- In my daily analysis of the gold market, it’s obvious to me that there are plenty of buyers out there that are willing to take advantage of the momentum.

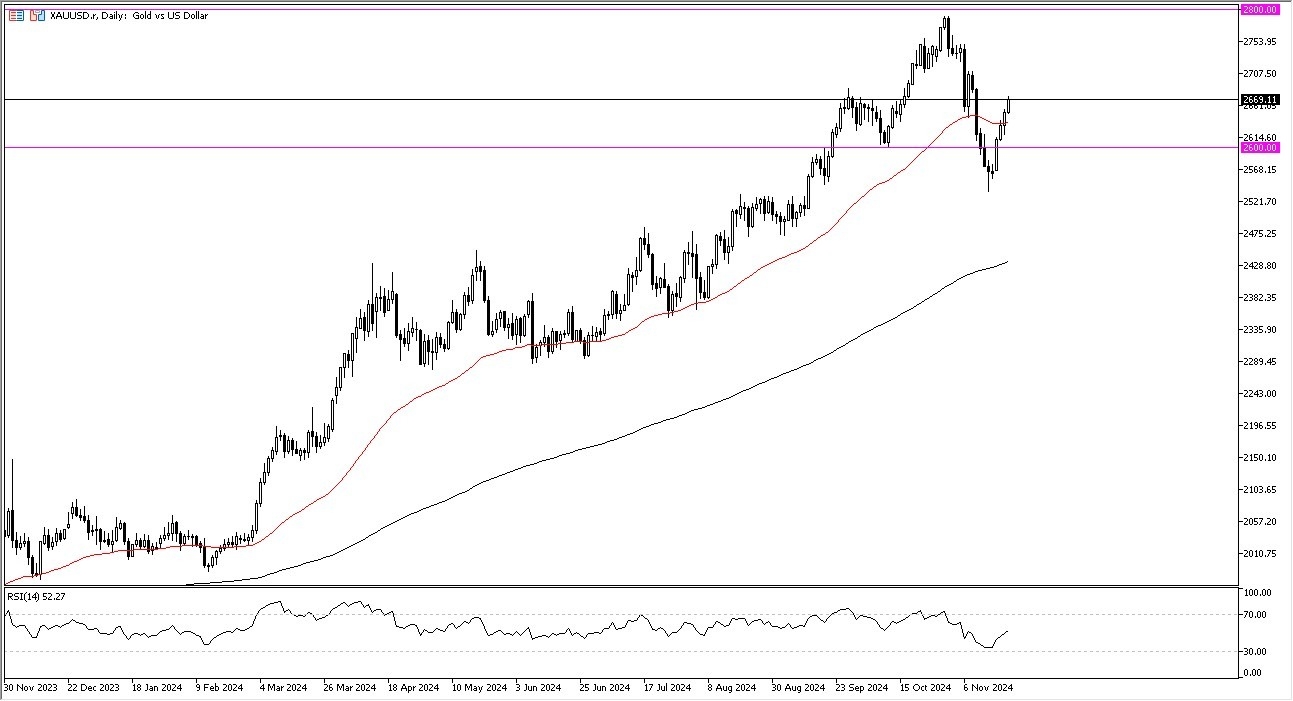

- Furthermore, we have broken above the minor psychological resistance barrier in the form of the $2650 level, and of course are above the 50 Day EMA.

- This has traders looking at this through the prism of a very bullish run.

Fundamental Reasons for Stronger Gold

Top Forex Brokers

There are plenty of fundamental reasons for gold to go higher, not the least of which would be the fact that we have a lot of momentum. However, beyond the fact that we have broken above the 50 Day EMA, the reality is that the market is going to be one that is paying close attention to geopolitics. After all, the Russians have just launched an ICBM at Ukraine, although obviously without a nuclear warhead. This is a massive escalation in tension, after the Ukrainians had launched NATO long-range rockets deep into the Russian territory, and President Joe Biden has now agreed to send landmines to Ukraine. In other words, the tensions are getting worse in Ukraine, and I think there’s a real concern that something bigger is about to kickoff.

The reality is that there are plenty of other reasons for gold to go higher, not just war. For example, central banks around the world continue to buy a massive amounts of gold, including China, Russia, Indonesia, and as per usual, India. This puts a little bit of a “permanent bid” in the market. That being said, we also have to keep in mind the central banks around the world are trying to cut interest rates, so that does mean it’s a little bit more tenable to hold physical gold instead of paper, or of course electronic bonds.

This is a market that should continue to go much higher, and short-term pullbacks will almost certainly attract a lot of attention. It’s worth noting that the Relative Strength Index is nowhere near the overbought condition, meaning that at least that widely followed indicator doesn’t put the kibosh on any type of bullish attitude.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.