- During my daily analysis of the commodity markets, the first thing that comes to my attention is the fact that gold markets are consolidating a bit in order to show signs of hesitation.

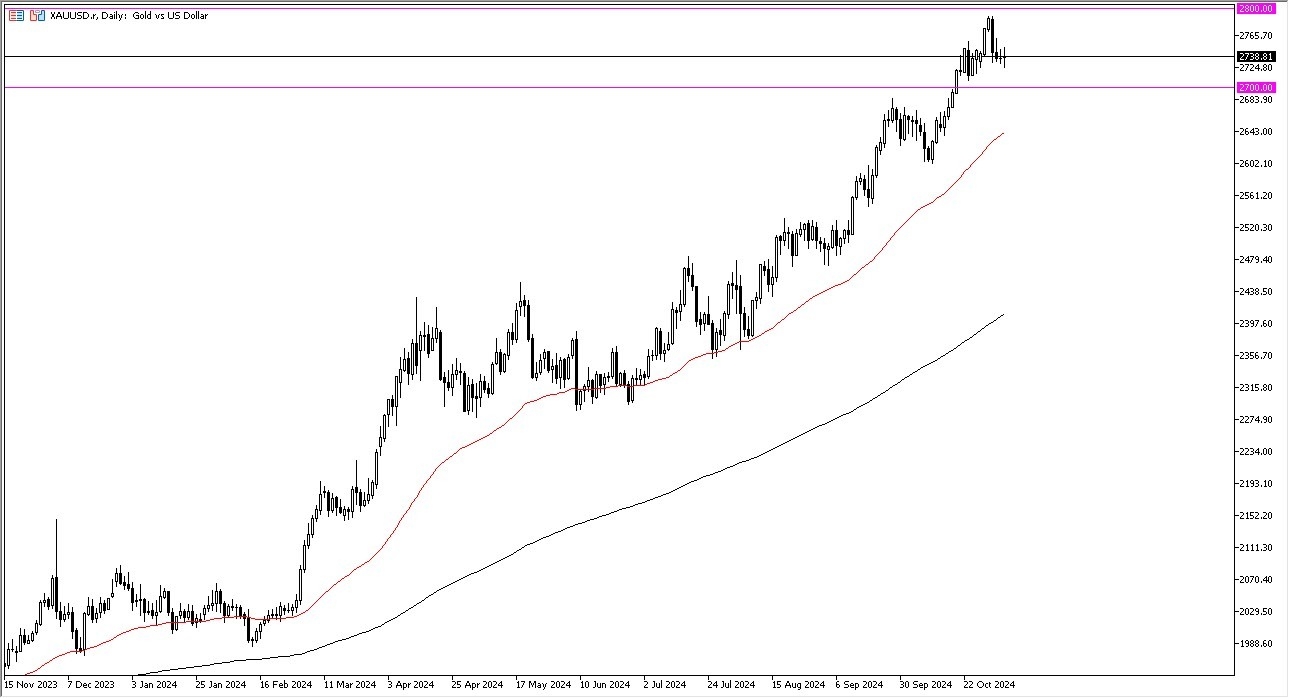

- Quite frankly, the market sees the $2700 level underneath as a major support, while the $2800 level above is a major resistance. As we are sitting roughly in the middle of that, I think this is a market that is just simply waiting to see what happens next.

Top Forex Brokers

A Couple of Rough Days

I suspect at this point in time we will have a couple of rough days, as the US election of course is going on during the Tuesday session, and it looks beyond is here: the United States is a Third World institution that will take several days to come to a conclusion, all things being equal.

Furthermore, we also have the Federal Reserve on Thursday, which is expected to cut rates, but a lot of what will see is going to be conjecture on what the press conference has to say, and of course how the market reads as to where the central bank is heading.

If we were to turn around and break down below the $2700 level, I think it’s probably only a matter of time before value hunters come back into the picture and try to take advantage of “cheap gold.”

Ultimately, the 50 Day EMA sits right around the $2640 level and is rising. Ultimately, I think this is a situation where traders will continue to look at this through the prism of whether or not geopolitics would calm down, and of course what happens with the US dollar, as well as interest rates. A lot of things out there will continue to be a situation where the momentum is still to the upside, and I do think that there is a certain amount of value hunting out there that will be willing to get involved with.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.