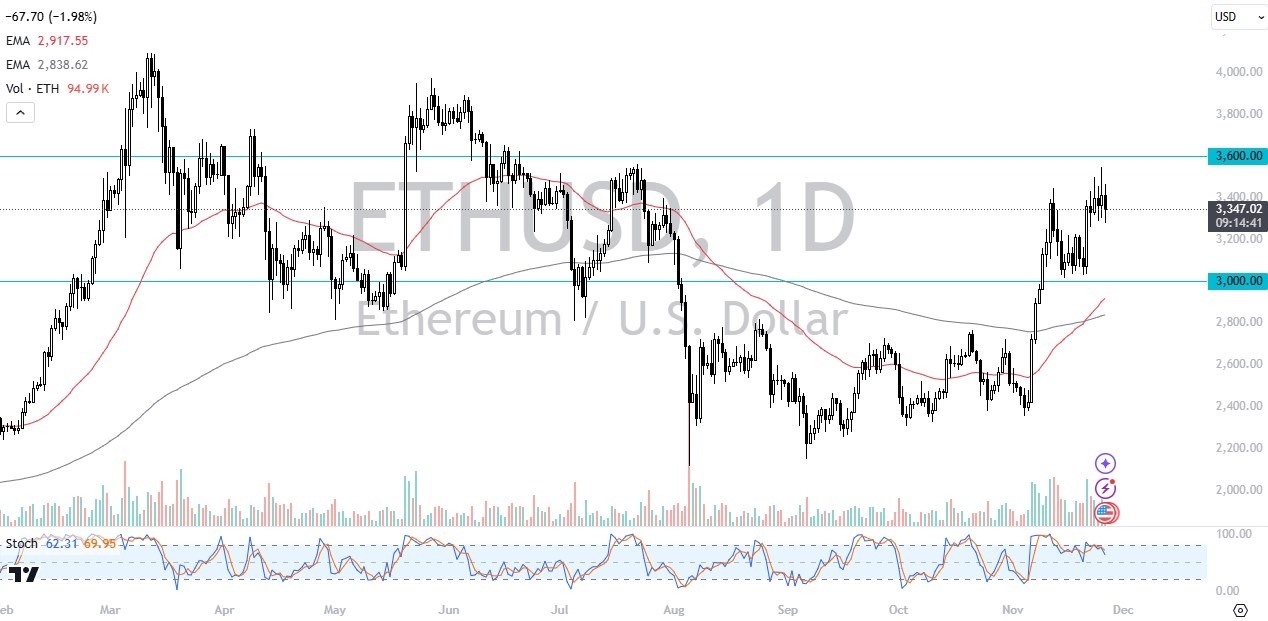

- During my daily analysis of Ethereum, I’ve noticed that the $3400 level continues to be a major anchor for price.

- All things being equal, this is a market that I think will continue to see a lot of noise, as Bitcoin continues to attract a lot of attention.

- After all, Bitcoin has reached awfully close to the psychologically important $100,000 level, and therefore I think a lot of people will be watching Bitcoin first signs that other crypto can inflate.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is bullish, but I also recognize that there is a lot of noisy resistance above near the $3600 level. Underneath the current trading, I see the $3000 level as being a significant support level. Quite frankly, with Bitcoin pulling back, I think you get an opportunity to pick up Ethereum a little bit cheaper from here. I’m not necessarily looking for some type of significant breakdown, but at this point I think what we are looking at is a scenario where the pullback might be bought into, especially if we get anywhere near that $3000 level.

That would be roughly a 10% pullback, which quite frankly wouldn’t be a huge surprise considering that Bitcoin is trying to do the same thing. The biggest signal for Ethereum will probably be if Bitcoin breaks above the $100,000 level, because it means that the theory market will probably attract people trying to take advantage of alternative coins, as although Ethereum is much cheaper than Bitcoin, the reality is that the Ethereum market is greatly influenced by what happens in the Bitcoin market. By extension, alternative coins are highly influenced by Ethereum itself.

All things being equal, this is a market that has a lot of support underneath it, and it’s not until we break down below the $3000 level that I would be concerned about the overall uptrend of Ethereum. It’s not necessarily ready to break out yet, but it certainly looks as if it is trying to build a bit of inertia.

Ready to trade Ethereum? Here are the best MT4 crypto brokers to choose from.