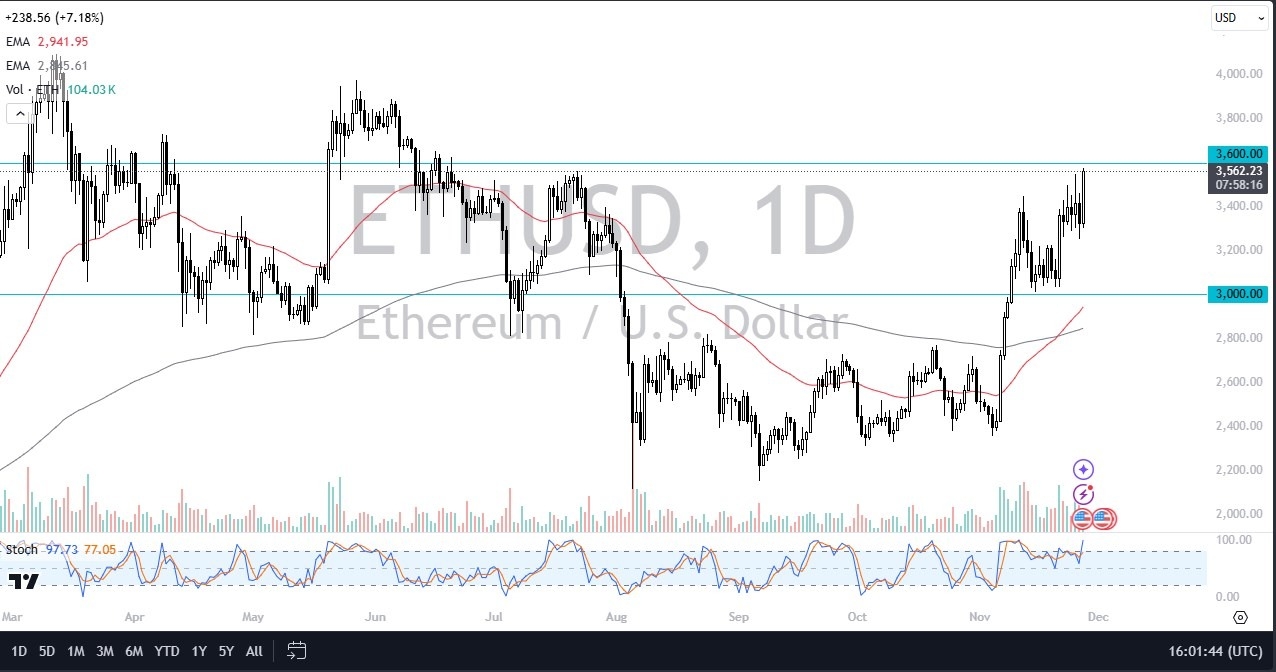

- During my daily analysis of the cryptocurrency markets, the Ethereum market has caught my attention as we are racing toward the crucial $3600 level.

- The $3600 level has been resistant multiple times in the past, but it is worth noting that we have broken above it a couple of times also.

- In other words, it’s not necessarily a massive “brick wall”, but at this point in time it’s probably worth noting that although it might put up a big fight, I do think that Ethereum most certainly could break through it.

Short-term pullbacks almost certainly will happen, but ultimately, I think that the $3300 level will continue to be significant support, which in and of itself is worth noting that we have seen this area as “fair value” between the $3000 level in the bottom, and of course the previously mentioned $3600 level.

Top Forex Brokers

Bitcoin Still Matters

Regardless of any of the nuances of the Ethereum market, it’s probably worth noting that Bitcoin continues to matter more than anything else. As we continue to see strength in the Bitcoin market, it makes a certain amount of sense that we will continue to see a lot of money flowing into the cryptocurrency markets, especially Ethereum as it always has played the role of “silver to Bitcoin’s gold attributes.” This isn’t to say that Ethereum itself can’t take off, it’s just that typically will follow Bitcoin.

The altcoins will continue to see a bit of momentum as well, and this has a direct effect on the Ethereum market, mainly due to the fact that most of these altcoins run on the Ethereum ecosystem. In other words, if we are going to see cryptos in general run higher, that will have a direct effect on this market. That being said, everything reverts back to Bitcoin in the end, and therefore you need to keep an eye on what’s happening with BTC, and it’s journey to break above the $100,000 level. In fact, you can almost directly correlated the $3600 level in the Ethereum market to that barrier.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.