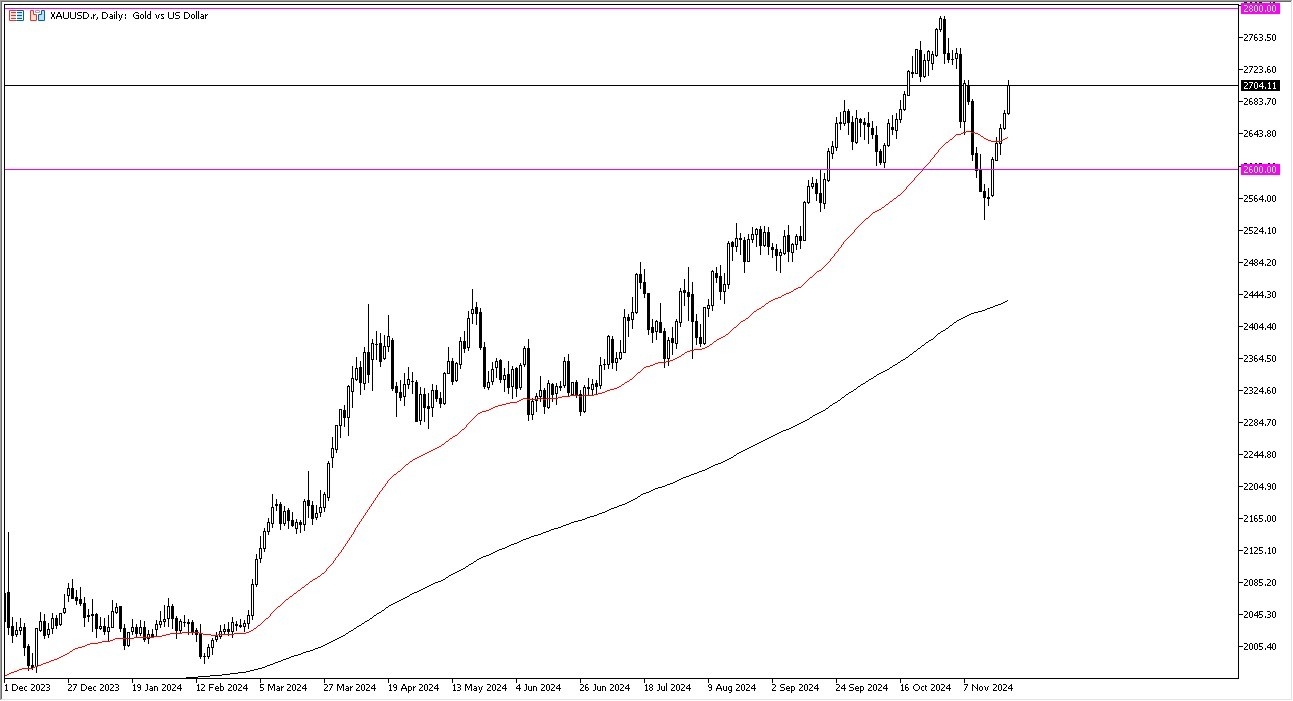

- Gold has rallied to reach the $2,700 level late on Friday as it looks like we are trying to break out to the upside.

- This is a huge move over the last couple of days as we had initially fallen pretty significantly last week only to turn around and rally significantly this week.

- This is a complete repudiation of what we had previously seen, so it’s interesting to see just how strong the uptrend is as it came roaring back in the gold market.

- This is despite the fact that the US dollar is rallying at the same time.

The market is well above the 50-day EMA now as well, so I think we are starting to see a lot of momentum going to the upside, perhaps reaching that crucial $2,800 level above that we had pulled back from.

Top Forex Brokers

Gold has plenty of reasons to go higher, not the least of which would be momentum, but we also have central banks around the world doing everything they can to buy gold, such as Russia, China, Indonesia, India, and a few others that I forget at this point. We also have the interest rate situation around the world, although rising central banks are cutting rates. So, this might be more about other currencies, not the US dollar.

War is Good for Gold Unfortunately

Furthermore, we have plenty of geopolitical concerns that could continue to be a major problem as the war in Ukraine seems to be accelerating and expanding, not cooling off, so it does make a certain amount of sense that there is a bit of a safety bid here. Regardless, gold is a market that looks bullish, and I think short-term pullbacks are buying opportunities where we could pick up cheap ounces. All things being equal if and when we can break above the 2800 dollars level, I think gold will then start looking towards the 3000 dollars level.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.