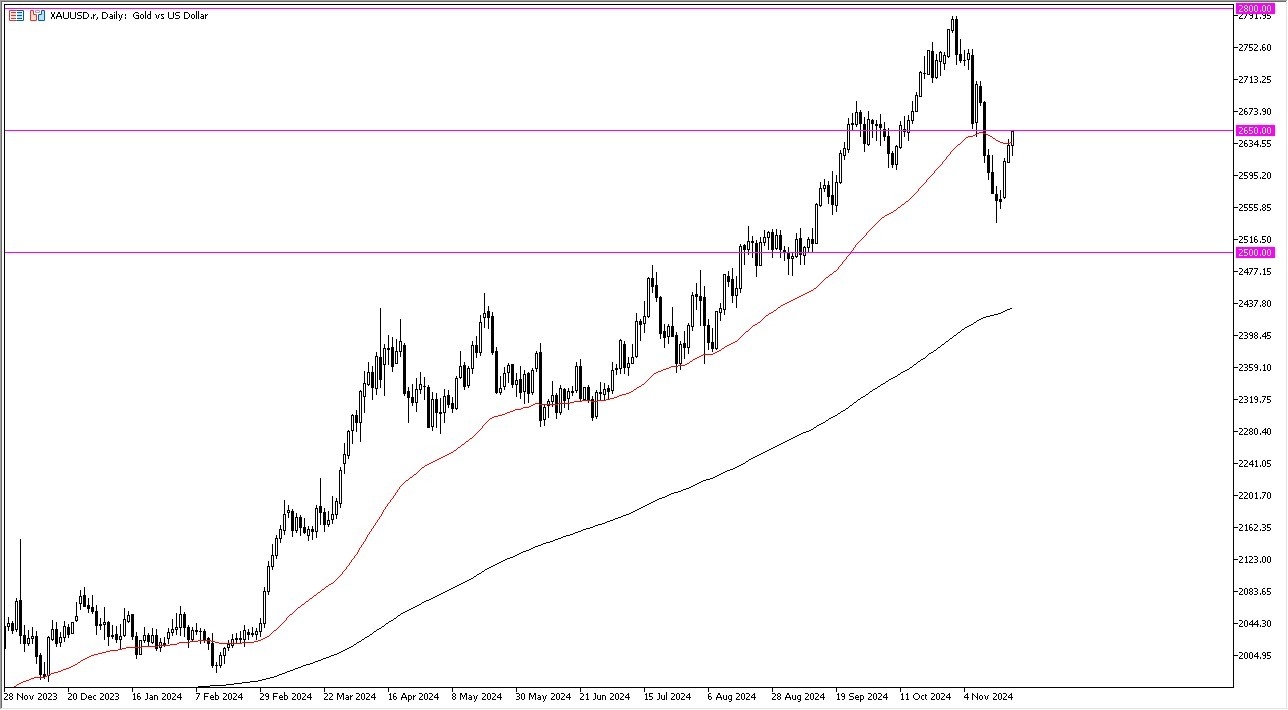

- During my daily analysis of the gold market, the resiliency has become apparent. We initially did pull back during the trading session, only to turn things around and show signs of strength, as we have broken above the 50 Day EMA.

- Now it looks like the gold market is trying to break above the crucial $2650 level.

- If we can break above that level, then it’s likely that the market could go looking to the $2800 level, which was the most recent swing high and also the all-time high.

All things being equal, this is a market that has plenty of reasons to go higher, and I think that will continue to be the mainstay of what happens here. After all, we have plenty of geopolitical concerns, with the war in Ukraine suddenly picking up.

Top Forex Brokers

Just today, Joe Biden has authorized the delivery of landmines to Ukraine, just a day after NATO long-range missiles were used by the Ukrainians. Quite frankly, traders are simply waiting to see what the next escalation will be as the Russians have now lowered the threshold to using nuclear weapons. While they probably won’t use ICBMs, there is a real possibility of using a tactical nuclear weapon.

Technical Analysis

The technical analysis for the gold market has been strong for some time, and quite frankly, with gold rallying against the US dollar, it’s probably an even better traded against other currencies. This would be especially true with the Japanese yen, which has been getting eviscerated as of late. There’s really not much out there that I would rather owned in gold, perhaps with the exception of Bitcoin, but that is a very short term rally. This market probably has several years left in it if things keep going the way they are.

The $2500 level underneath continues to be a major “floor in the market”, so I think you need to pay close attention to it. Furthermore, the 200 Day EMA is racing toward that area, and I think you’ve got a situation where it becomes a “hard floor” for a lot of different people.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.