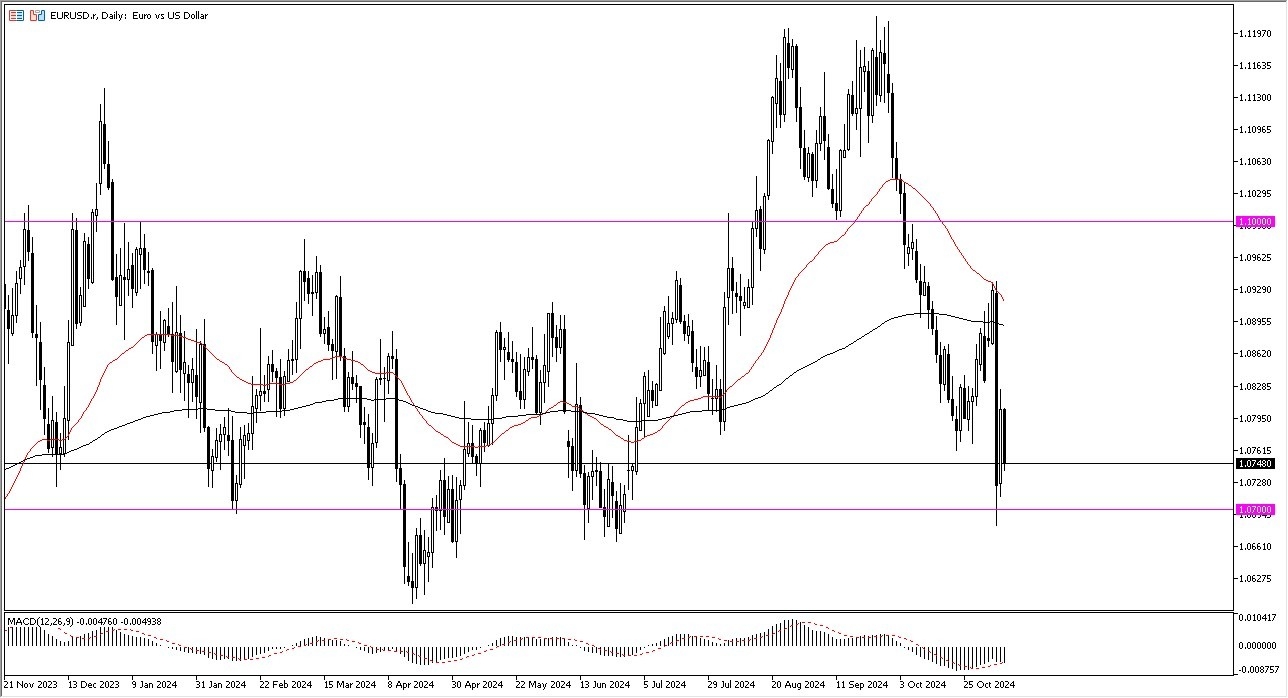

- The Euro initially pulled back just a bit during the trading session on Friday.

- As we continue to see plenty of support underneath at the 1.07 level, I think we see so much in the way of support that it is going to be difficult to break down below here.

- But I also would point out the fact that the market is near the bottom of a larger consolidation range that I think this becomes more of a buy on the dip situation for short-term traders.

Longer-term traders probably need to see a little bit more convincing price action. So right now, we'll have to see how this closes out, but it certainly looks like a market that is seeing a lot of support near the 1.07 level. And then again, probably at the 1.06 level, if we do in fact continue to fall. This would be a major area of support and trouble, and therefore we will have to pay close attention to it.

Top Forex Brokers

Interest Rates Continue to be a Major Factor

All things being equal, EUR/USD is a market that is moving based on interest rates in America going higher, despite the fact that the Fed continues to cut rates. This shows that the bond market is starting to get out of control a little bit. And perhaps that's part of what's going on. Remember, the US dollar is considered to be a safety currency, so that is something that you need to take into account anytime you trade this market.

Nonetheless, this is one that I think you favor short-term bounces and fading signs of exhaustion on the upside. I'm not aggressive in this market at all. And most of the time I just use it as an indicator as to how to trade the US dollar against almost everything else. As in general, if you get the US dollar right in the Forex world, you get most things right.

Ready to trade our EUR/USD Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.