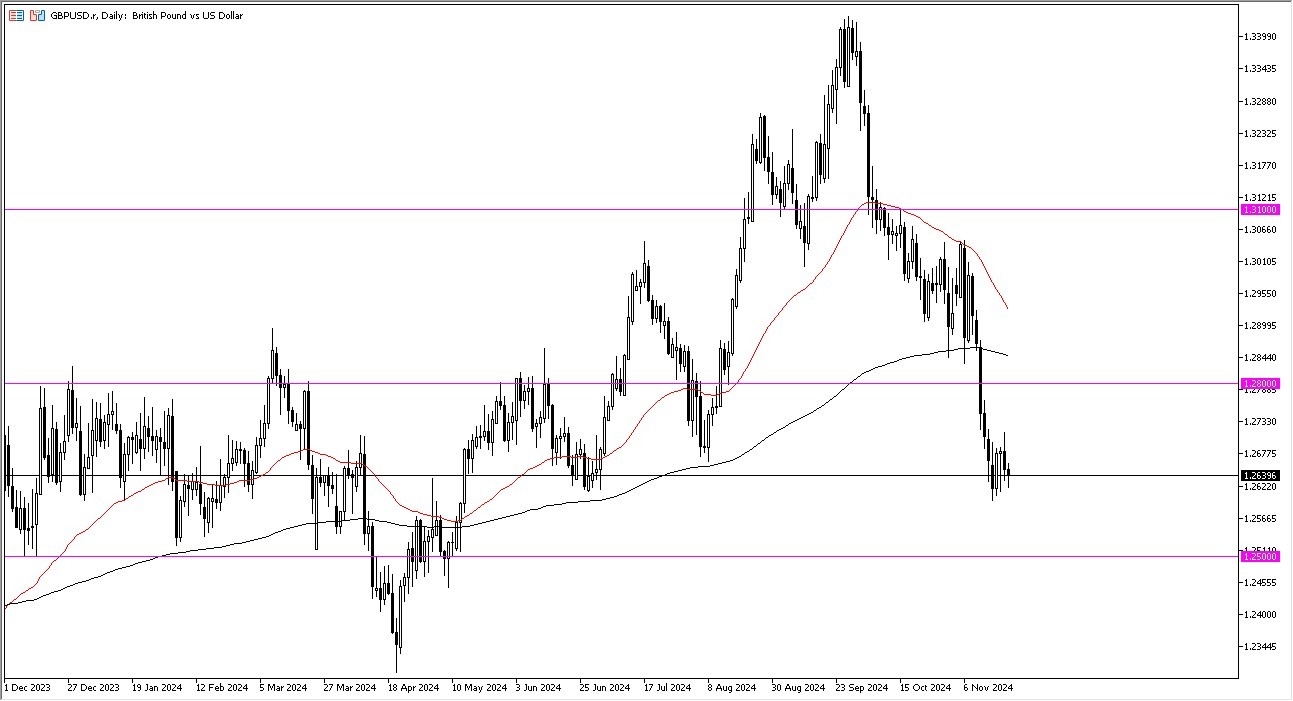

- During my daily analysis of the GBP/USD pair, the British pound has truly looked fairly weak.

- As we continue to threaten the 1.26 level, it looks as if we are eventually going to break down, and perhaps go looking to the 1.25 level underneath, which is a large, round, psychologically significant figure.

During the Friday session, we get the PMI numbers for both Manufacturing and Services from both the United Kingdom and the United States. That will have a direct influence on how this pair goes going forward, but I would also point out that a lot of people are paying close attention to the bond markets in the United States as interest rates continue to rise. As long as those interest rates continue to stay fairly high, it does make the US dollar much more attractive than the British pound. Furthermore, we have a lot of other things to think about at the moment that could continue to influence what happens next with the greenback.

Top Forex Brokers

US Dollar Continues to Be a Safety Currency

Keep in mind that the US dollar continues to be thought of as a currency that is sought out in times of need for safety. With the escalation of the war in Ukraine, I suspect that we have yet another reason to think that the US dollar will continue to strengthen against most others. Furthermore, the United Kingdom has a lot of economic and social issues at the moment that seem to be getting worse at this point. With that being said, it’s not necessarily an economy that a lot of foreign money wants to go running to. This isn’t to say that the United Kingdom’s economy is going to collapse or anything hyperbolic like that, just that the US economy seems to be on much stronger footing.

Given enough time, I think that this market will probably go looking to the 1.25 level, and if we were to break down below there, the GBP/USD market could really start to break down. In this environment, you would probably see the US dollar strengthen against multiple other currencies, not just this one.

Ready to trade our daily GBP/USD Forex forecast? Here’s some of the best forex broker UK reviews to check out.