Potential signal:

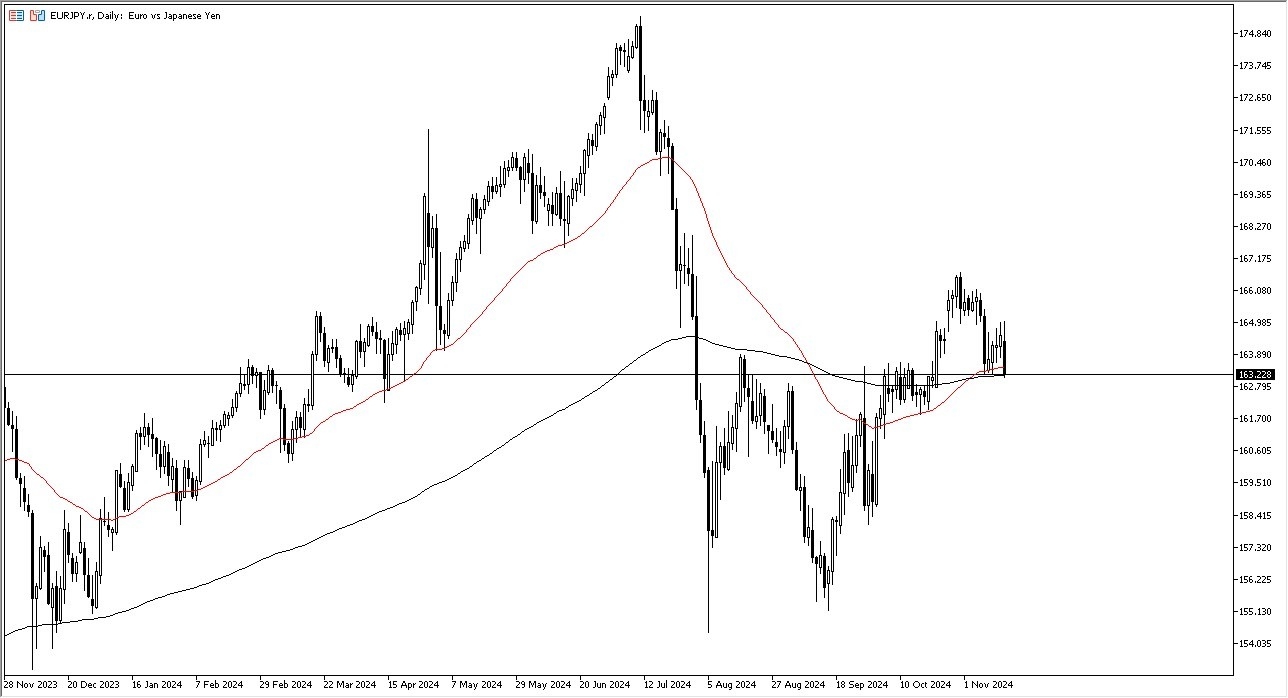

I would be a buyer of this pair if we can recapture the ¥164 level. If we get above there, I would put a stop loss at the ¥163 level and aim for the ¥167 level.

- Dear my daily analysis of the yen related pairs, it’s worth noting that the euro initially did try to rally, but then it plunged.

- Because of this, we are now testing the 200 Day EMA, which of course is an important indicator that a lot of people will pay attention to for the longer-term, and therefore think you get a situation where if the buyers are going to return, it’s probably going to be fairly soon.

- All things being equal, this is a fairly ugly candlestick, so it’ll be interesting to see if we can get some of that “mojo back” from the previous move higher.

Top Forex Brokers

All things being equal, this is a pair that continues to favor interest rate differentials for the euro, with this being the case, the market is likely to continue to see a lot of people getting involved, as they can get paid at the end of every day to hang on to this pair. Quite frankly, even though the euro itself isn’t necessarily a currency that I liked, it is going to probably fare better than the Japanese yen going forward.

Technical Analysis

The technical analysis for the EUR/JPY currency pair of course suggests that there is a lot of support in this area, as the ¥163 level is an area that we’ve seen a lot of action at previously. That being said, the market is likely to continue to see the area between they are in the ¥162 level as a major “squishy support level.” By doing so, the market is likely to continue to see a lot of value hunters out there trying to get involved, and therefore I think you’ve got a scenario where people will look for a value play to get long again.

If we were to break down below the ¥161 level, then it’s likely that the pair could drop down to the ¥158.50 level, which is an area that we have seen a lot of support at previously. That would be a target for short sellers, but at this point in time I think they will probably be repudiated long before we get to that area.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.