Potential signal:

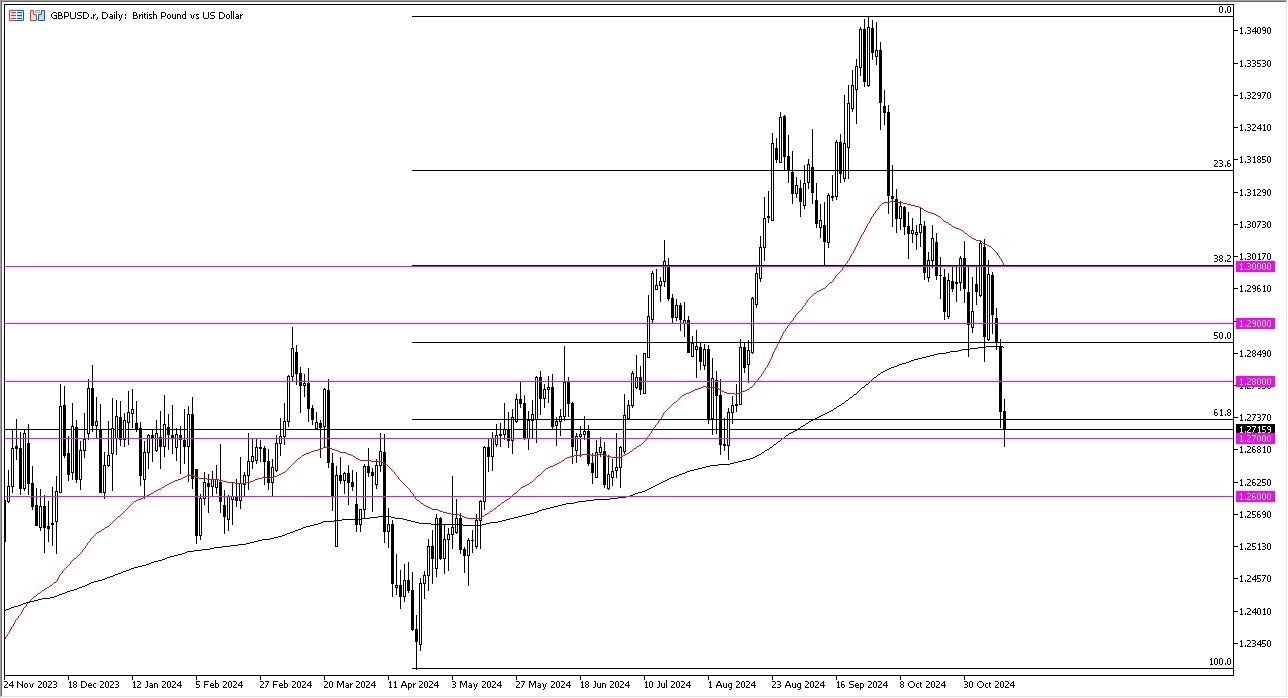

I would consider buying this pair near the 1.2775 level, with a target near the 1.2850 level, and a stop loss near the 1.2733 level.

- During my daily analysis of major currency pairs, the GBP/USD pair has captured a bit of attention due to the fact that we are at a major crossroads when it comes to the technical analysis aspect of this market.

- Furthermore, we have the GDP numbers coming out of the United Kingdom on Friday, so perhaps traders are starting to think about the idea of whether or not the British pound is getting oversold.

Top Forex Brokers

That being said, the market has been rattled by the strengthening US dollar, and I think that will continue to be one of the major things to think about. After all, the US dollar has seen strength against almost everything around the world, so the British pound will be any different. However, with the GDP numbers coming on Friday there is the possibility that we get a little bit of a bounce due to the fact that some people might be covering short positions, as any surprise in the GDP numbers could cause havoc in this particular pair.

Technical Analysis

The technical analysis for the GBP/USD currency pair of course is rather negative, but we also have a couple of things going on in this general vicinity that I think is worth paying attention to. While I don’t necessarily want to be a major buyer of this pair, the reality is that we might get a little bit of a short-term bounce, and therefore it might be worth paying attention to what happens over the next day or two. On the other hand, if we break down below the bottom of the candlestick, it could open up a move down to the 1.26 level underneath, which of course is a large, round, psychologically significant figure.

All that being said, I do expect to see a lot of volatility, and therefore volatility is a major feature of this pair, and you need to be very cautious with your position size. However, we are oversold and that is something worth paying attention to.

Ready to trade our free trading signals? We’ve made a list of the best UK forex brokers worth using.