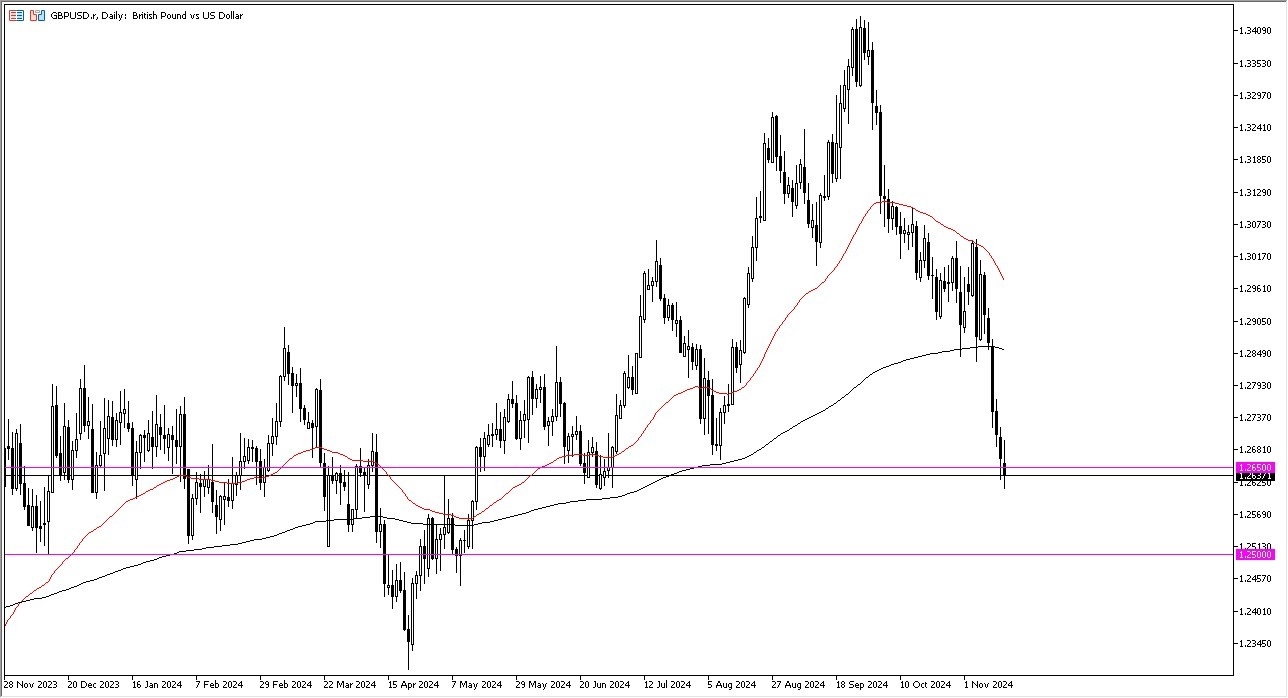

- The British pound initially did try to rally during the trading session on Friday but gave back gains as it looks like we continue to struggle overall.

- The 1.2650 level is an area that's been important multiple times in the past, so I think it does make a certain amount of sense that it could offer support.

- But having said that, we have plunged over the last week or so, especially after the election in the United States as the US dollar is king again.

- Between the 1.2650 level and the 1.25 level, I think you've got an area that could be rather supportive, and a bounce from here would make a certain amount of sense mainly due to the fact that we've just sold off so much.

Interest Rates and More

Top Forex Brokers

Interest rates in America are to blame as to why the US dollar continues to strengthen as well as investment in US indices, because quite frankly, US indices continue to be the better performing ones in the world from a longer term perspective, dwarfing most others. So with that being said, I think you still have an argument for the US dollar, but whether or not we just fall from here, or if we get another bounce is the real question.

On a move to the upside, I'd be looking to fade any rally, especially if we get anywhere near the 200 day EMA, which is closer to the 1.2850 level. The Bank of England has been somewhat hesitant to cut rates, but they did recently. So it'll be interesting to see what the trajectory there is. Federal Reserve comments coming out suggesting that perhaps the Americans might have to pause on any rate cuts. So, the game begins. We'll have to wait and see how this plays out, but it certainly looks very negative at this point.

Ready to trade our GBP/USD daily analysis and predictions? Here are the best forex trading platforms UK to choose from.