- The euro has been a little bullish against the Swiss franc during the trading session on Wednesday.

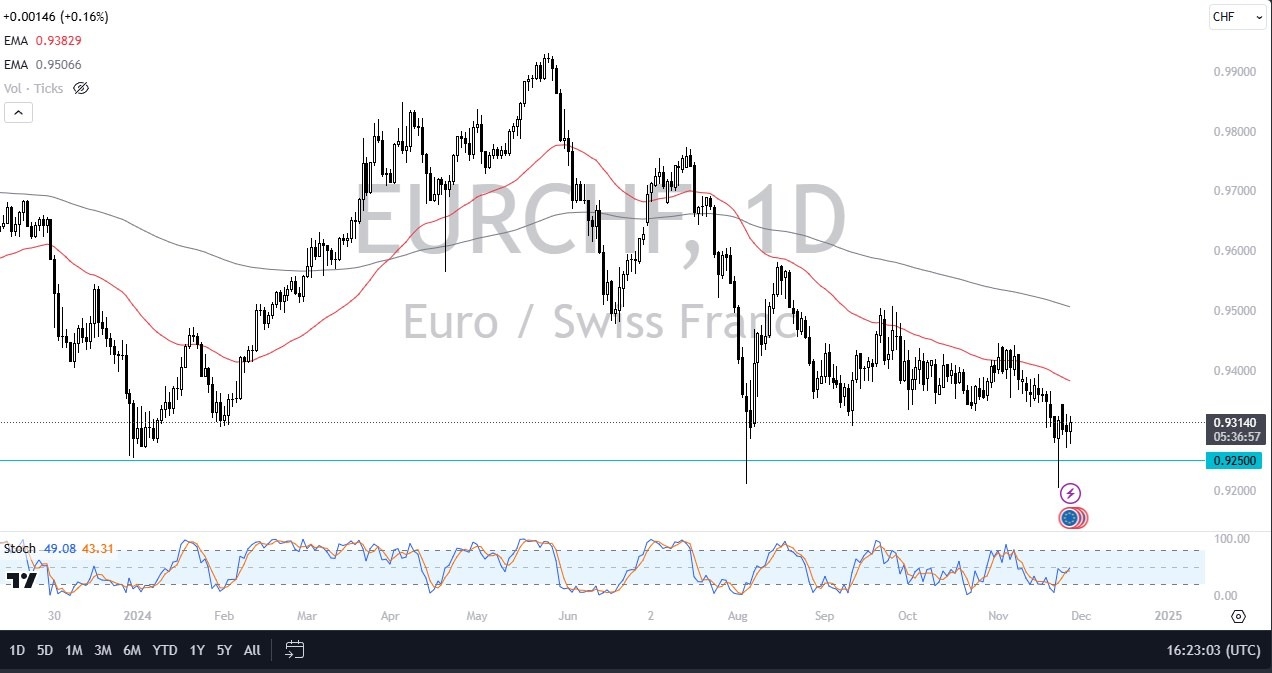

- As we continue to scrape along the bottom, there seems to be a band of support from the 0.93 level down to the 0.92 find zero level.

- Last Friday, we saw the market dip below the 0.92 level, only to turn around and pop right back up.

So having said that, I do think there is significant support here. In fact, this is a pair that has a history of intervention by the Swiss National Bank. So, it's a little difficult to get overly aggressive at these low levels because Switzerland wants it's Franc to at least be competitive in the European union, as something like 85% of all Swiss exports end up in the European Union.

Top Forex Brokers

Not as Clear as One Might Think

There are a lot of questions to ask about this EUR/CHF pair though, because with the hot war going on in Ukraine, one would think that a certain amount of Europeans are throwing their money into Switzerland to protect it. However, the interest rate differential does favor Europe, although it's not as wide as it has historically been, as traders have the feeling of needing to get a return of capital instead of a return on capital.

The upside has the 0.94 level offer and resistance with the 50 day EMA. And if we can break above that, then I think we may start to pick up a little bit of traction. I think short-term buying on the dip is possible here, but as far as a longer-term trade, we don't really have that set up quite yet. Although clearly, the market doesn't want to fall significantly from here. Because of this, I recognize that we may get a lot of short term buying opportunities from time to time in this pair and therefore I'm looking for short term gains more than anything else at this juncture.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.